PI has been in a persistent downtrend since the start of March. With bearish pressure intensifying over the past week, the token has shed 32% of its value in seven days.

Further losses appear likely as selling pressure strengthens among PI market holders.

PI Bulls Struggle as Trading Activity Plummets

PI currently trades at $1.17, noting a 1% price rise over the past day. Despite this modest uptick, PI’s declining trading volume suggests that the slight rebound is not backed by strong demand for the altcoin. It merely mirrors the broader market growth recorded over the past 24 hours.

During the review period, PI’s trading volume totals $366 million, down 37%. When an asset’s price rises while trading volume declines, it suggests that the upward movement lacks strong buyer participation, making the rally weak or unsustainable.

This indicates reduced market interest, as fewer PI traders are supporting the increase. If volume does not pick up, the token’s price may struggle to maintain its gains and could resume its decline.

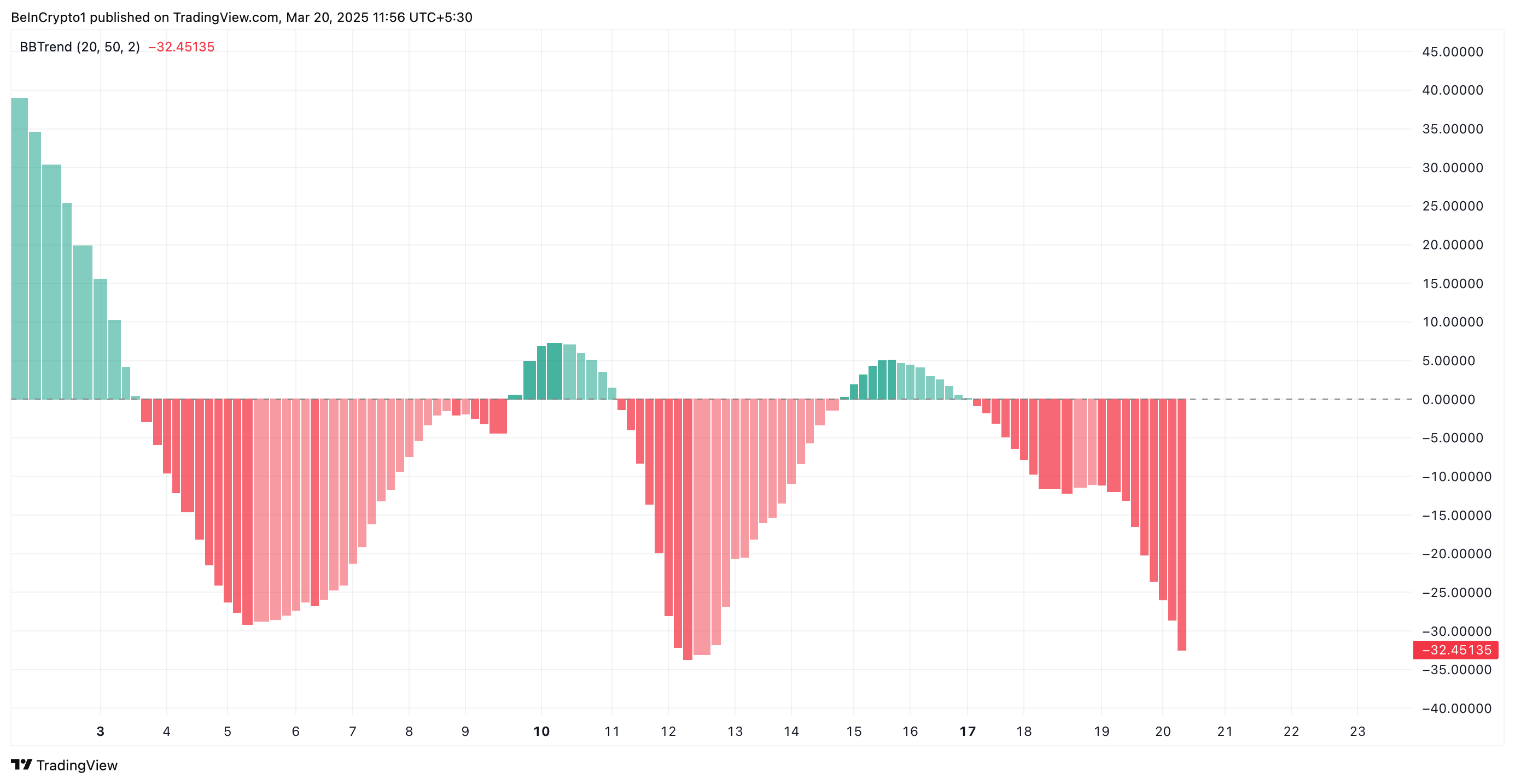

Further reinforcing the negative outlook, PI’s BBTrend remains in the red, confirming that bearish forces are firmly in control. Observed on a four-hour chart, the momentum indicator is at -32.45, the lowest it has ever been since PI launched.

The BBTrend indicator measures the strength and direction of an asset’s price movement in relation to the Bollinger Bands. A positive BBTrend value signals an uptrend, indicating that prices are pushing toward the upper band with strong momentum.

Conversely, a negative BBTrend value indicates a downtrend, suggesting that the asset is trading closer to the lower band, with bearish pressure prevailing.

When an asset’s BBTrend is deep in negative territory like PI’s, it indicates a strong and persistent downtrend, with sellers firmly in control. This suggests that PI’s price declines are not just short-term corrections but part of a broader bearish trend accompanied by significant volatility.

PI Holds Critical $1.11 Support—Will Bulls Prevent a Drop to $0.87?

PI currently holds above the support formed at $1.11. If selloffs intensify, the bulls might be unable to defend this support floor, causing the token’s price to plummet to $0.87.

On the other hand, a positive shift in market sentiment and a resurgence in new demand for PI would invalidate this bullish projection. In that scenario, the token’s price could resume its rally and climb toward $1.34.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.