As Bitcoin (BTC) hovers near critical price levels, crypto investors focus on a packed week of US economic data releases that could sway market sentiment.

From employment figures to Federal Reserve Chair Jerome Powell’s insights, these macroeconomic indicators are poised to influence Bitcoin’s trajectory.

US Macroeconomic Data To Watch This Week

Crypto market participants, traders, and investors have several US economic events to watch this week. This follows a notable sentiment shift during the weekend, driven by US President Donald Trump’s move to commission a crypto reserve.

The crypto market’s reaction to the president’s executive order reflects Bitcoin’s growing place in the United States macroeconomic space. Here is a breakdown of the five key data points to watch and their potential impact on the world’s leading cryptocurrency.

ADP Employment Report

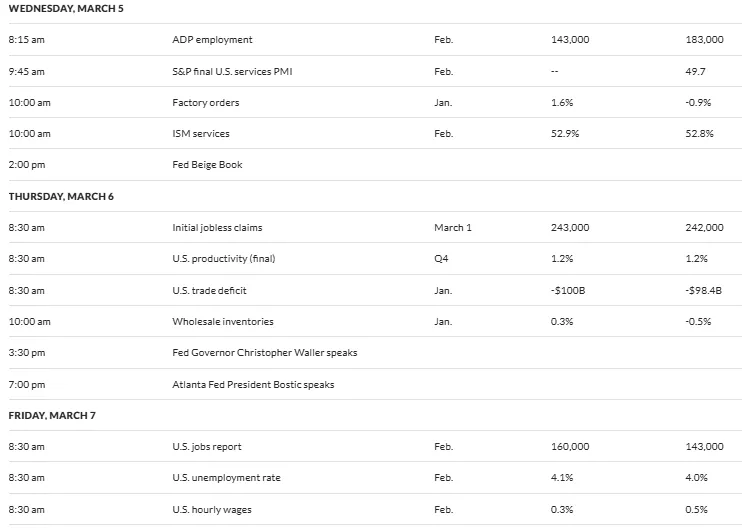

The week kicks off with the ADP National Employment Report on Wednesday. This US economic data is a key gauge of private-sector job growth. After the previous 183,000, economists forecast February’s jobs data slowing down to around 143,000. This reflects a continued cautious hiring environment, as President Trump’s economic policies remain a topic of interest.

A stronger-than-expected report could signal resilience in the labor market, potentially boosting the US dollar and pressuring Bitcoin as investors pivot to traditional assets. Conversely, a weaker print might fuel expectations of Federal Reserve rate cuts, lifting BTC as a risk asset.

“The focus is on jobs data this week, with ADP on Mar 5 expected at 143,000 and non-farm payrolls on Mar 7 forecasted at 160,000. If those hit or beat, the bulls will likely drive a 1-2% gain, fueled by optimism in tech and a belief in a soft landing,” one user commented.

However, the outcome remains uncertain, with historical trends showing mixed reactions in crypto markets to ADP surprises.

Initial Jobless Claims

Thursday’s Initial Jobless Claims report will offer a real-time snapshot of the US labor market’s health. The previous week’s figure increased to 242,000, beating the consensus of 225,000, signaling economic softening.

According to data on MarketWatch, analysts anticipate a slight uptick to around 243,000 for the week ending March 1. Lower claims could reinforce confidence in the economy, potentially reducing Bitcoin’s appeal as a hedge against uncertainty.

Higher claims, however, might stoke fears of a slowdown, driving investors toward BTC as a safe-haven alternative.

US Unemployment Rate

Friday’s US jobs report, including the unemployment rate, is a market marquee event. Forecasts peg job growth at 160,000 for February, up from January’s 143,000, with the unemployment rate forecasted at 4.1%, higher than the previous 4.0%.

Strong job growth could dampen hopes for monetary easing, pressuring Bitcoin as higher interest rates make yield-bearing assets more attractive. A disappointing report, on the other hand, might bolster BTC’s narrative as a hedge against economic weakness.

Jerome Powell Speech

Federal Reserve Chair Jerome Powell’s upcoming speech is also a wildcard. It features US economic data that could influence crypto sentiment this week. His speech could set the tone for monetary policy expectations.

His remarks, scheduled for Friday, will be parsed for clues on rate cuts in 2025, especially after the Fed’s latest interest rate decision. Dovish hints—suggesting more aggressive easing—could propel Bitcoin higher by weakening the dollar and boosting risk appetite. A hawkish stance, emphasizing inflation control, might weigh on BTC as borrowing costs rise.

Notably, Powell recently told the Senate Banking Committee that he is in no rush to cut interest rates, maintaining a cautious economic approach. Nevertheless, it is impossible to ignore the growing concerns among US policymakers about President Trump’s policies.

“Many participants suggested that a variety of factors underlined the need for a careful approach to monetary policy decisions over coming quarters,” the Fed’s previous minutes stated.

Consumer Credit

Friday’s Consumer Credit data will shed light on American borrowing trends by rounding out the week. Following a $40.85 billion increase in December, a sharp rise could signal strong consumer confidence, potentially reducing Bitcoin’s allure as disposable income flows elsewhere.

A slowdown in credit growth might suggest economic caution, nudging investors toward BTC as a store of value amid uncertainty. Nevertheless, data on MarketWatch indicates a modest median forecast of $12 billion.

As of this writing, Bitcoin was trading for $92,811, up by over 8% since Monday’s session opened. With these five data points looming, volatility is all but guaranteed.

Meanwhile, traders and investors are waiting expectantly for the crypto summit on Friday at the White House, as President Trump aims to position the US at the forefront of the growing digital asset industry.

“While I anticipated the pro-American crypto asset reserve that focused specifically on American blockchains, I didn’t trade the news. This is the beta trade. Look at the tokens that have not been added yet before the summit on Friday and consider holding some in your portfolio. It is a pretty speculative trade though because while Trump did hint there would be more added, those that aren’t chosen will likely take a reverse hit,” one X user quipped.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.