A recent analysis by Messari has revealed that token buyback programs, often touted as a stabilizing mechanism, have failed to prevent sharp price declines for several major tokens.

This comes as buyback programs have gained traction, with many networks adopting similar strategies.

Are Token Buybacks Effective? Messari’s Analysis Says Otherwise

BeInCrypto recently pointed out that the token buyback trend is expanding. The list of networks implementing these programs is extensive, including Arbitrum (ARB), Aave (AAVE), Jupiter (JUP), and Hyperliquid (HYPER), among others.

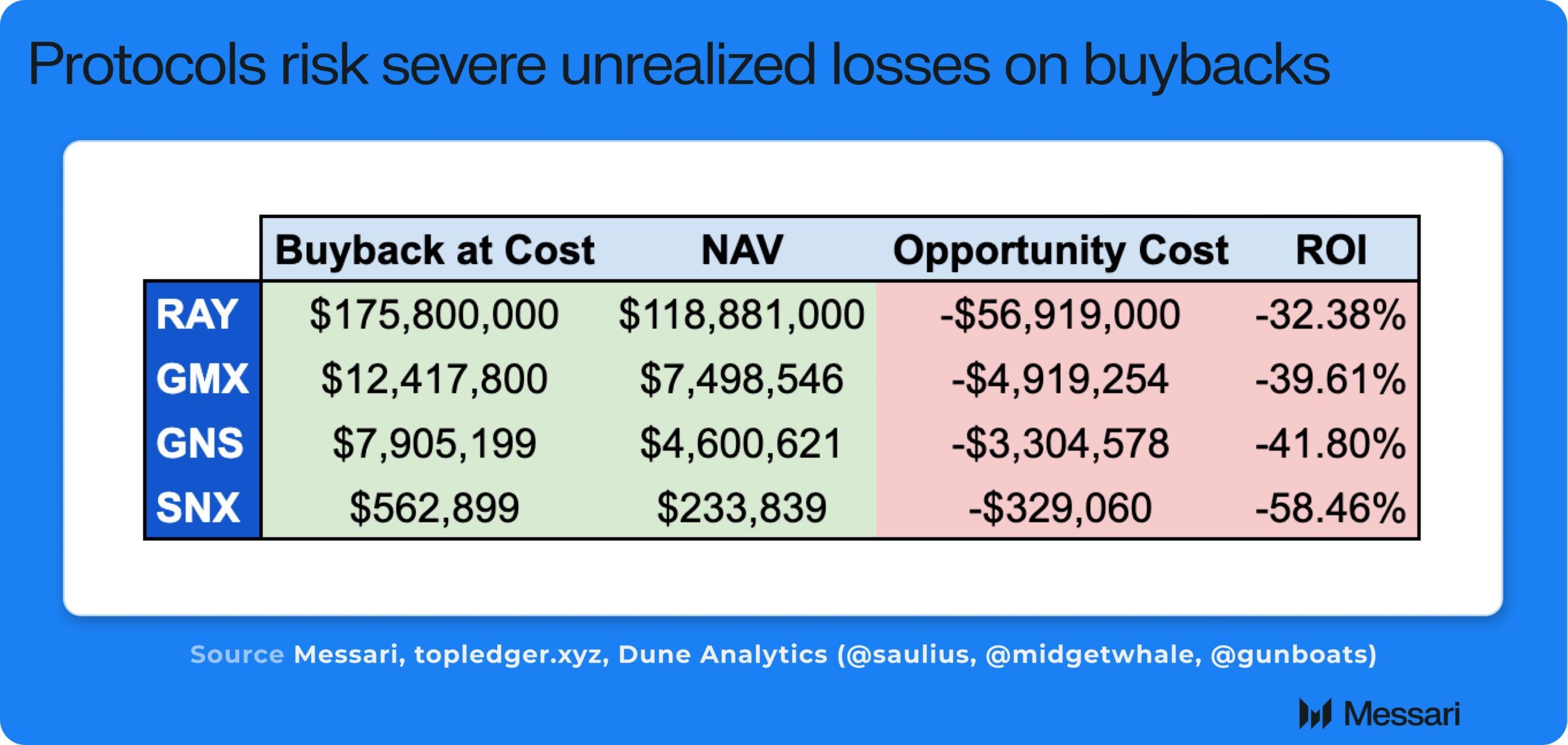

However, Messari’s analysis revealed that these strategies have largely failed for projects like Raydium (RAY), GMX (GMX), Gains Network (GNS), and Synthetix Network (SNX). Instead of driving up demand and price, these programs have been followed by steep losses.

Among the tokens, SNX saw the sharpest decline, tumbling 77%, while GNS plunged by 76%. In addition, GMX experienced a 34% decrease, and RAY saw a 26% fall in value.

“RAY, GMX, GNS and SNX have programmatically bought back millions in tokens which are now worth way below cost,” Messari’s enterprise research analyst Sunny Shi wrote on X.

Shi identified three major flaws in token buyback strategies, referring to them as part of the “programmatic token buyback fallacy.” First, he emphasized that buybacks are largely irrelevant to price action. Instead, he argued that this is driven by factors like revenue growth and market narrative rather than token repurchases.

Second, he explained that when a project’s revenues are high, and token prices are elevated, buying tokens back at inflated prices leads to inefficient use of capital.

Finally, Shi noted that in periods of low prices and revenues, when cash is essential for innovation or restructuring, companies find themselves lacking the necessary funds. Meanwhile, they are sitting on significant unrealized losses from their buyback investments.

“This is just poor capital allocation. The mindset should be growth at all costs or real value distribution to holders in the form of stables / majors (see veAERO or BananaGun),” he concluded.

Mason Nystrom, Junior Partner at Pantera Capital, echoed this sentiment.

“Solid analysis on how programatic buybacks can negatively impact a business as they force protocols into a dilemma of buying back tokens at inflated prices and limiting the capital that protocols can use to drive fundamental growth vs just token price,” he said.

Nystrom argued that companies and protocols should use the revenue to invest in growth or conduct strategic buybacks with long-term goals. This approach, he believes, will ultimately create more value for token holders.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.