Bounce has gone parabolic in 2025, making it one of the best-performing cryptocurrencies in the market.

Over the last six consecutive weeks, Bounce (AUCTION) moved to a high of $67.55 — its highest level since October 2021. It has jumped by over 712% from its lowest level this year, bringing its market cap to over $380 million.

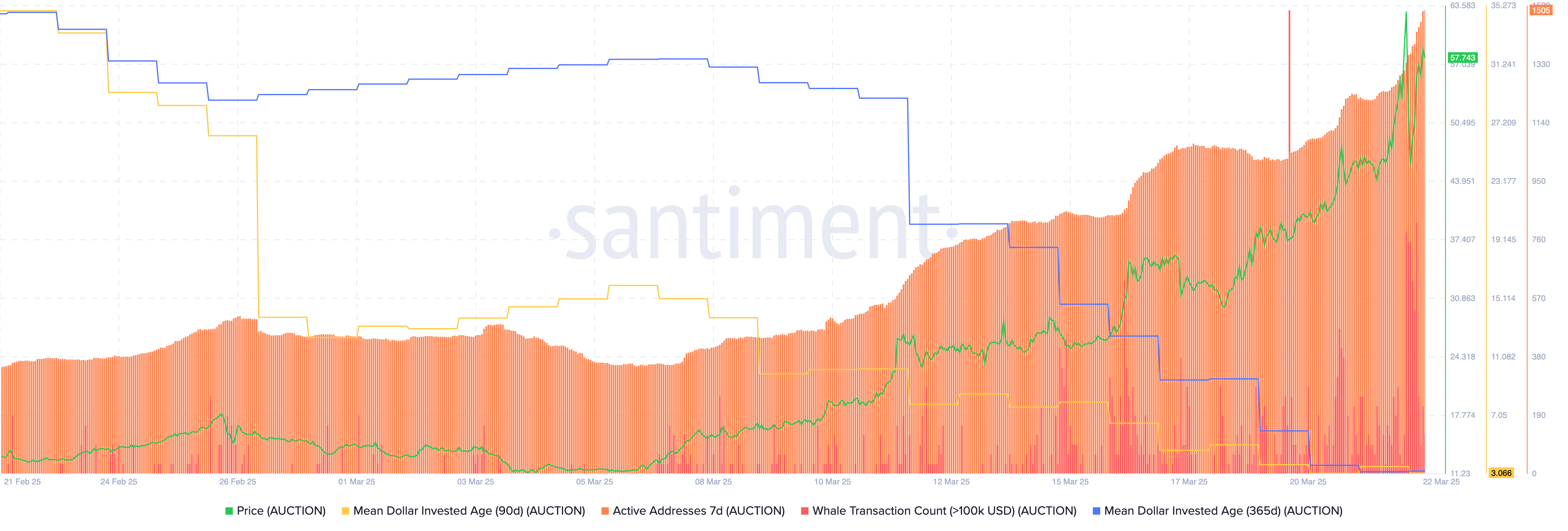

The surge has accelerated as many retail investors embraced the fear of missing out or FOMO. Santiment data shows that the number of active addresses has gone parabolic, reaching a high of 1,505. This is a significant increase since the seven-day addresses stood at less than 400 earlier this month.

More on-chain data points that this surge could be part of whale manipulation. The number of whale transactions worth over $100k has jumped to the highest level in months. Similarly, transactions worth over $1 million have soared, too.

The rising number of whale transactions could be a good signal, especially when they are accumulating. The Santiment number of whale transactions does not provide more information on whether these whales are buying or selling.

A look at the Mean Dollar Invested Age or MDIA sends a red alert on the coin. The 365-day MDIA indicator has crashed from 112 earlier this month to 38.

Similarly, the 90-day MDIA indicator has moved from 33.4 to just 3. A drop in the MDIA indicator is often a sign that a token will have a big reversal.

The risk of whale manipulation has risen because the ongoing surge has not coincided with any major news from Bounce Finance.

The most recent news occurred Friday when the developers launched the Bouncing Art Onchain, a product for tokenizing real-world art.

Bounce token price analysis

The weekly chart shows that the AUCTION token price bottomed at $7.10 earlier this month to $67.54. It crossed the important resistance level at $48.95 — its highest level in December last year. It has also moved above the 50-week moving average.

There are signs that it has moved to the markdown phase of the Wyckoff Theory. This phase is usually followed by the distribution and then the markdown, where the asset drops.

The AUCTION price also moved to the overbought level, with the Relative Strength Index and the Stochastic Oscillator soaring. Therefore, there is a risk that it will have a harsh reversal in the coming days as it moves to the distribution phase.