BlackRock’s tokenized US Treasury fund, BUIDL, has seen a sharp rise in adoption, with the fund’s assets under management (AUM) surging past the $1 billion milestone this month.

This growth highlights a strong shift toward real-world asset (RWA) tokenization, even as broader crypto markets face headwinds.

BlackRock’s BUIDL Leads the RWA Sector

According to data from RWA. XYZ, BUIDL’s AUM, has increased by almost 129% over the last 30 days, bringing it to $1.4 billion.

This milestone means that it took only one year for the fund, which launched on the Securitize platform in March 2024, to cross the $1 billion mark.

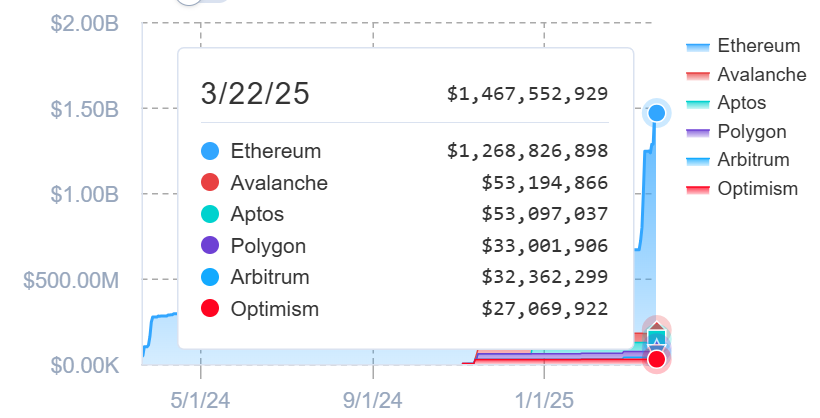

While BUIDL has expanded to multiple blockchains, the majority of its supply—over $1 billion, or 86.46%—remains on Ethereum. This indicates strong minting activity on the network.

Other chains, such as Avalanche and Aptos, each hold about $56 million of the fund’s supply, or roughly 3.6%. Ethereum Layer-2 networks like Polygon, Arbitrum, and Optimism host the rest.

Meanwhile, investor participation has also grown. In the past month, the number of holders rose by 19%, bringing the total to 62.

Market observers pointed out that these numbers highlight the growing trust in blockchain-based financial products and the rising institutional interest in tokenizing bonds and credit.

Fidelity Joins the Tokenization Race

BUIDL’s milestone comes as asset management firm Fidelity also moves into the tokenization space.

Over the past week, the firm filed with the US Securities and Exchange Commission (SEC) to launch a blockchain-based version of its Treasury money market fund. The new share class, named “OnChain,” will operate using blockchain as a transfer agent and settlement layer.

“The OnChain class of the fund currently uses the Ethereum network as the public blockchain. In the future, the fund may use other public blockchain networks, subject to eligibility and other requirements that the fund may impose,” the filing added.

Fidelity’s move mirrors a broader trend. Financial institutions are turning to blockchain to tokenize bonds, funds, and credit instruments. This shift offers improved efficiency, round-the-clock settlement, and better transparency.

Meanwhile, the filing comes as institutional interest in RWAs continues to rise, despite a sluggish crypto market. While Bitcoin is down 11% year-to-date, RWA tokens have seen sustainable growth in 2025.

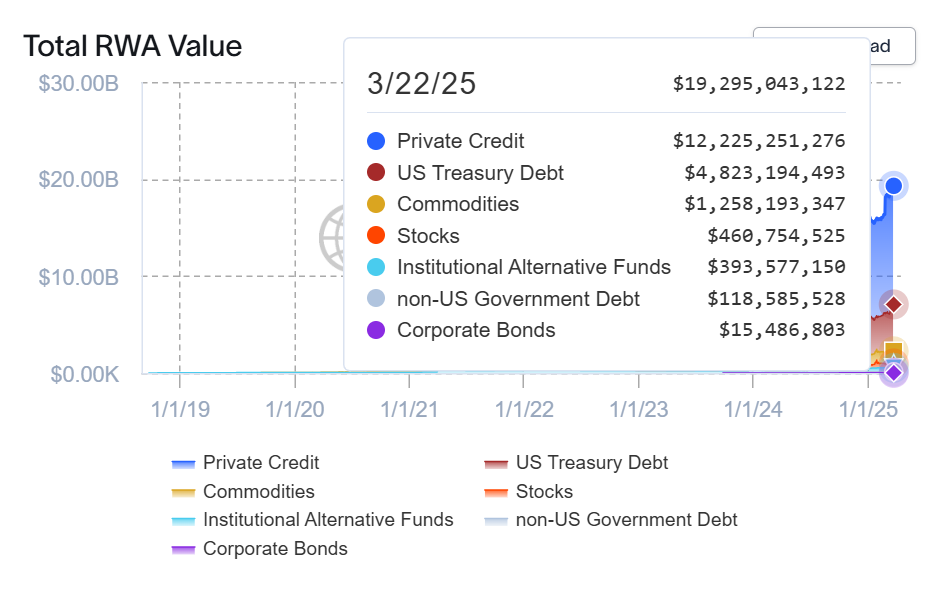

On-chain data shows the total RWA market has grown 18.29% in the past 30 days, reaching $19.23 billion. The number of RWA holders also increased by 5%, now nearing 91,000.

BlackRock’s BUIDL leads the RWA space by market cap. It’s followed by Hashnote’s USDY at $784 million and Tether Gold (XAUT) at $752 million.

Meanwhile, US Treasuries make up $4.76 billion of the total, while private credit dominates with $12.2 billion.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.