- Ethereum price rises in past week amid broader crypto market recovery.

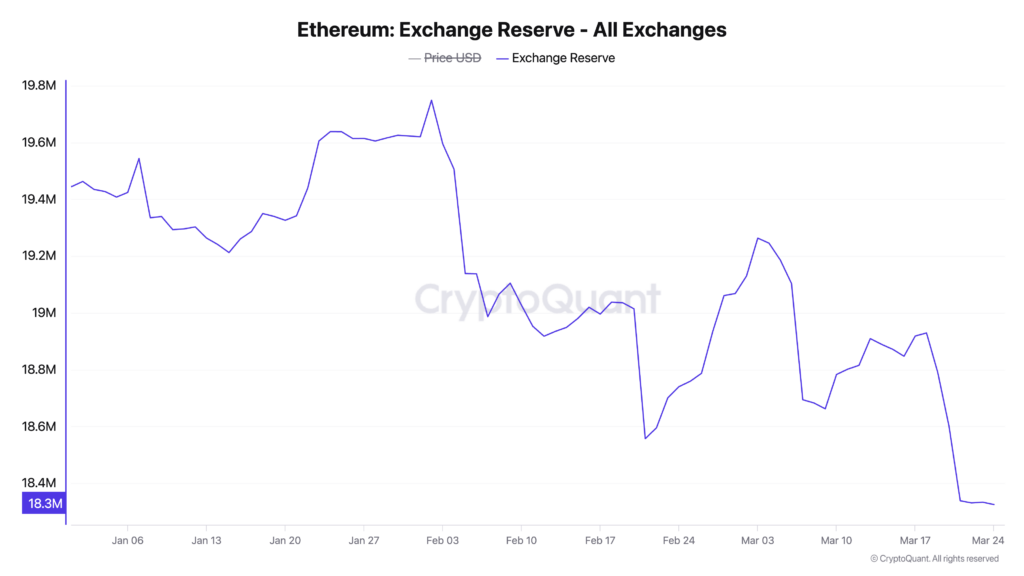

- Exchange reserves drop to 18.32 million ETH, down 7% from February peak.

- Rising leverage ratio indicates increased trader optimism despite year’s volatility.

Ethereum (ETH) has shown notable resilience with a 9% price increase over the past week as the cryptocurrency market attempts to recover from its recent downturn. While the second-largest cryptocurrency by market capitalization benefits from improving general market sentiment, two key on-chain metrics suggest this upward momentum could be more than a temporary bounce.

On-chain data reveals that Ethereum’s exchange reserve has declined to its lowest level of 2025, currently standing at 18.32 million ETH. This represents a substantial 7% reduction from the year-to-date peak of 19.74 million coins recorded on February 2. This metric, which measures the total amount of ETH held in exchange wallets available for immediate trading, provides significant insight into holder behavior and potential price pressure.

The declining exchange reserve indicates that traders are moving their ETH off exchanges and into long-term storage, staking solutions, or spot ETH ETFs. This reduction in readily available supply can create upward price pressure, as lower selling liquidity combined with steady demand typically drives prices higher. The consistent outflow from exchanges suggests growing confidence in Ethereum’s long-term prospects despite recent market volatility.

Ethereum’s ELR has been on the spike

Simultaneously, Ethereum’s Estimated Leverage Ratio (ELR) has been climbing, reaching a year-to-date high of 0.686 on March 21 before experiencing a minor pullback to its current level of 0.683.

This metric, calculated by dividing the asset’s open interest by the exchange’s reserve for that currency, measures the average amount of leverage traders are employing in their positions.

The surging ELR signals increased risk appetite among Ethereum traders despite the cryptocurrency’s price challenges since the beginning of 2025. This trend indicates that many market participants remain optimistic about a near-term rally and are willing to leverage their positions to amplify potential gains, a sign of growing confidence in Ethereum’s immediate prospects.