Pepe coin’s price has bounced back this month as investors bought the dip and futures open interest surged.

Pepe (PEPE), a viral meme coin, jumped to a high of $0.000008960, its highest point since February 24, and 73% from its lowest point this year.

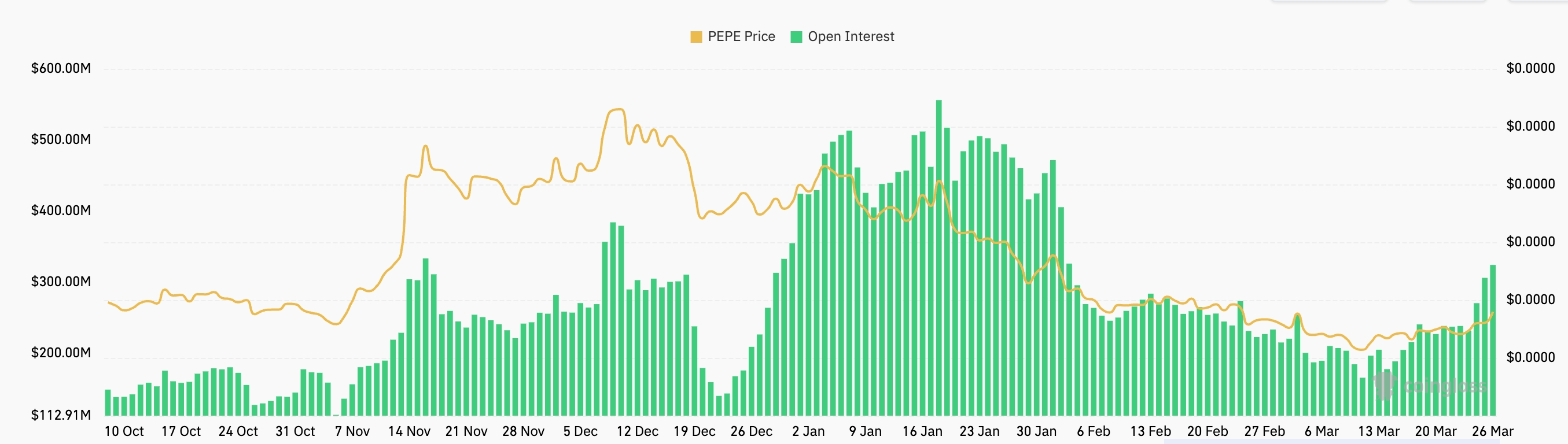

The ongoing rebound came as futures open interest rose to its highest level since Feb. 2. The metric surged to over $324 million, up from this month’s low of $166 million.

Soaring open interest is a crucial indicator in crypto markets, measuring all outstanding futures contracts that have not yet been settled. A rising open interest is often viewed as a bullish signal.

Pepe has also rallied amid signs of investor accumulation. According to Nansen, exchange reserves fell by 0.73% in the past seven days to 240.7 trillion tokens. Declining exchange reserves often indicate that holders are moving their tokens off exchanges, typically a sign they intend to hold rather than sell.

Additional data shows that the most profitable Pepe holders over the past week are still holding most of their positions. The most profitable trader has earned $607,000 in profits and still holds 91% of his tokens. The next three top traders each hold nearly 100% of their positions.

Pepe’s rebound has coincided with an uptick in overall crypto sentiment. The Crypto Fear & Greed Index has exited the “extreme fear” zone, climbing from a low of 18 earlier this month to 34. The improvement came alongside a broad market rally that pushed the total crypto market cap near $3 trillion.

Pepe price analysis

The ongoing Pepe coin price surge is in line with recent crypto.news predictions, as you can read here and here.

The daily chart shows the token rebounded after bottoming at $0.000005895 on March 10. That level is significant, as it matches the lowest point reached in August 2023. Since then, the coin has tested but failed to break below that range several times.

The latest bounce followed the formation of a falling wedge pattern, a common bullish reversal setup. This pattern forms when an asset trades between two descending, converging trendlines approaching a breakout point.

The Relative Strength Index and the MACD indicators have pointed upwards. The RSI has moved to 60, while the two lines of the MACD are nearing their zero line.

Pepe price has moved slightly above the 50-day Exponential Moving Average, a bullish sign. The next key resistance point to watch will be $0.00001717, the 50% Fibonacci Retracement level, which is about 95% above the current level. A move above that level will point to more upside, potentially to the all-time high.