MakerDAO’s governance token, MKR, has posted double-digit gains in the past 24 hours, making it the market’s top performer. The surge propelled MKR to a seven-day high of $1,485, where it traded briefly during Thursday’s early Asian hours.

This signals a renewed bullish momentum for the altcoin and hints at a potential sustained rally.

MKR Demand Strengthens as Market Sees Renewed Investor Interest

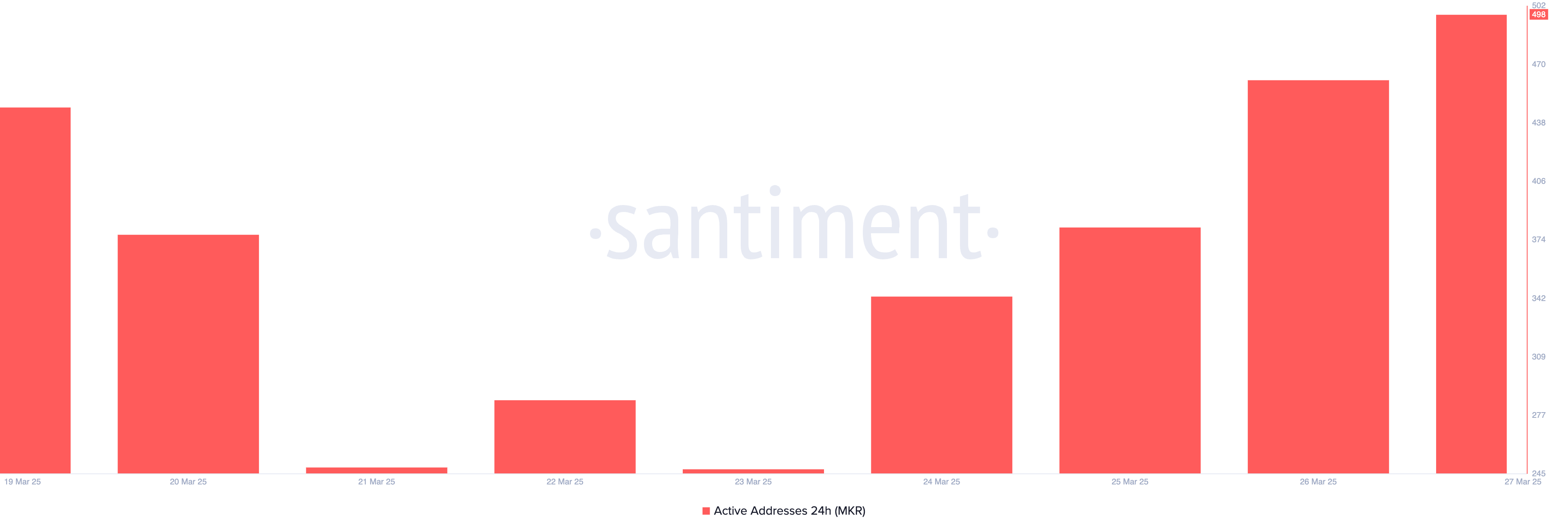

On-chain data reveals a significant spike in MKR’s active address count over the past 24 hours, indicating increased trading activity and investor interest.

According to Santiment, MKR’s active address count has surged to a seven-day high of 498, marking an 8% increase in the past 24 hours. An uptick in an asset’s daily active address count suggests growing demand as more market participants engage in transactions.

As noted by MKR, the sudden spike in this metric indicates a resurgence in bullish bias toward the altcoin.

If sustained, MKR’s rising active addresses could strengthen the bullish pressure on its price, reinforce liquidity, and strengthen the asset’s overall market presence.

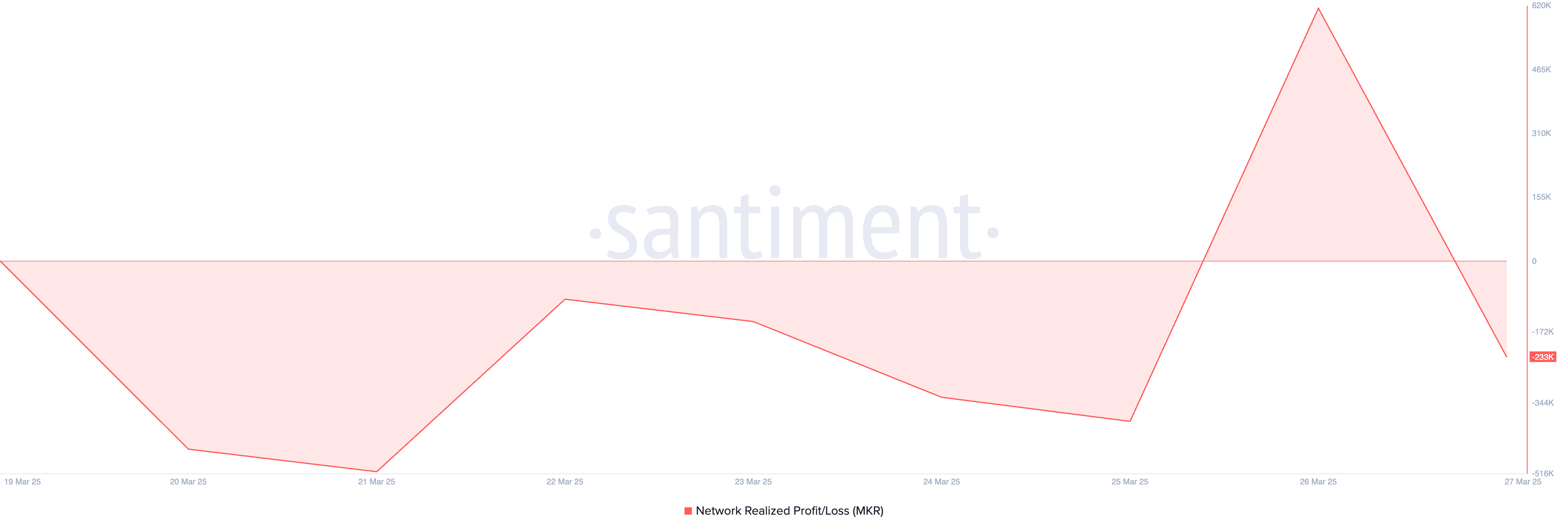

Additionally, the token’s Network Realized Profit/Loss (NPL) has turned negative, indicating that holders are less incentivized to sell at the current price levels as they hold at a loss. At press time, MKR’s NPL is in a downward trend at -233,000.

This metric measures investors’ total profit or loss when transferring their assets on-chain. A negative NPL, as seen with MKR, indicates that, on average, investors are selling at a loss.

If MKR’s NPL remains in negative territory, it could weaken selling pressure, as traders may hesitate to offload their holdings at a loss. This reluctance could create conditions for a sustained MKR rally.

MKR Turns Resistance Into Support—Is a Rally to $1,780 Next?

MKR has flipped the key resistance formed at $1,464 into a support floor. If demand strengthens, the bulls will consolidate their strength and attempt to prevent a price dip below this floor.

In that scenario, a strong buying pressure could propel MKR toward $1,780, a price high it last reached on February 27.

However, a resurgence in bearish bias toward MKR would invalidate this bullish outlook. In that scenario, the altcoin’s price could break below $1,466 and fall to $1,109.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.