Ethereum (ETH) has regained its position as the leading blockchain for decentralized exchange (DEX) trading volume.

On this metric, Ethereum has effectively surpassed Solana (SOL) for the first time since September 2024.

Ethereum Surpasses Solana in DEX Trading Volume

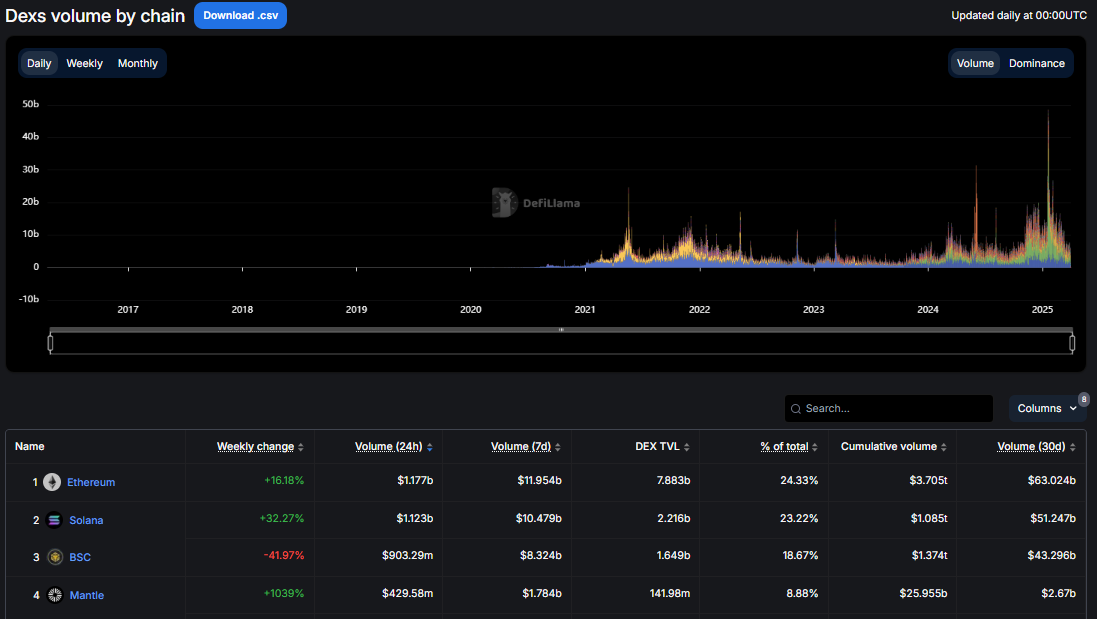

According to data from DefiLlama, Ethereum-based DEXs recorded approximately $63 billion in trading volume throughout March 2025. This traction saw Ethereum overtake Solana’s $51 billion during the same period.

The shift marks a significant moment in the ongoing competition between Ethereum and Solana in the decentralized finance (DeFi) ecosystem.

Solana had dominated the DEX space for months, bolstered by its low fees and high transaction throughput. Franklin Templeton noticed the trend and predicted Solana’s DeFi surge could rival Ethereum’s valuation.

“Solana DeFi valuation multiples trade on average lower than their Ethereum counterparts despite significantly higher growth profiles. This highlights an apparent valuation asymmetry between the two ecosystems,” read an excerpt in Franklin Templeton’s report.

However, recent declines in trading volume on key Solana-based platforms suggest a changing market dynamic. The drop in Solana’s DEX trading volume is closely tied to decreased activity on major platforms like Raydium (RAY) and Pump.fun.

Pump.fun, in particular, has seen a sharp decline in trading volume since the beginning of the year. Monthly volumes fell from a January peak of $7.75 billion to just $2.53 billion in March, representing a 67% drop.

Data on Dune shows that this downturn aligns with a slowdown in the platform’s token graduation rate, which has fallen from 0.8% to 0.65% per week.

The graduation rate reflects the percentage of new tokens reaching the $100,000 market capitalization threshold required to migrate from Pump.fun to the Raydium platform.

A lower graduation rate suggests fewer tokens are reaching this threshold, which is reducing overall trading activity on Solana’s DEX ecosystem.

Ethereum’s Strength in the DEX Market

While Solana’s DEX activity has faltered, Ethereum’s trading volume has remained resilient. This is likely bolstered by the strong performance of platforms like Uniswap (UNI) and Curve Finance (CRV).

In March, Uniswap alone facilitated over $30 billion in trading volume, significantly contributing to Ethereum’s overall market dominance.

Ethereum’s ability to reclaim the top spot is also attributed to its established infrastructure and network effects. Despite higher gas fees than Solana, Ethereum continues attracting high-value trades, institutional interest, and liquidity. These reinforce its position as the primary blockchain for DeFi activity.

Against this backdrop, industry analysts believe that while Solana is very competitive, it still has a long way to go before it can dethrone Ethereum.

Meanwhile, others say Ethereum’s resurgence may extend into the second quarter (Q2), driven by upcoming network upgrades and broader market trends.

“On-chain developments offer some hope for ETH…With Pectra now successfully deployed on the Holesky testnet and a mainnet upgrade expected in Q2, could we see a reversal of the downward ETH/BTC trend in the coming quarter?” analysts at QCP Capital noted.

The Pectra upgrade, once implemented on the Ethereum mainnet, is expected to improve scalability and efficiency, potentially boosting user adoption and trading activity.

Adding to the positive momentum, spot Ethereum ETFs (exchange-traded funds) saw net inflows on Monday, contrasting with net outflows from Bitcoin ETFs. This trend suggests growing investor confidence in Ethereum’s market position.

This shift in ETF flows could indicate a broader reallocation of capital within the crypto market, particularly as Ethereum strengthens its DeFi ecosystem and prepares for key upgrades.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.