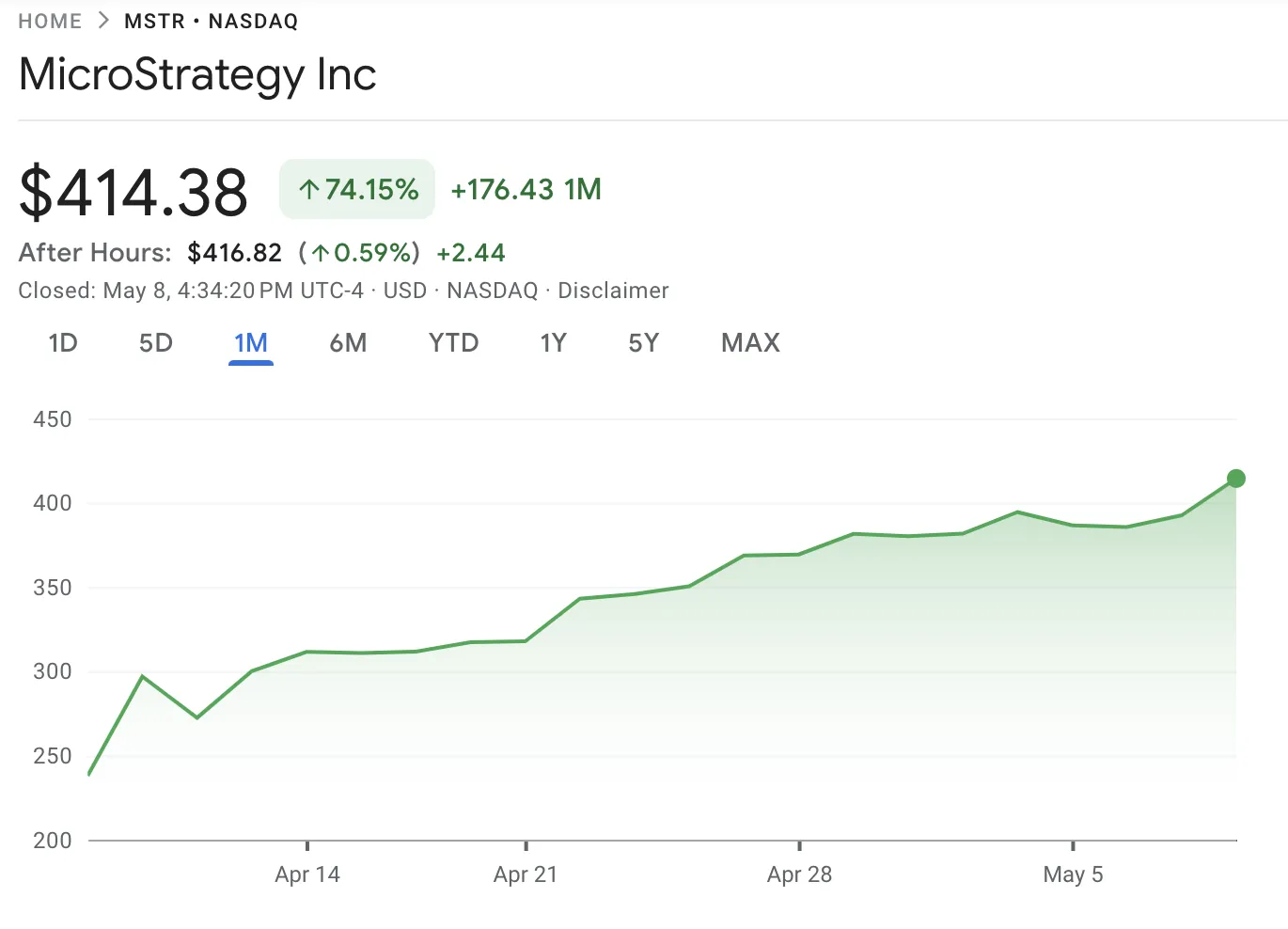

Strategy’s stock has been surging alongside Bitcoin’s gains lately. MSTR surged 7% today and 75% in the last month despite massive losses in early March and Q1.

Critics are growing increasingly wary of the company, as its debt obligations may become unstable soon. Nonetheless, its valuation has been rising consistently in the weeks preceding this milestone.

Strategy’s Bitcoin Bet Pays Off

Bitcoin reached $100,000 today, potentially marking a turnaround for the crypto industry. Strategy, the largest corporate holder of Bitcoin, can breathe easily in spite of persistent bearish rumors.

The firm recently reported massive Q1 losses, but its stock valuation is soaring nonetheless:

At first, this may seem like a conundrum. Strategy has been receiving intense criticism over its Bitcoin plan, as critics feared a forced liquidation.

However, the price of BTC has been rising steadily, and Michael Saylor’s company has been growing alongside it. MSTR rose nearly 50% since its lows in March, and the stock is currently outperforming BTC and leading tech firms.

A few factors contributed to the company’s strong performance. Although Trump’s tariffs caused the crypto market to contract for several weeks, the market is showing more positive signs right now. During this period, Strategy continued purchasing Bitcoin at a consistent rate.

Doing so became a pillar of Bitcoin confidence for the crypto community. This resolute attitude won the firm prominent admirers, such as Eric Trump.

Still, a lot is in flux right now. The market is extremely chaotic, and false rumors have moved it on several recent occasions. BTC reached $100,000 because of a UK-US trade deal, but this moment may not last.

Strategy hitched its entire future to Bitcoin, and the company’s debt is growing out of control. Although the firm’s stocks are outperforming BTC, it doesn’t look stable.

To be clear, though, the company has posted very consistent gains over the past month. Although forced Bitcoin liquidation rumors have dogged Strategy, this didn’t blunt its forward momentum whatsoever.

As of now, it looks likely that Bitcoin and its largest corporate holder will continue growing like this for the foreseeable future.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.