North Korean hackers and shattered on-chain projects have left several decentralized finance blockchains struggling, with tens of millions in user asset outflows.

Data from DefiLlama shows that multiple DeFi chains have lost around 90% of total user deposits over the years, particularly since the last crypto cycle. On-chain analyst 0xThoor identified Ethereum Virtual Machine-compatible blockchain Harmony as the biggest drop regarding DeFi total value locked.

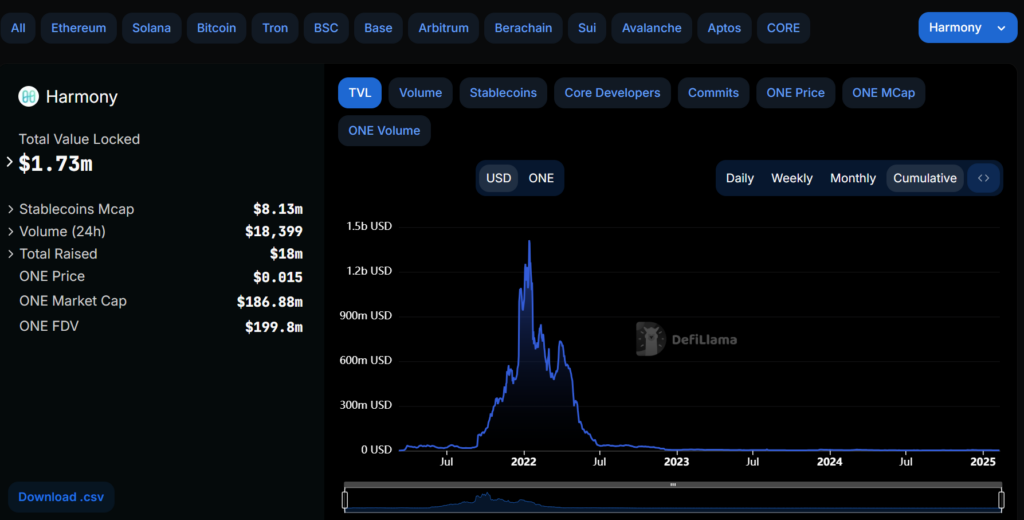

Harmony launched its layer-1 mainnet in 2019, two years before the previous bull run and its 2021 peak. By January 2022, Harmony’s TVL reached an all-time high, surpassing $1.4 billion.

Six months later, in June, North Korean hacker group Lazarus stole $100 million from Harmony’s Horizon bridge in one of DeFi’s largest hacks to date. Harmony’s user deposits steadily declined from that point. The protocol held $1.7 million in TVL by publishing time, down 99% from its 2022 ATH.

DeFi TVL for projects like Aurora, Moonrise, Canto, and Evmos have also tumbled by at least 90%. Even Polygon, a popular Ethereum-based scaling solution, has lost 92% of its TVL. Crypto deposited on the L2 from $9.9 billion in 2021 to $700 million in early 2025. “Many more TVL charts will look like this over the coming years,” 0xThoor tweeted on Feb. 10.

Total DeFi TVL currently hovers above $106 billion, down from $175 billion in 2025. Despite major protocol collapses, projects like Coinbase-incubated Base and emerging Bitcoin DeFi operability may propel the on-chain ecosystem to new heights as adoption accelerates.