Berachain (BERA) is up roughly 7% in the last 24 hours, pushing its market cap above $900 million. The recent price surge is supported by strong technical indicators, with RSI approaching overbought levels and DMI showing buyers firmly in control.

If the current uptrend continues, BERA could retest levels above $8.5 and possibly challenge resistance at $9. However, if momentum fades, key support levels at $6.18 and $5.48 could be tested, determining the next directional move.

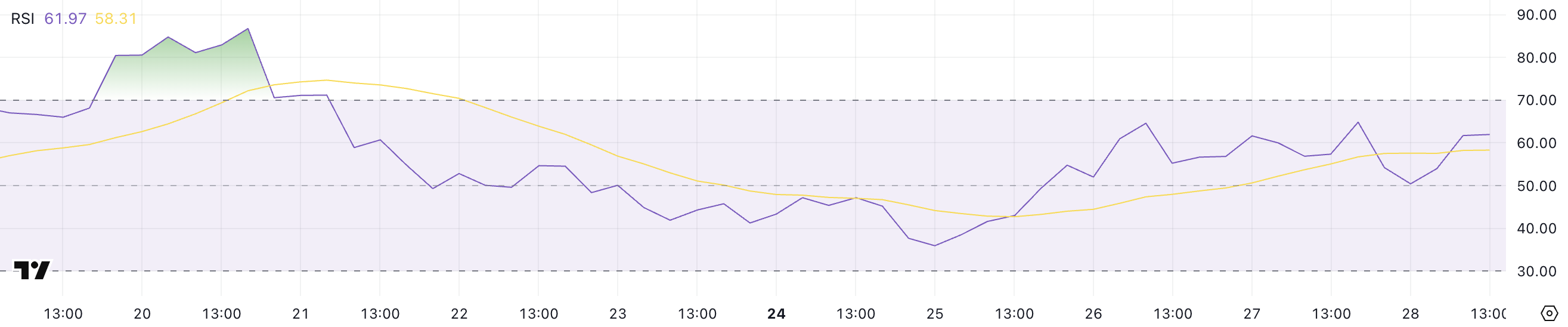

Berachain RSI Is Close to 70

Berachain’s RSI is currently at 61.97, rising from 35.9 just three days ago after staying neutral for eight days. The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements, ranging from 0 to 100.

An RSI above 70 indicates overbought conditions, suggesting a potential pullback, while an RSI below 30 signals oversold conditions, indicating a possible rebound. An RSI between 30 and 70 is generally considered neutral, reflecting no strong directional bias.

With Berachain’s RSI at 61.97, the price is approaching the overbought threshold but remains in neutral territory for now. This increase suggests growing bullish momentum and buying interest, indicating that BERA could continue to rise if the RSI moves closer to 70.

However, if the RSI crosses into overbought territory, a short-term pullback or consolidation phase could follow as traders take profits. The next price movement will depend on whether buying pressure persists or if sellers start to dominate as the RSI approaches overbought levels.

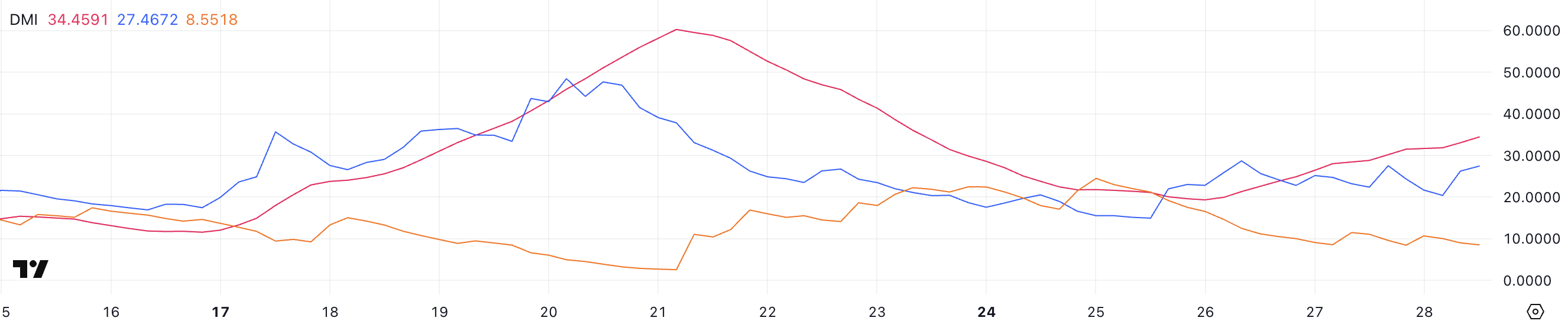

BERA DMI Shows Buyers Are In Control

Berachain’s DMI shows that its ADX is currently at 34.4, rising from 19.3 two days ago, after previously reaching 60.2 a week ago when BERA’s price surpassed $8.5. The Average Directional Index (ADX) measures the strength of a trend without indicating its direction, ranging from 0 to 100.

An ADX above 25 signals a strong trend, while values below 20 suggest a weak or non-trending market. The increase in ADX indicates that the current uptrend is gaining strength, reflecting growing momentum and market conviction.

Meanwhile, BERA’s +DI is at 27.4, showing strong buying pressure, while the -DI is at 8.55, down from 11.1 two days ago, indicating weakening selling pressure.

This configuration confirms that BERA is in an uptrend, with buyers clearly in control. The widening gap between the +DI and -DI suggests that the bullish momentum is increasing, making a continuation of the uptrend more likely. As long as the +DI remains above the -DI and ADX stays above 25, BERA is likely to maintain its upward trajectory.

Will BERA Reclaim Levels Above $9 In March?

Berachain (BERA) could be on its way to retest levels above $8.5, and if the current uptrend continues to gain momentum, it could rise further to challenge resistance above $9.

With a market cap of $884 million, the $1 billion threshold could be a crucial level to watch in the coming weeks, as breaking this milestone could attract increased investor interest and buying pressure.

However, if the uptrend reverses, BERA could decline to test the support at $6.18.

If this level fails to hold, the price could drop further to $5.48, signaling a deeper correction. These key support and resistance levels will play a vital role in determining BERA’s next price movement.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.