Cardano witnessed a 60% price surge over the weekend, climbing above $1 on Sunday. The rise came after US President Donald Trump announced his administration’s plan to establish a reserve of digital assets, which included ADA.

However, the hype has turned out to be short-lived. ADA has since lost momentum, plunging by 20% in the past 24 hours and slipping back below the crucial $1 price mark.

Cardano Dips 20% in 24 Hours—Is the Rally Over?

ADA soared above $1 on Sunday after Trump announced the proposed US crypto strategic reserve, which will consist of five coins: ADA, BTC, ETH, XRP, and SOL.

However, the speculative enthusiasm around the proposal may have faded, leading to a wave of profit-taking among ADA traders. At press time, the coin trades at $0.82, noting a 20% dip over the past 24 hours.

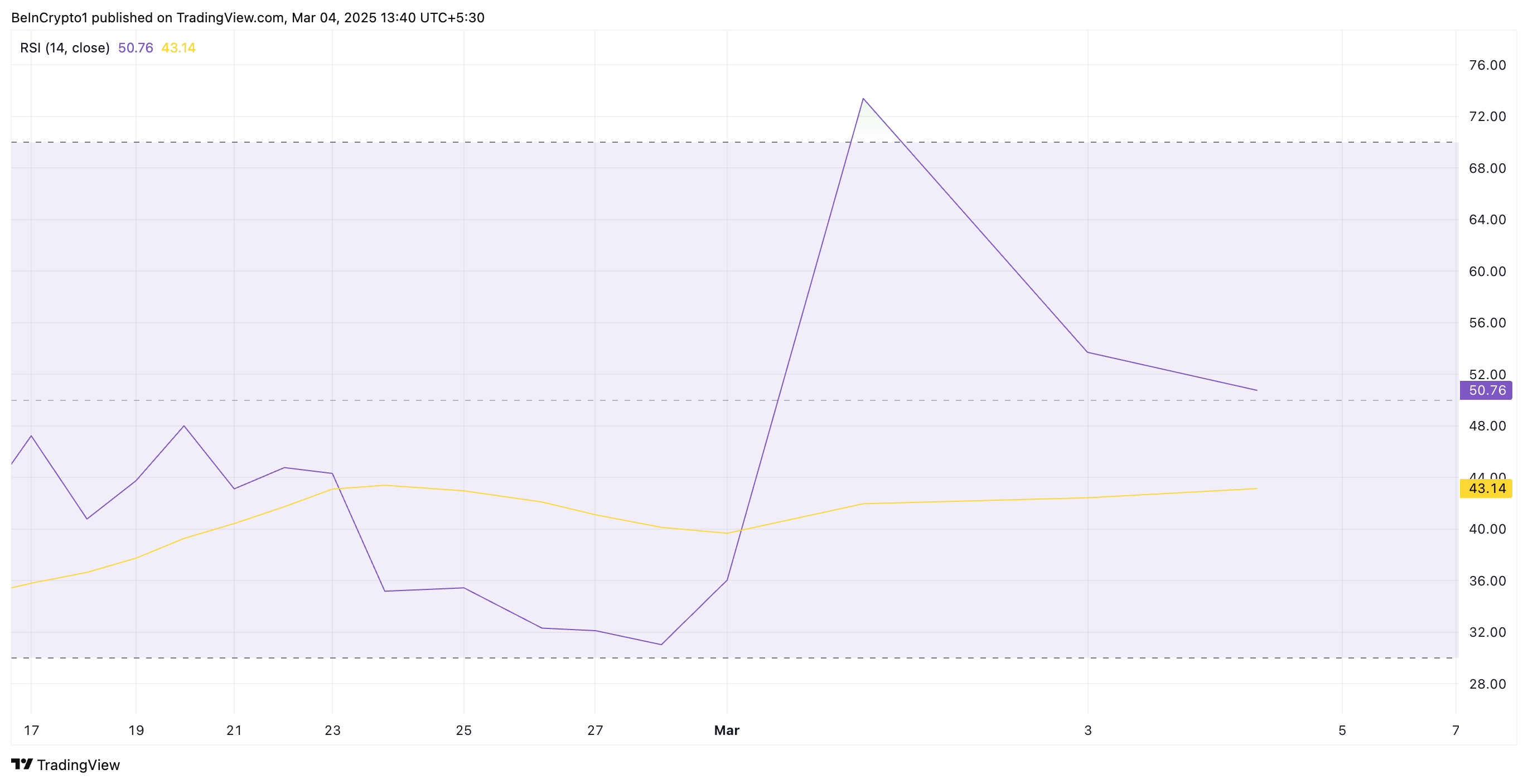

Technical indicators assessed on a daily chart reinforce the weakening demand for ADA. For example, its Relative Strength Index (RSI) is trending downward, signaling a decline in buying pressure. At press time, this key momentum indicator, which measures the asset’s oversold and overbought conditions, is poised to breach the 50-center line.

The trend signals a bearish shift in momentum. A move above 50 suggests strengthening bullish control, while a drop below 50 indicates increasing bearish pressure. Hence, ADA’s falling RSI suggests that market participants favor selling their coins for profit over acquiring new ones, exacerbating the downward pressure on its price.

Further, ADA’s price is currently gearing to fall below its 20-day exponential moving average (EMA). This key moving average measures the asset’s average price over the past 20 trading days, giving more weight to recent price changes.

When an asset’s price is about to fall below its 20-day EMA, it signals weakening short-term momentum. A confirmed break below the level indicates a bearish trend reversal and highlights the increased selling pressure in the market. Therefore, a break below this key level puts ADA at risk of extending its decline in the short term.

ADA Eyes $0.94 if Buyers Step In

ADA trades at $0.82 at press time, resting above the support formed at $0.72. If bearish pressure strengthens, this support level may fail to hold. In that case, ADA’s price could decline toward $0.60.

However, a resurgence in ADA demand would invalidate this bearish outlook. If profit-taking stalls and new buyers enter the market, it could drive up ADA’s value to $0.94.

A successful breach of this resistance could propel Cardano’s price toward a three-month high of $1.32.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.