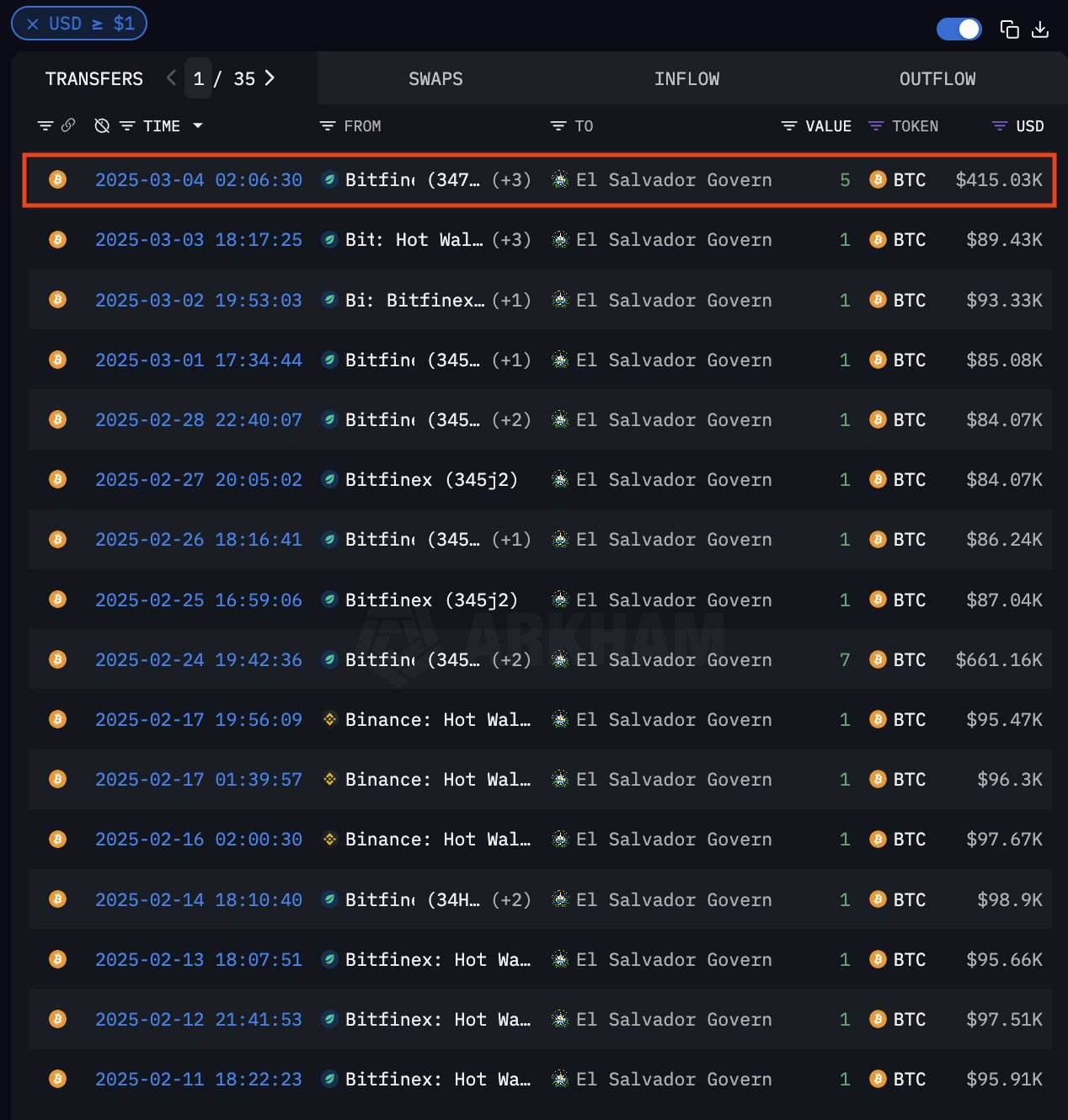

El Salvador purchased five Bitcoins today, and President Bukele claimed that the country doesn’t plan to stop in the future. However, the government signed an agreement with the IMF mandating that the public sector can no longer voluntarily purchase BTC.

Some community members have speculated that the agreement includes some extension period that the public isn’t aware of. Otherwise, this agreement and the $1.4 billion in associated loans could blow up in everyone’s face.

El Salvador Keeps Buying Bitcoin

Since El Salvador made Bitcoin legal tender in 2021, the Central American nation has become a major BTC holder. However, after years of a combative relationship with international financial institutions, the IMF attempted to soften its anti-Bitcoin policies last October.

El Salvador agreed to amend its laws, but it has continued stockpiling the asset since. Specifically, the IMF’s technical memorandum of understanding includes a clause that prohibits the voluntary accumulation of Bitcoin by the public sector.

Additionally, the agreement restricts the public sector from issuing any debt or tokenized instruments indexed to or denominated in Bitcoin.

However, the El Salvador government continues to purchase 1 BTC per day as part of a long-term strategy to stockpile the asset. Today, it acquired five Bitcoins, further contradicting this directive.

Samson Mow, an influential community figure, has been following a December agreement between El Salvador and the IMF. Today, the IMF published additional commentary, claiming that El Salvador was neither allowed to purchase nor mine Bitcoin.

“If there is a loophole for continued buying, I didn’t find it in the document. If the plan is to just outright defy the IMF, I don’t think that is good for the additional loans, or to present an image of a serious stable country,” wrote Samson Mow.

However, President Bukele rejected these assertions.

“This all stops in April, this all stops in June, this all stops in December! No, it’s not stopping. If it didn’t stop when the world ostracized us and most ‘bitcoiners’ abandoned us, it won’t stop now, and it won’t stop in the future,” Bukele claimed on X (formerly Twitter).

On one hand, the country has plenty of reasons not to capitulate to the IMF. El Salvador has used Bitcoin to lead broader societal transformations, fostering a domestic community and using ample geothermal energy to create massive mining operations.

Abandoning these efforts would severely curtail the country’s economic independence.

However, where does this aggressive stance leave the IMF agreement? El Salvador allegedly consented to stop buying Bitcoin so it could receive $1.4 billion in loans. What happens to that money or any future trade deals? Is Bukele’s activity prohibited or not?

There are many questions still in the air. It’s possible that the IMF gave El Salvador a few extra months to buy Bitcoin, and Bukele is maintaining his outward bullishness until then.

Yet, these concerns remain unanswered and further regulatory clarification might be needed down the line.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.