Solana has faced a sharp decline, plunging to a multi-month low amid broader market weakness. The altcoin’s ongoing downtrend, exacerbated by recent technical indicators, has made a recovery uncertain.

Solana’s future price action largely depends on Bitcoin’s performance, as a potential BTC rebound could support SOL’s turnaround.

Solana Investors Need A Nudge

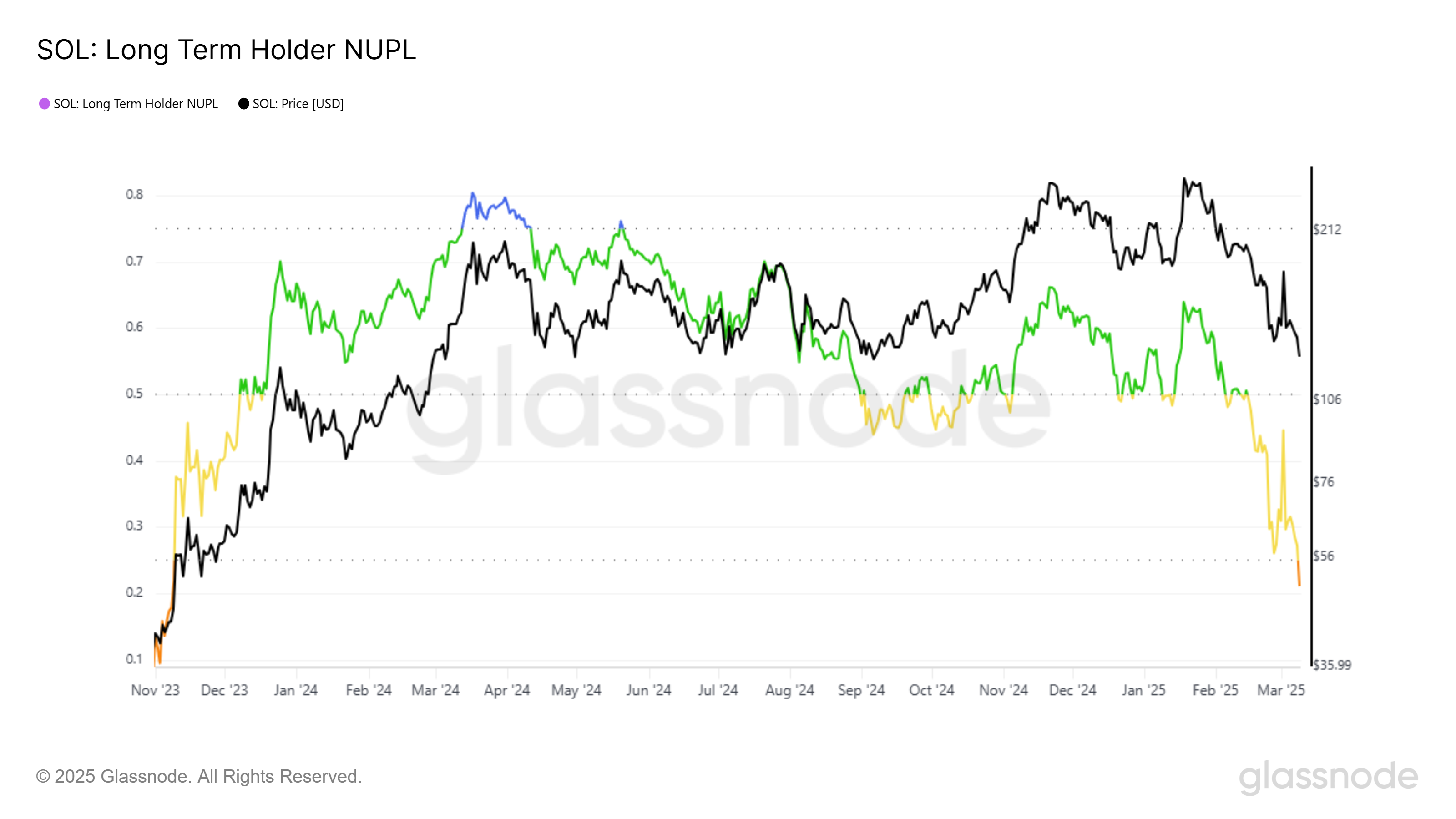

Solana’s Long-Term Holder Net Unrealized Profit/Loss (LTH NUPL) has entered the Fear zone, signaling increased market distress. Currently sitting at a 16-month low, this indicator reflects the broader market downturn’s impact on SOL investors. As long-term holders experience rising losses, the potential for significant selling pressure increases, posing a risk of further declines.

The sentiment among these investors could extend to retail traders if fear escalates. A mass sell-off could amplify bearish pressure, making it harder for SOL to recover. Unless Bitcoin stabilizes and market conditions improve, investor confidence in Solana is likely to remain weak in the near term.

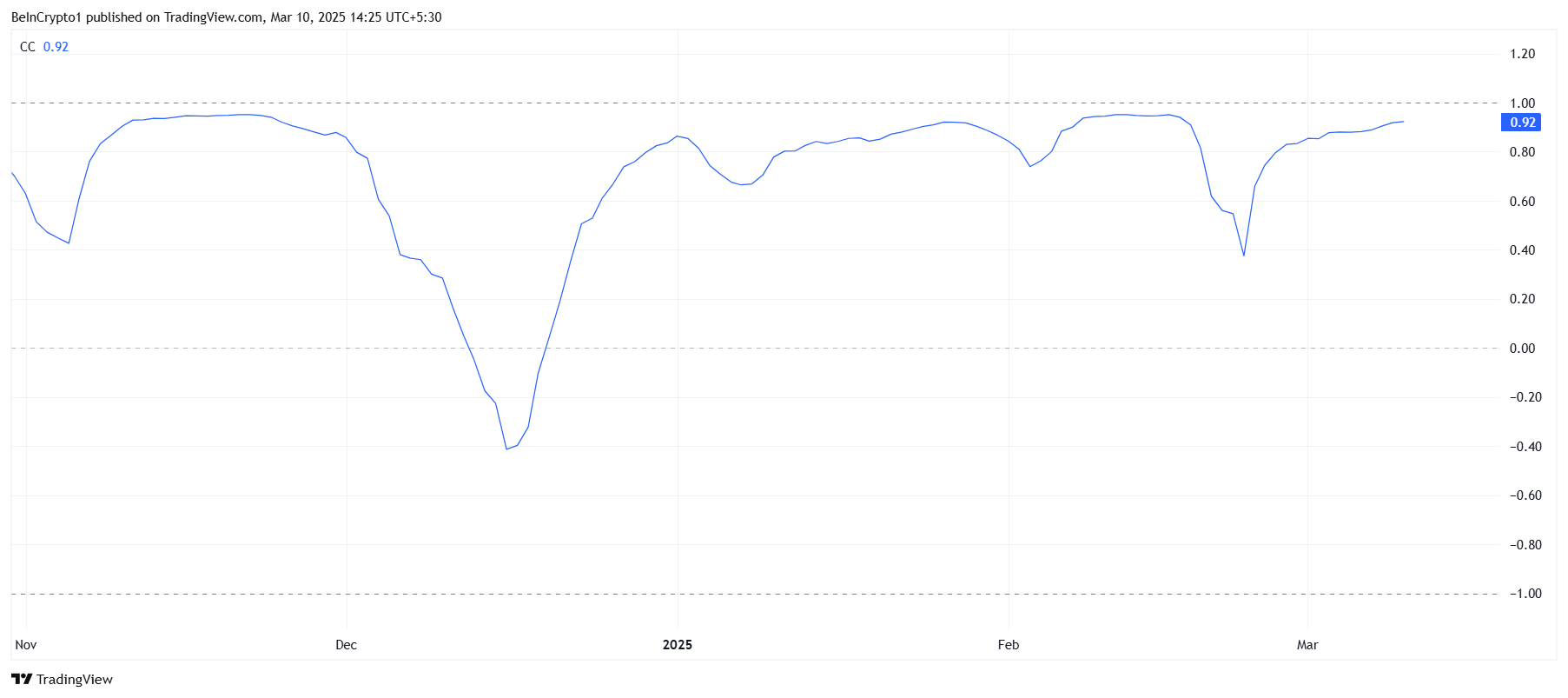

Solana maintains a strong correlation with Bitcoin, currently at 0.92. While high correlation typically signals bullish alignment, in SOL’s case, it is a bearish indicator. Bitcoin is struggling to hold above $80,000, meaning any further BTC weakness could pull Solana down alongside it.

If Bitcoin fails to regain momentum, Solana’s price could face additional losses. The altcoin’s reliance on BTC’s stability adds to its vulnerability. Until Bitcoin reclaims key support levels, SOL’s macro momentum will likely remain bearish, prolonging its downtrend.

SOL Price Takes A Hit

Solana’s price has dropped 28% in the past 24 hours, trading at $128. The decline stems from overall market bearishness and the Death Cross formation on SOL’s chart last week. This technical pattern suggests continued downside unless strong buying pressure emerges.

Currently, SOL is holding above $120, attempting to stabilize. However, if broader market conditions do not improve, the altcoin risks breaking below its key support at $128. A failure to hold this level could accelerate losses, leading to deeper corrections.

On the other hand, if investors take advantage of the lower price and accumulate, SOL could reclaim $137 as support. A successful breakout beyond this level would open the door for a potential rally toward $155, effectively invalidating the bearish outlook. Market sentiment and Bitcoin’s trajectory remain critical to Solana’s recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.