Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

WhiteRock’s XRPL-powered testnet has shown strong performance, drawing attention ahead of its live launch and upcoming AMA on March 11.

WhiteRock’s recent testnet, conducted through its integration with XRPL, has delivered strong results. The testnet recorded a network latency of 4.2 milliseconds and $324.5 million in 24-hour market activity.

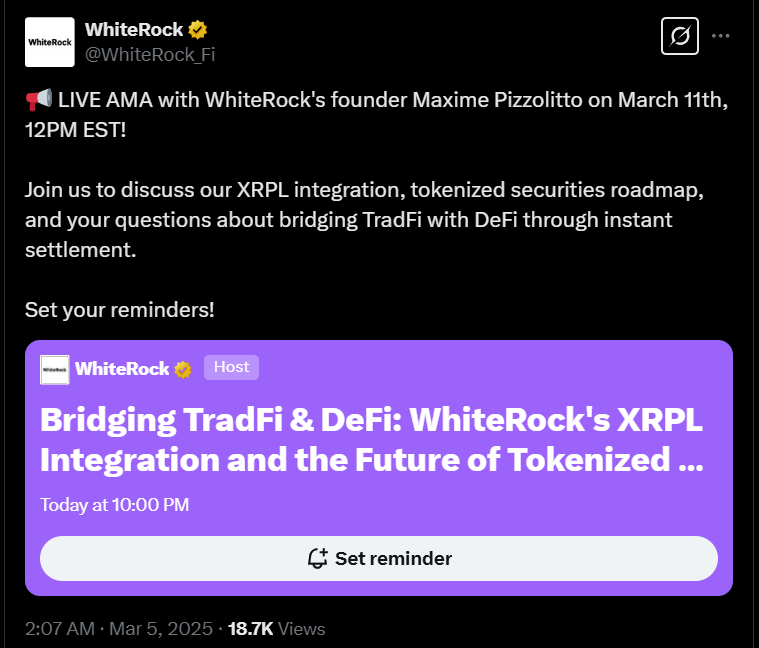

To discuss this XRPL integration and answer the public’s questions, WhiteRock has organized a LIVE AMA with its founder Maxime Pizzolitto on March 11 at 12 pm (EST).

WhiteRock is a popular blockchain-powered decentralized brokerage platform. Its partnership with the XRP Ledger (XRPL) by Ripple is gaining considerable attention after the promising test net phase, hinting at a live launch soon.

Amid these developments, various financial firms are showing keen interest and are eyeing WhiteRock’s whitelist before the live launch. This also reflects growing trust in XRPL’s ability to simplify tokenized securities and bonds. The company plans to onboard these partners shortly, which is a key milestone.

XRPL’s 5-second transaction times and small fees give WhiteRock an edge over traditional brokers and some rivals. With 6.1 million accounts holding 62.5 billion XRP and a built-in decentralized exchange, it’s a strong foundation for tokenized asset trading. The launch of the world’s first XRP ETF in Brazil has also highlighted XRPL’s rising profile.

WhiteRock’s testnet, powered by XRPL, has turned heads with a network latency of 4.2 milliseconds and $324.5 million in 24-hour market activity. Settlement times hit 3.4 seconds, outpacing the standard T+2 process. Meanwhile, a market beta of 1.12 and manageable risk underscore XRPL’s reliability.

Backed by 2.8 billion transactions over 12 years, it’s a solid base. Pizzolitto adds, “XRPL’s quick transactions fit our needs perfectly, setting us up for what’s ahead.”

WhiteRock’s WHITE token is starting to gain traction among traders; the platform is growing by supporting more trades and liquidity. With a $420m FDV, there is space for growth as WHITE’s role could expand, with WhiteRock’s XRPL partnership gaining steam.

As the live launch nears, WhiteRock appears well-placed to meet the rising demand for efficient tokenized securities. For more details and insights into what’s ahead, tune in to Maxime Pizzolitto’s AMA on X, on March 11 at 12 pm (EST).

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.