Ondo Finance (ONDO) is up nearly 7% in the last 24 hours, attempting to reclaim a $3 billion market cap after a sharp 38% correction over the past 30 days. The recent price recovery suggests a potential trend shift, but key resistance levels must be broken for confirmation.

Indicators like the DMI and CMF show that selling pressure is fading while buying interest is increasing. If ONDO breaks past $0.90, it could rally toward $1.08 and even $1.20. However, failure to sustain momentum could lead to another drop below $0.70.

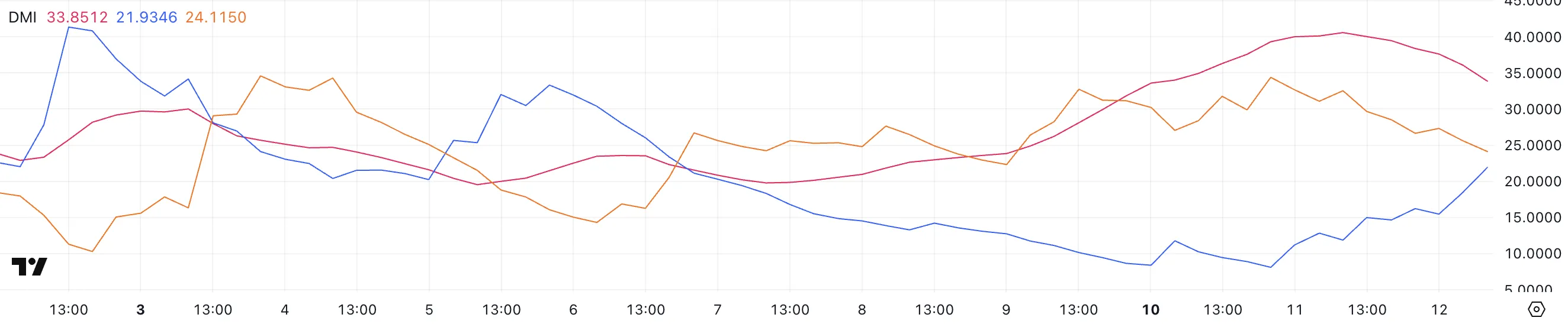

ONDO DMI Shows The Downtred Could Revert Soon

ONDO’s ADX is currently at 33.8, down from 40.5 yesterday. This indicates that while the downtrend remains strong, its intensity is starting to weaken.

The ADX (Average Directional Index) measures trend strength on a scale from 0 to 100, with values above 25 signaling a strong trend and values below 20 suggesting a weak or non-trending market.

Since Ondo Finance ADX is still well above 25, the bearish trend remains dominant, but the decline suggests that momentum could be slowing.

Meanwhile, the +DI has climbed to 21.9 from 11.18, while the -DI has dropped from 34.3 to 24.11, showing that selling pressure is fading while buying pressure is increasing.

However, since -DI remains slightly above +DI, the downtrend is still in place. If +DI continues rising and crosses above -DI, it could confirm a shift in momentum, potentially signaling a trend reversal.

Until then, Ondo Finance remains in a downtrend, but bulls are gaining ground.

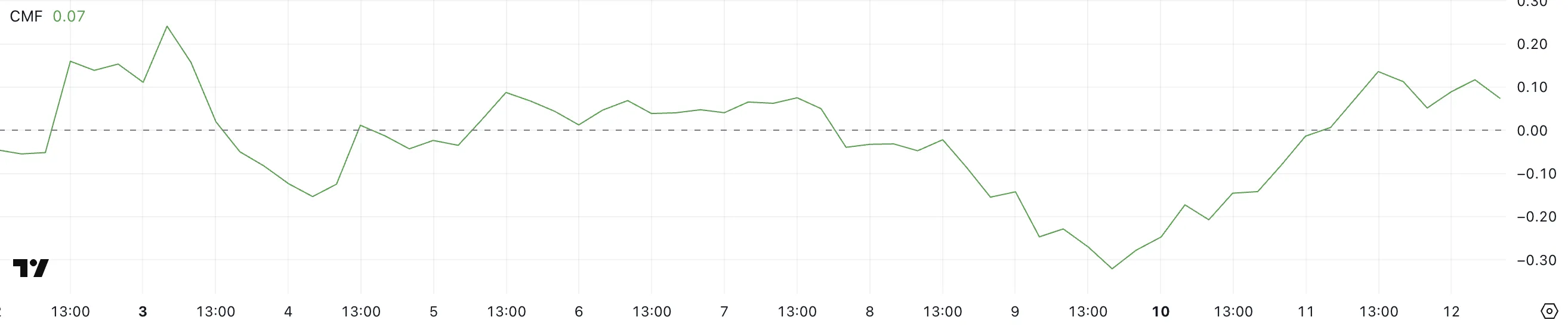

Ondo Finance CMF Surged In The Last Three Days

ONDO’s Chaikin Money Flow (CMF) is currently at 0.07, recovering from a negative low of -0.32 just three days ago.

The CMF measures buying and selling pressure by analyzing both price and volume, with values above 0 indicating accumulation (buying pressure) and values below 0 signaling distribution (selling pressure).

A CMF above 0.05 suggests growing bullish momentum, while prolonged negative readings often align with downtrends.

Ondo Finance CMF turned positive yesterday after spending two consecutive days in negative territory, signaling that buying pressure is increasing.

With CMF now at 0.07, capital inflows are returning, which could support further price recovery. However, since the value is still relatively low, sustained buying volume is needed to confirm a strong uptrend.

If CMF continues rising, it could indicate stronger accumulation, potentially leading to a breakout, establishing ONDO among the top Real-World Assets coins in the market.

Will ONDO Reclaim $1 Soon?

ONDO is currently recovering after dipping below $0.79 for the first time in months, following a broader correction across major RWA coins in the last 30 days.

The recent bounce suggests buyers are stepping in, but the trend remains uncertain, with key resistance levels ahead.

If it breaks above $0.90, it could continue rising toward $0.99, and a further breakout could send it to $1.08 or even $1.20.

However, if the uptrend fails and selling pressure returns, ONDO price could drop to $0.73, with the risk of falling below $0.70 for the first time since November 2024.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.