Story’s IP has extended its bullish streak, recording another day of gains as its uptrend continues. In the last 24 hours alone, IP has surged 11%, making it the second-highest gainer during this period.

Over the past week, the altcoin has climbed 17%, bucking the broader market decline and solidifying its position as one of the strongest performers.

IP’s Short-Term Outlook Remains Bullish as Buying Pressure Builds

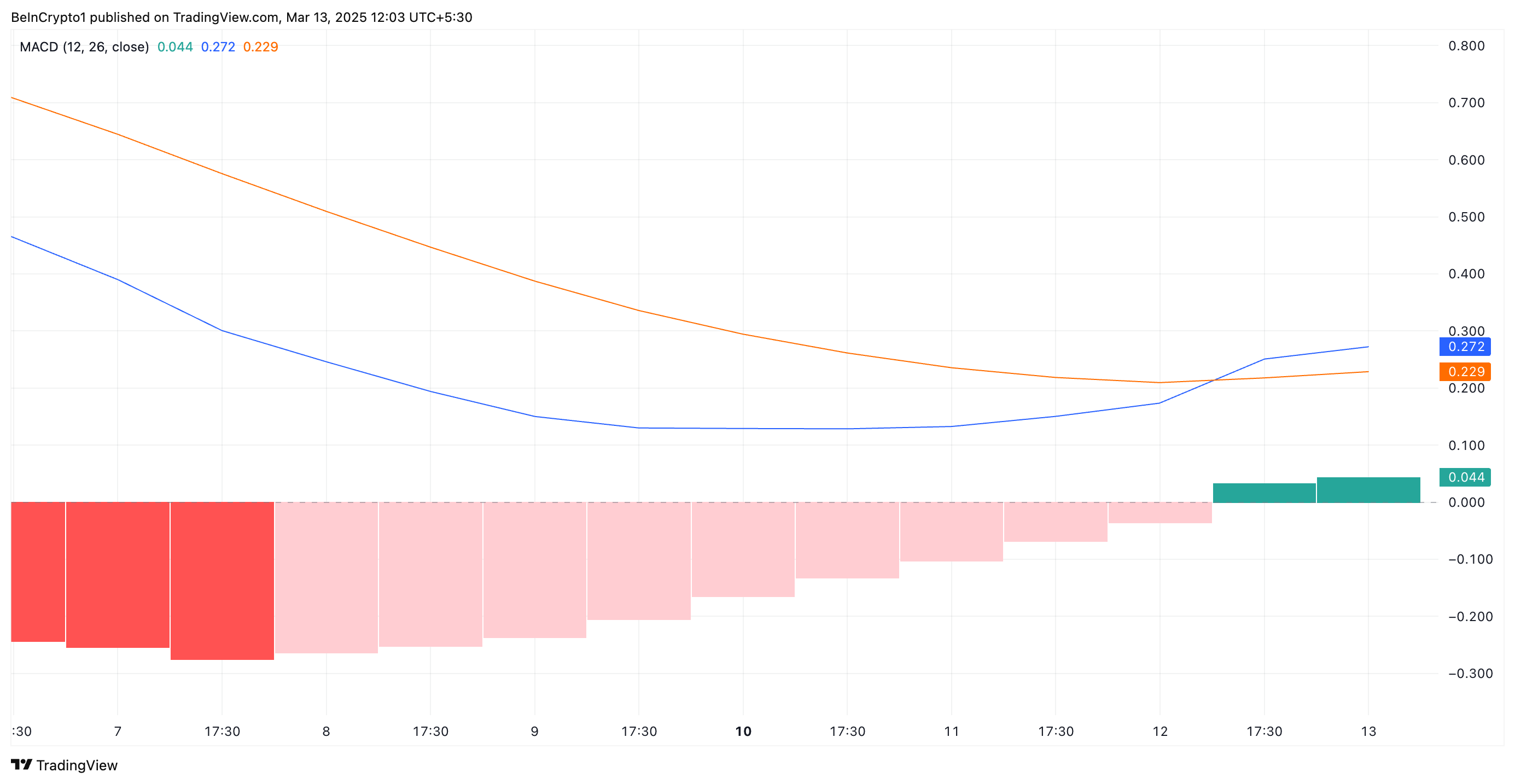

Readings from the IP 12-hour chart hint at a sustained price growth in the short term. For example, the coin’s Moving Average Convergence Divergence (MACD) supports this bullish outlook.

After spending an extended period below the signal line (orange), IP’s MACD line (blue) flipped above it during Wednesday’s trading session, posting a green histogram bar.

This bullish crossover suggests a bullish shift in momentum, indicating increasing buying pressure. The appearance of a green histogram bar reinforces the strength of this trend, signaling that IP’s uptrend could continue. If sustained, this momentum may attract more traders, potentially driving the coin’s price even higher.

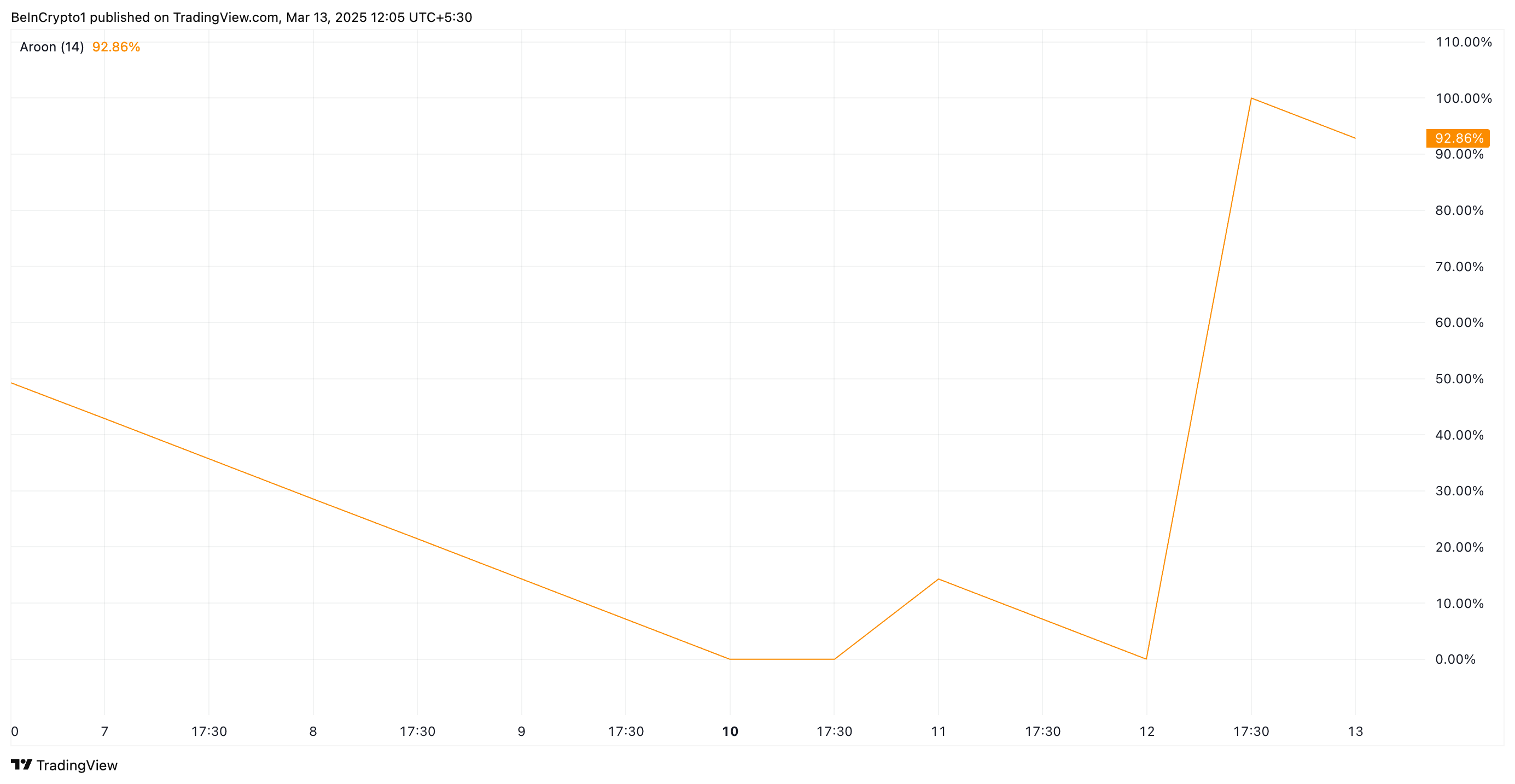

Additionally, IP’s Aroon Up Line, which tracks the strength of its trends, confirms that the current rally is still intact, indicating that the uptrend may not be slowing down anytime soon. At press time, this indicator is at 92.86%.

When an asset’s Aroon Up Line is close to 100%, it indicates a strong uptrend. The metric suggests that IP is consistently reaching new highs within the review period. This is true of the coin, which currently trades at $5.91, its highest since March 8.

IP Holds Strong Above Support—Can It Reclaim Its $7.95 All-Time High?

At its current price, IP trades strongly above the support floor formed at $5.54. If the bullish pressure in its spot markets remains, IP could continue its upward trend and attempt to revisit its all-time high of $7.95.

On the other hand, a resurgence in profit-taking among IP holders would invalidate this bullish projection. In that scenario, the coin could lose its recent gains, fall below the $5.54 support, and drop toward $4.05.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.