Amid Ethereum’s (ETH) ongoing market challenges, industry experts are drawing striking comparisons between the cryptocurrency’s current position and the early growth trajectories of tech giants such as Amazon (AMZN), Microsoft (MSFT), and Tesla (TSLA).

They claim that investing in ETH now is akin to purchasing high-growth stocks a decade ago, with the expectation that Ethereum will ultimately experience substantial gains in the future as adoption increases.

Ethereum the Next Big Growth Asset?

In a detailed post on X (formerly Twitter), DeFi Dad contended that many investors are fundamentally mispricing ETH. According to him, ETH is being assessed as a stable, value-oriented stock rather than a high-growth asset that it has the potential to become.

“Please stop trying to analyze ETH like it’s Procter & Gamble. Buying ETH is closer to buying a high-growth stock like AMZN, MSFT, or TSLA decades ago,” he stated.

The analyst suggested that this is a critical time to “front-run” Ethereum’s potential dominance in the blockchain space. He stressed that Ethereum is distinguished by its continuous innovation, but rather than prioritizing immediate user growth, the network has focused heavily on security. This commitment to reliability has positioned Ethereum as the most trusted settlement layer in the industry.

“Ethereum’s strategy to grow the dominance of the EVM could/should be likened to Amazon,” he added.

Additionally, he highlighted the role of Layer 2 (L2) solutions in Ethereum’s ecosystem. While L2s are not yet significantly profitable for Ethereum, the expert believes they function as an essential distribution network.

DeFi Dad further pointed out that Ethereum, much like Bitcoin (BTC), has transformed into a trusted asset, attracting Wall Street investors and governments that were initially skeptical of cryptocurrencies. He highlighted that Ethereum is now the preferred blockchain for banks and institutions entering the on-chain space, even though it retains the potential to disrupt these very entities.

Another expert echoed this perspective. He suggested that Ethereum’s price could experience upward momentum if investors begin to place confidence in the vision for L2 scaling solutions. As the market recognizes the potential future benefits of these scalability improvements, demand for Ethereum may rise, driving its price higher.

“It’s like growth stocks (Uber, Netflix etc): First get users, than revenue comes,” Ignas wrote on X.

Is Ethereum in a Downward Spiral? Market Trends Suggest So

This outlook comes amid challenging market conditions for ETH. Since late 2024, ETH has been on a persistent downtrend. In fact, the altcoin has shed 29.4% of its value over the past month alone.

At the time of writing, ETH was trading at $1,948, reflecting a modest 2.6% increase in the last 24 hours.

BeInCrypto recently reported that Ethereum’s daily active addresses reached a yearly low, raising concerns about declining adoption and inflation risks. Ethereum’s market dominance has also slipped to levels last seen in 2020, exacerbating investor concerns.

In a further blow to ETH’s outlook, Standard Chartered recently slashed its 2025 price target for Ethereum by 60%, reducing it from $10,000 to $4,000.

“We expect ETH to continue its structural decline, and we lower our end-2025 price target level,” Geoffrey Kendrick, Standard Chartered’s Global Head of Digital Assets Research, noted.

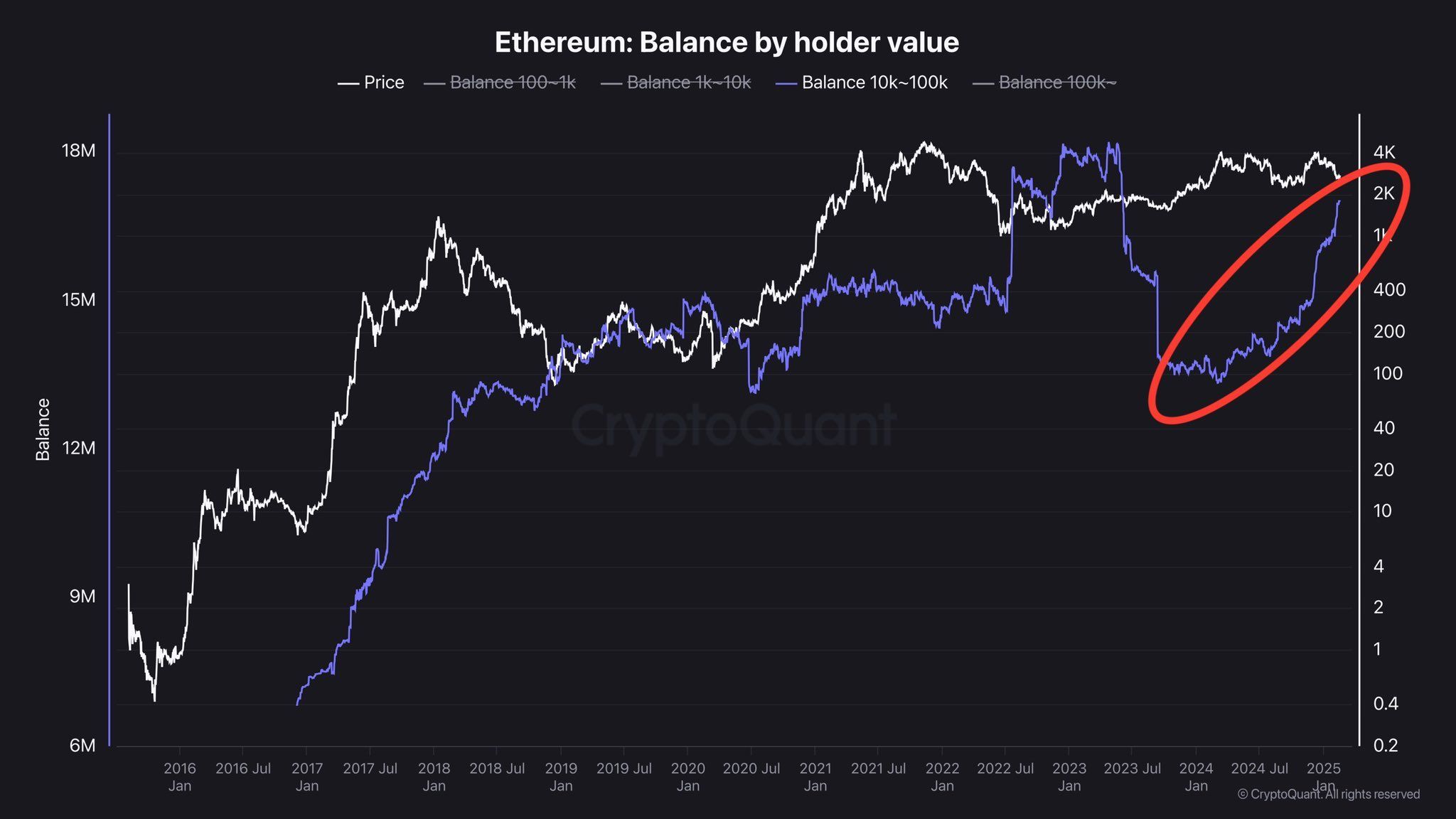

Despite this, on-chain data suggested a contrasting narrative. Analyst Quinten Francois revealed that whale wallets—large investors holding significant amounts of ETH—have been accumulating the coin increasingly.

“Large holders are buying aggressively. They’re playing you,” the analyst noted.

This hinted at potential long-term bullish sentiment among institutional and high-net-worth investors.

While Ethereum’s near-term outlook remains uncertain, these developments indicate that institutional players are still positioning themselves within the ETH ecosystem. Whether Ethereum follows the trajectory of tech giants or faces further market challenges remains to be seen.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.