The Aave Chan Initiative (ACI), led by founder Marc Zeller, has introduced a new proposal to revamp the Aave (AAVE) protocol’s tokenomics, revenue distribution, and liquidity management.

The proposed changes in the Aave Request for Comment (ARFC) proposal follow a community-approved TEMP CHECK.

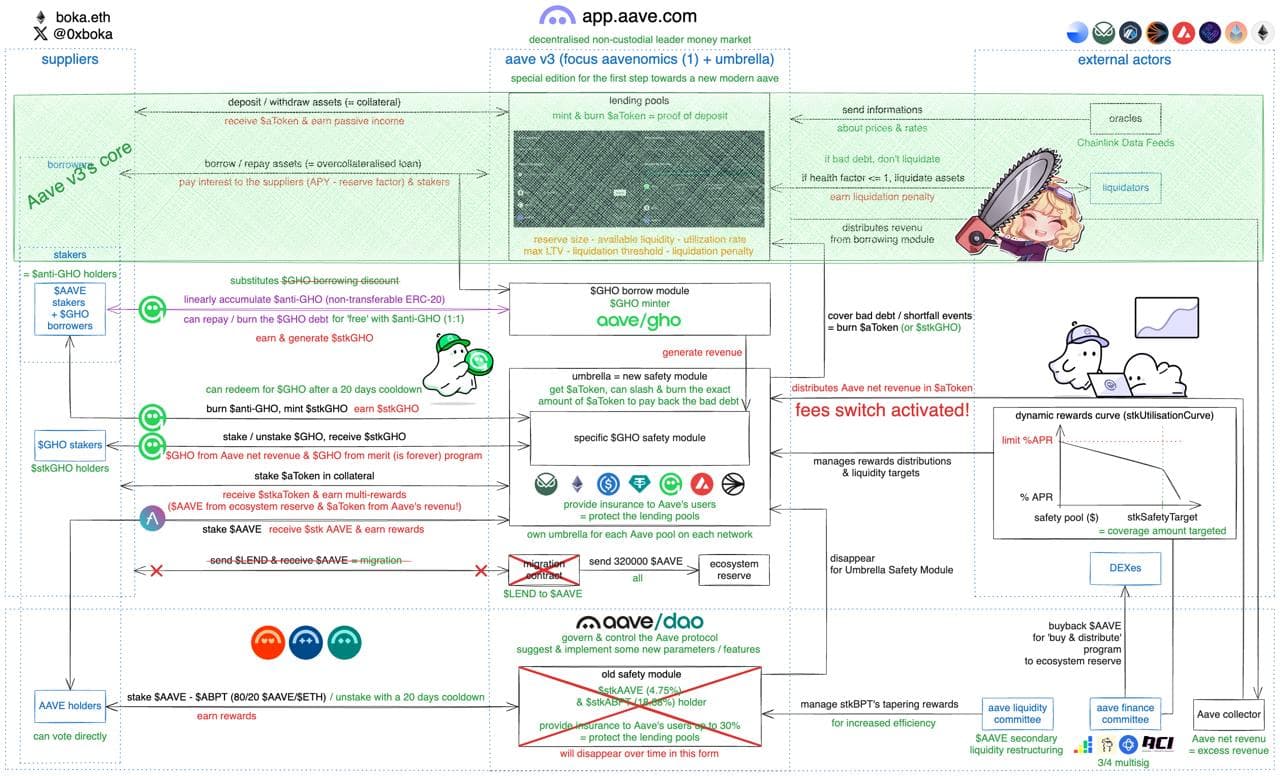

Aave Unveils Major Tokenomics Overhaul

In the latest X (formerly Twitter) post, Zeller noted that the updated Aavenomics proposal represents the culmination of five years of development.

“We consider it the most important proposal in our history, feel free to have a read and provide feedback,” he said.

The proposal introduces the creation of the Aave Finance Committee (AFC), a new body tasked with overseeing treasury operations. The AFC will spearhead a “Buy and Distribute” program.

Under this program, the committe will repurchase AAVE tokens from secondary markets at a rate of $1 million per week for the first six months. The buyback rate will be reassessed afterward. Depending on the protocol’s financial position, it might increase.

“This is big news. Buybacks will reduce AAVE’s circulating supply, making token scarcer and more valuable. Activating fee mechanism will create a new revenue stream for protocol; increasing demand,” a user wrote.

Another key shift involves AAVE stakers. The update eliminates slashing risks for those staking in StkBPT, a significant relief for participants. However, this comes with a phased reduction in StkBPT rewards as Aave transitions to a hybrid model favoring liquidity incentives over traditional staking payouts.

The proposal also closes the LEND to AAVE migration contract. Therefore, this will redirect 320,000 AAVE tokens—valued at roughly $65 million—back to the ecosystem reserve. This move concludes a nearly five-year transition, aligning with Aave’s strategy to prioritize real revenue over inflationary token emissions.

A centerpiece of the update is Anti-GHO, a non-transferable ERC20 token. This will replace the current discount mechanism.

Anti-GHO serves dual purposes. Holders can burn it at a 1:1 ratio to offset GHO borrowing costs, acting as a discount mechanism.

Additionally, they can convert it into StkGHO via the Merit system for later redemption as GHO after a cooldown. Aave has earmarked 50% of GHO revenue—approximately $6 million annually—for this program. 80% is allocated to AAVE stakers and 20% to StkBPT holders.

The proposal doesn’t stop there. Aave’s new Umbrella mechanism aims to protect users from bad debt while fortifying liquidity across multiple chains. By allocating excess DAO revenue to incentivize Umbrella aToken stakers, the system will initially safeguard wETH, USDC, USDT, and GHO, with plans for broader coverage.

The proposal is now open for community feedback. Afterward, the next step is a Snapshot vote. If approved, implementation will begin with an Aave Improvement Proposal (AIP), paving the way for the features to roll out.

The post Aave Proposes Major Tokenomics Revamp: Buybacks, Staking and Liquidity Boost appeared first on BeInCrypto.