Berachain has emerged as a leading blockchain for net bridge inflows and one of the fastest-growing networks in total value locked over the past month.

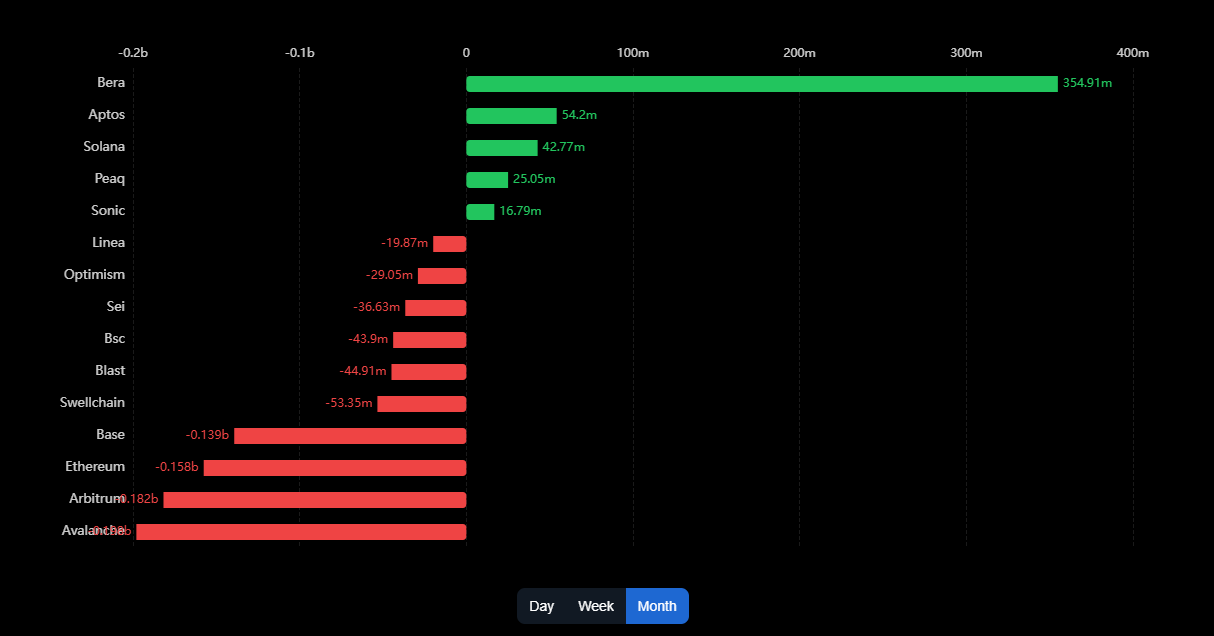

Over the past month, Berachain (BERA) led in net bridge flows with $354.91 million, outpacing Aptos (APT) at $54.2 million and Solana (SOL) at $42.77 million.

Additionally, Berachain has seen a 18.89% increase in TVL over the past month, the highest growth among the top 15 blockchains by active addresses. This is despite having fewer protocols (49) compared to larger networks, which means that liquidity in Berachain is concentrated in a smaller set of in-demand apps.

A week ago, on March 24, Berachain expanded its PoL rewards beyond BEX pools to include external apps and vaults. Given that it has only been a week since expansion, most of the growth in liquidity and TVL can be attributed to the initial concentration of capital in BEX apps. The real test now is whether this liquidity will stay within the ecosystem or rotate away once early rewards are claimed. Historically, when new incentive structures launch, a surge in TVL is common, but sustaining it requires more than just high yields. If TVL drops sharply in the coming months, it will suggest that this capital was mercenary, meaning investors were farming PoL rewards but exited as soon as better yield opportunities emerged elsewhere.

Following the PoL expansion beyond BEX, BERA rose from $6.76 on March 24 to its monthly peak at $8.57 on March 28, briefly testing resistance at around $8. However, it has since dropped back to $6.79 at press time, down by 8% in the past 24 hours and by over 18% in the past month.

The RSI peaked above 60 during the rally but has now dropped below 50, showing weakening bullish momentum. With the RSI currently 46.39, the price is considered in the neutral-to-bearish range.

However, the token’s price is still holding the historical support at around $6. If BERA continues to hold this level and bounces back with strong volume, it could retest $8 and push towards $10. However, a breakdown below $6 could lead to a further drop towards the $5 psychological support level.