Upbit and its parent company, Dunamu, secured a notable win after the Seoul Administrative Court temporarily suspended a three-month business restriction imposed by South Korea’s Financial Intelligence Unit (FIU).

New Upbit users can continue depositing and withdrawing crypto assets until at least 30 days after the main lawsuit’s final judgment.

Court Suspends Upbit Business Restriction

Local media reported that the decision came after Dunamu challenged the FIU’s disciplinary action. Specifically, Upbit’s parent company argued that the penalties were excessive.

Based on this, the 5th Administrative Division of the Seoul Administrative Court, led by Judge Soonyeol Kim, ruled in favor of Dunamu, granting an emergency suspension of the business restriction.

“…the effect will be suspended until 30 days from the date of the judgment of the main lawsuit. This is a measure to buy some time for Dunamu,” read the report.

The FIU’s initial penalty was based on allegations that Upbit violated South Korea’s Special Financial Transactions Act. The exchange reportedly allowed transactions with unregistered overseas exchanges without real-name verification.

Authorities discovered these infractions during an anti-money laundering (AML) audit from August to October last year.

“…We deeply sympathize with the purpose of the financial authorities’ recent sanctions, which are aimed at stably establishing the anti-money laundering system and strengthening the legal compliance system through strict discipline on virtual asset operators,” Upbit responded at the time.

Nevertheless, the FIU suspended Upbit’s ability to process deposits and withdrawals for new users for three months. Authorities reprimanded Upbit’s CEO, Lee Seok-woo, leading to the dismissal of the company’s compliance officer.

Dunamu quickly responded by filing a lawsuit to overturn the restriction and requesting a stay of execution. While the suspension was initially set to take effect on March 7, the court granted a temporary delay to review the case.

With the official suspension in place, Upbit can continue operations as usual until the final ruling.

This is not the first time Upbit has faced regulatory challenges. Just two months ago, South Korean authorities temporarily suspended the exchange over 700,000 Know-Your-Customer (KYC) violations.

Upbit was also under investigation for alleged antitrust violations six months earlier, with authorities scrutinizing its market practices.

While this ruling offers Upbit some breathing room, the legal battle is far from over. The final verdict in the main lawsuit will determine whether the FIU’s sanctions were justified or an overreach.

This ruling is pivotal for Upbit, South Korea’s largest crypto exchange. The South Korean government recently ordered Google to block 17 foreign cryptocurrency exchanges that failed to comply with local regulations. With these competitors effectively shut out, Upbit is in a prime position to strengthen its market presence and attract more users.

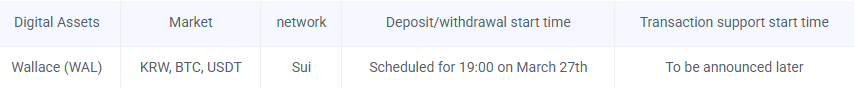

In a separate development, Upbit announced the launch of Wallace (WAL) trading pairs, citing the Korean won (KRW), Bitcoin (BTC), and USDT stablecoin.

WAL token ties to the Walrus protocol, which focuses on decentralized storage for blockchain data. Walrus, developed by the Sui (SUI) team at Mysten Labs, recently secured $140 million in funding, with its mainnet launch coinciding with Upbit’s announcement on March 27.

South Korea’s crypto market is influential, and Upbit’s listing could boost WAL’s visibility. However, past listings like ORCA and BONK show such gains often fade quickly.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.