Over the past few months, Onyxcoin’s (XCN) price has struggled to break free from a persistent downtrend. Despite some optimistic sentiment from investors, recent attempts at an upward breakout have been unsuccessful.

The broader market conditions remain bearish, which is dampening the cryptocurrency’s price action and limiting recovery potential.

Onycoin Needs Stronger Support

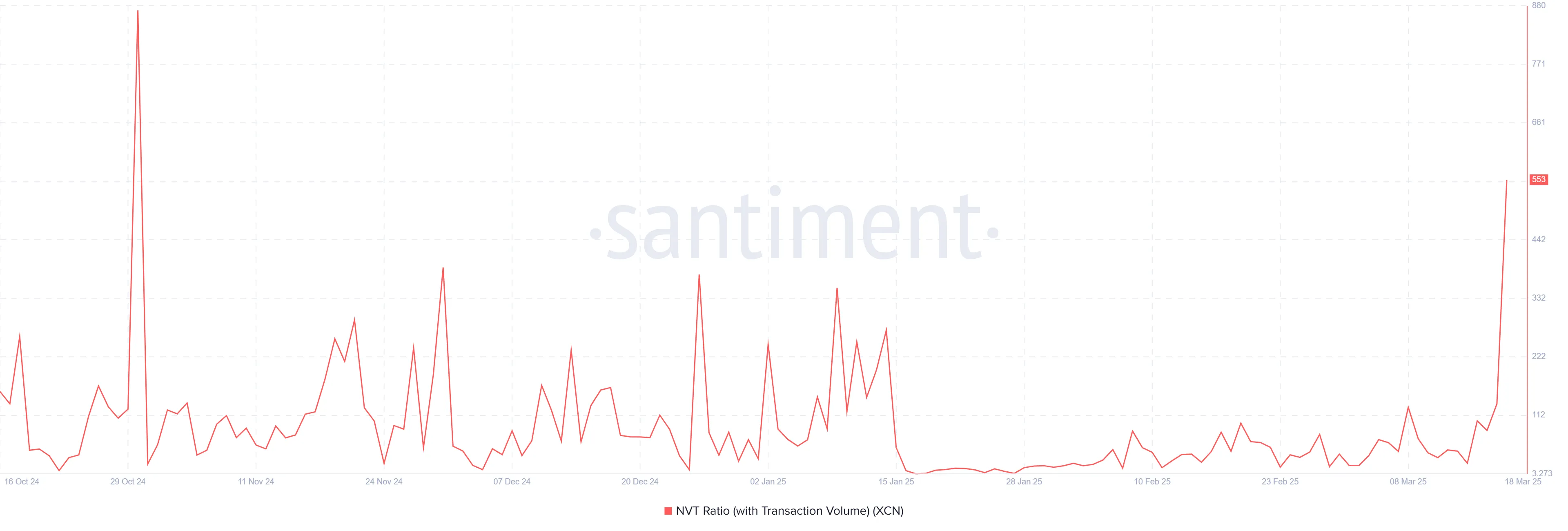

The NVT (Network Value to Transaction) ratio for Onyxcoin is currently at a four-month high, which highlights an imbalance between the network value and the asset’s market value. High NVT ratios indicate that although the network is gaining attention, actual transactions are weak.

This is a bearish signal because it suggests that the hype surrounding Onyxcoin is not backed by substantial user activity or adoption. Consequently, the altcoin’s recent price movements are driven more by speculative interest rather than organic growth, making it difficult for the coin to escape its current downtrend.

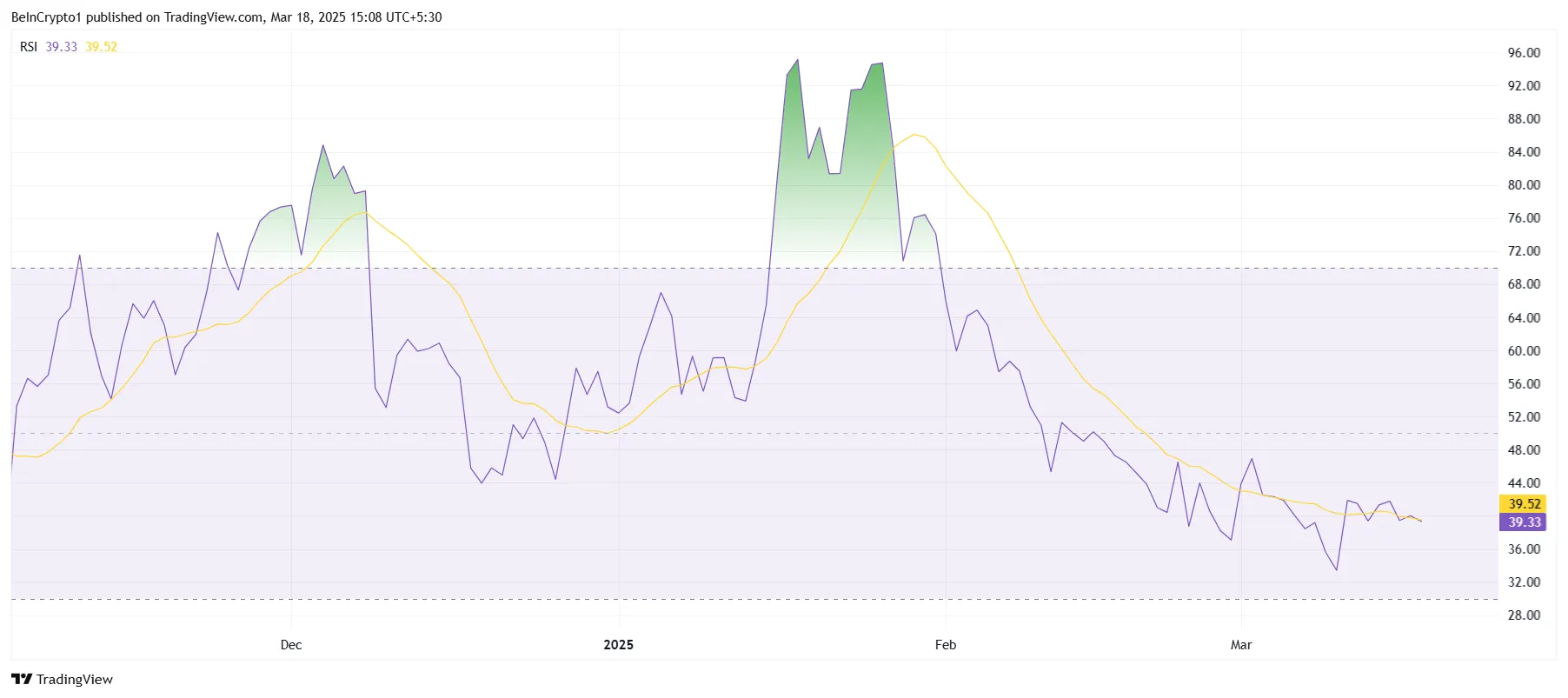

Onyxcoin’s overall macro momentum also looks concerning. The Relative Strength Index (RSI) is currently below the neutral mark of 50.0, signaling that the cryptocurrency is in a bearish zone.

The RSI has been weak for some time, reflecting investor pessimism and weak market sentiment. This bearish momentum is likely to continue, especially given that the broader cryptocurrency market is also showing weak performance, reinforcing the downward trend for XCN. The lack of positive momentum in the broader market further affects Onyxcoin’s ability to recover.

XCN Price Needs To Break Out

Currently trading at $0.0122, Onyxcoin is holding just above the critical support of $0.0120. The coin has been trapped in a nearly two-month-long downtrend, and unless there is a significant shift in market conditions, this downtrend is expected to persist.

The next key support level for Onyxcoin is at $0.0100. Given the ongoing bearish indicators, it seems likely that the price will fall to this level, extending the downtrend. If the broader market conditions fail to show signs of improvement, Onyxcoin could see further declines, possibly testing even lower support levels.

However, the bearish outlook could be invalidated if Onyxcoin manages to breach its downtrend line and push past the $0.0150 mark. Successfully flipping this resistance into support would signal a potential recovery and could lead the price to $0.0182 or higher.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.