PI’s bullish momentum appears to be fading, and the altcoin has continued its downward trajectory since the start of March.

Over the past 24 hours, the altcoin’s price has plunged by 14%, reinforcing this bearish trend and signaling increased selling pressure in the market.

Pi Network Bears Tighten Grip

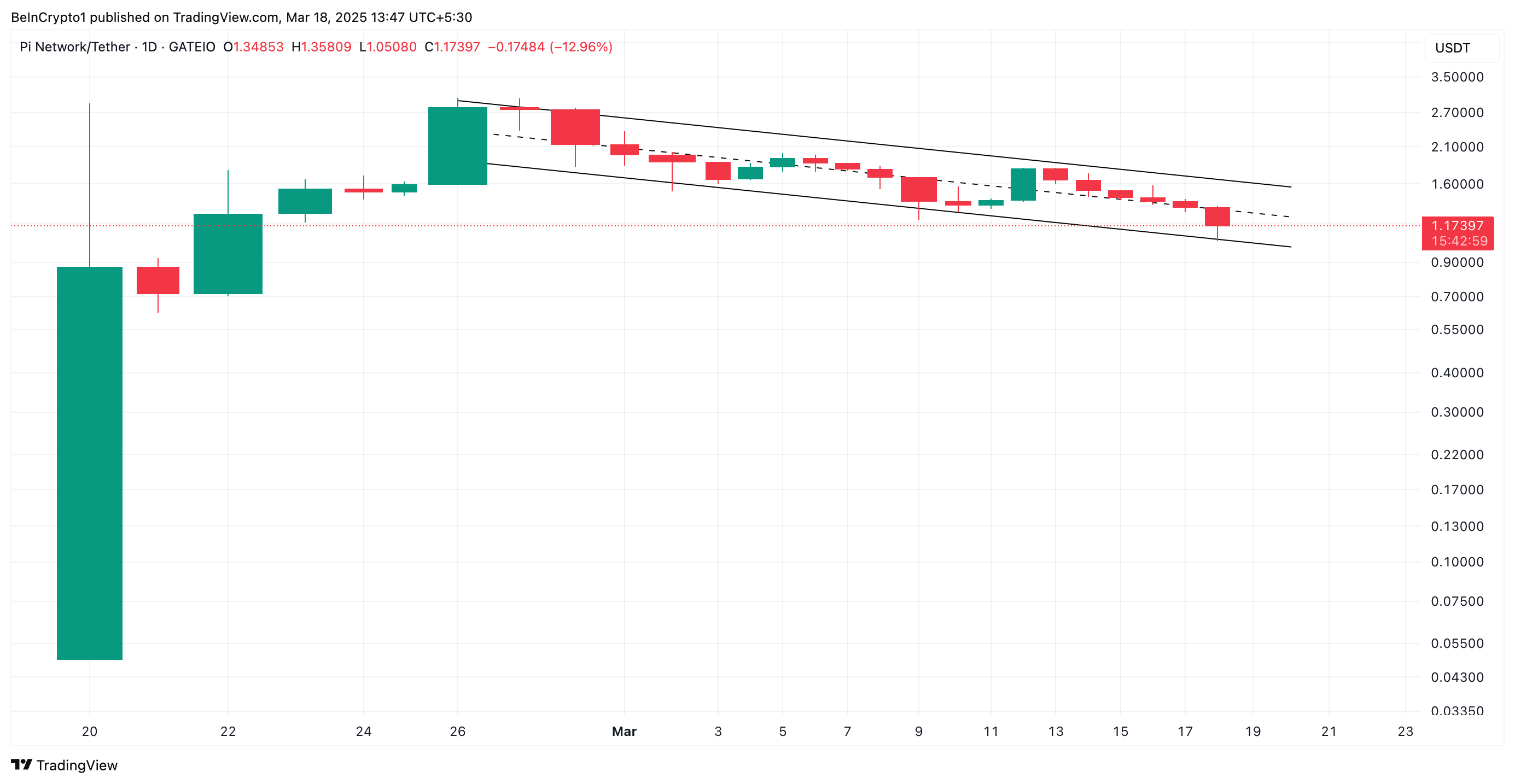

Since the beginning of March, PI has been in decline. The token has traded within a descending parallel channel, a pattern that typically indicates sustained downward movement.

This bearish pattern is formed when an asset’s price moves within two downward-sloping parallel trendlines, creating a pattern of lower highs and lower lows.

The structure indicates a sustained bearish trend in the PI market, where sellers consistently push prices lower while buyers fail to establish higher price levels.

Moreover, the Super Trend Indicator has flashed a sell signal, further confirming PI’s bearish outlook. This momentum indicator currently forms dynamic resistance above the token’s price at $2.23.

This indicator tracks the direction and strength of an asset’s price trend. It is displayed as a line on the price chart, changing color to signify the trend: green for an uptrend and red for a downtrend.

When an asset’s price trades below its Super Trend indicator, it is a bearish trend, signaling a decline in buying pressure. Traders interpret this as a sell signal or a warning to exit long positions and take short ones.

PI Downtrend Deepens: Can Bulls Prevent a Drop to $0.87?

PI risks noting further declines if selling pressure gains more momentum. In this scenario, the altcoin could fall toward $1.05 in an attempt to break below its descending parallel channel.

This would signal an acceleration of the current downtrend, indicating that selling pressure has intensified. It would mean that PI bears have taken full control, increasing the likelihood of further declines as support levels fail to hold.

However, if accumulation resumes and bullish pressure spikes, PI could reverse its current trend and climb to $1.34.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.