Pi Network (PI) is under mounting pressure as technical indicators and community sentiment become increasingly bearish. Despite a 23% gain over the past week, PI has plunged 44% in just four days, falling below the $1 mark following backlash over its $100 million fund launch.

Indicators like the Ichimoku Cloud and BBTrend show fading momentum, with no signs of a reversal. PI may remain vulnerable to further downside if key resistance levels are reclaimed and buying pressure returns.

PI Struggles Below Cloud as Bearish Momentum Persists

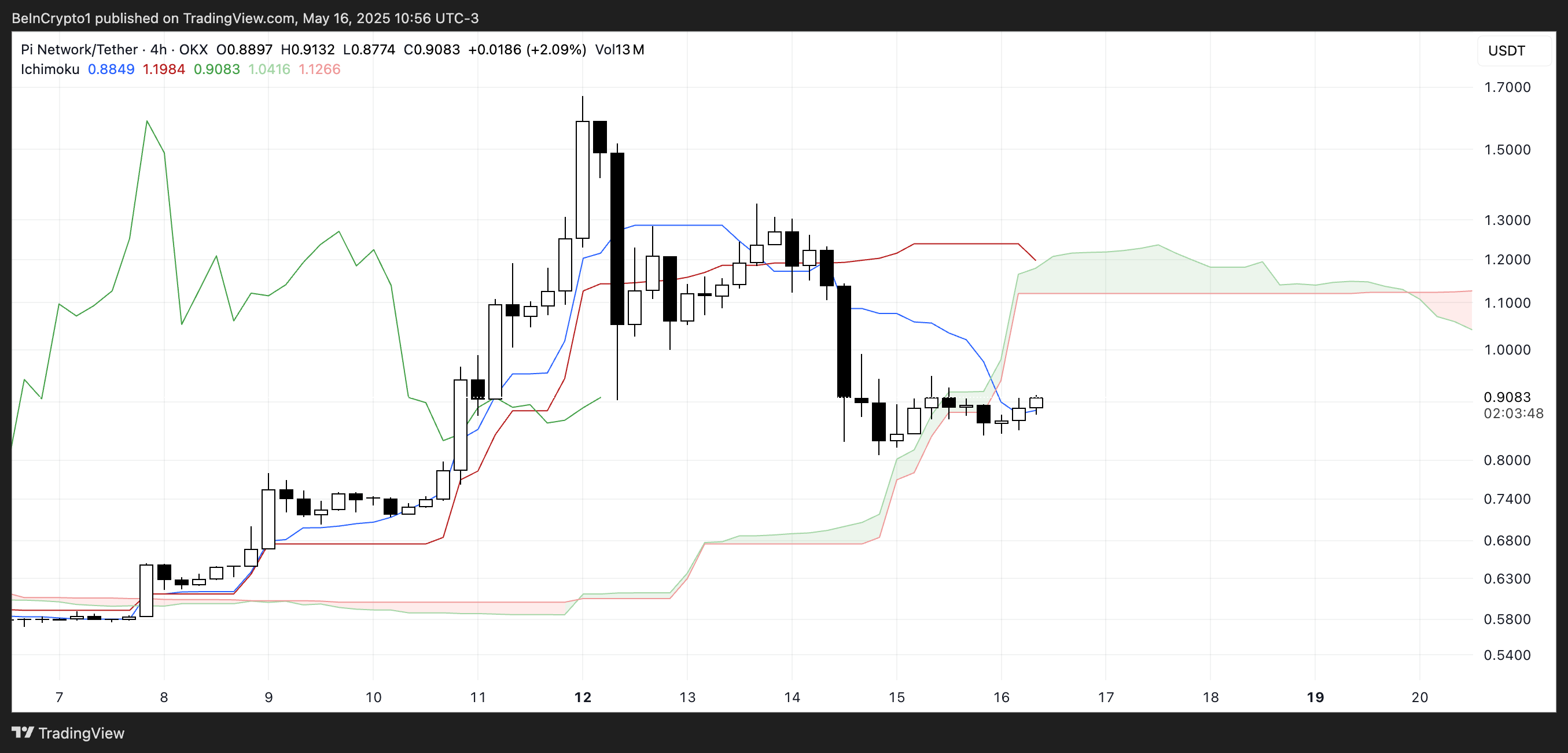

The Ichimoku Cloud chart for Pi Network (PI) shows signs of ongoing weakness following a sharp decline. Price action is below the Kijun-sen (red line) and close to the Tenkan-sen (blue line), indicating that short-term momentum remains bearish.

The recent candles also interact with the lower boundary of the Kumo Cloud (green/red shaded area), showing hesitation in regaining upward traction.

The Chikou Span (green lagging line) is now positioned below the price candles, further reinforcing a bearish outlook.

Despite the current consolidation near the cloud’s edge, there’s no strong signal yet of a reversal. The leading span lines that form the Kumo ahead are flat and slightly downward-sloping, suggesting limited bullish support in the near term.

For sentiment to shift, PI must break decisively above both the Kijun-sen and the cloud, confirming a potential trend reversal.

Until then, the chart favors caution, with bears still holding the upper hand.

Pi Network Trend Strength Collapses as BBTrend Falls to 10.63

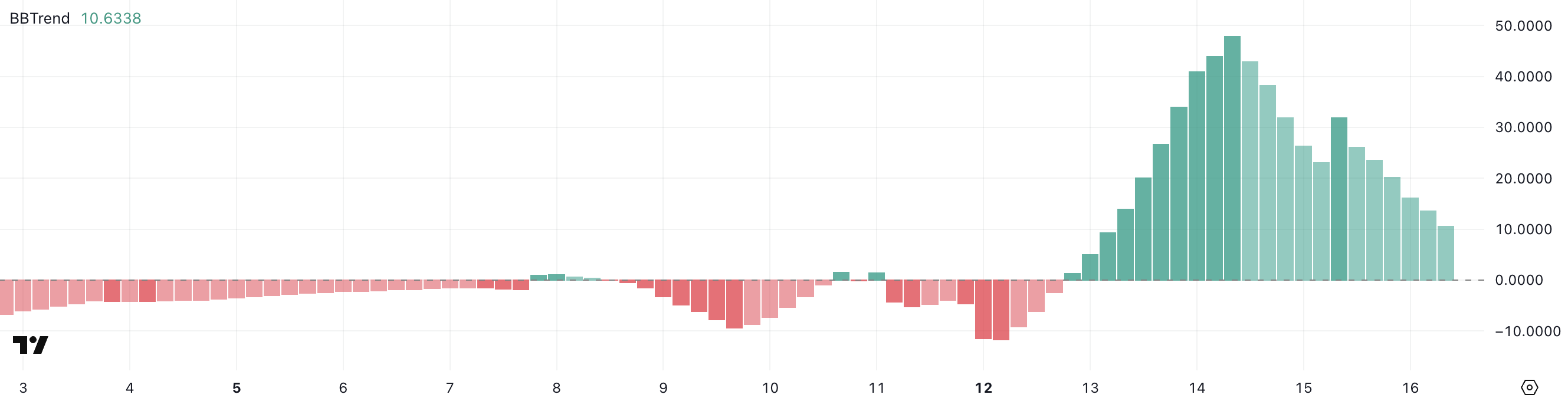

Pi Network’s BBTrend indicator has sharply declined to 10.63, after peaking near 48 just two days ago and dropping to 32 yesterday.

This steep fall reflects a significant weakening in trend strength over a short period, suggesting that the recent bullish momentum is fading quickly.

The rapid loss in trend intensity may indicate a transition toward consolidation or even a potential reversal if no new buying pressure emerges.

The BBTrend (Bollinger Band Trend) measures the strength of a price trend by comparing the width of Bollinger Bands to price volatility.

Higher values typically reflect strong trending behavior—either bullish or bearish—while lower values suggest sideways movement or weakening momentum.

At 10.63, Pi’s BBTrend suggests the asset may enter a neutral phase, where volatility contracts and price could range without clear direction unless a new breakout or breakdown develops.

Following the announcement of its $100 million Pi Network Ventures fund, Pi Network is facing growing pressure from both its community and the market.

Despite launching the initiative to boost ecosystem growth and real-world adoption, critics argue that the project has failed to deliver on key promises—such as launching 100 decentralized apps (DApps), timely KYC processes, and referral rewards.

Many Pioneers see the fund as a distraction from unresolved issues, especially since applications are collected via a simple Google Form. Market sentiment reflected this frustration, with PI’s price dropping below $1 and falling 44% over the last four days.

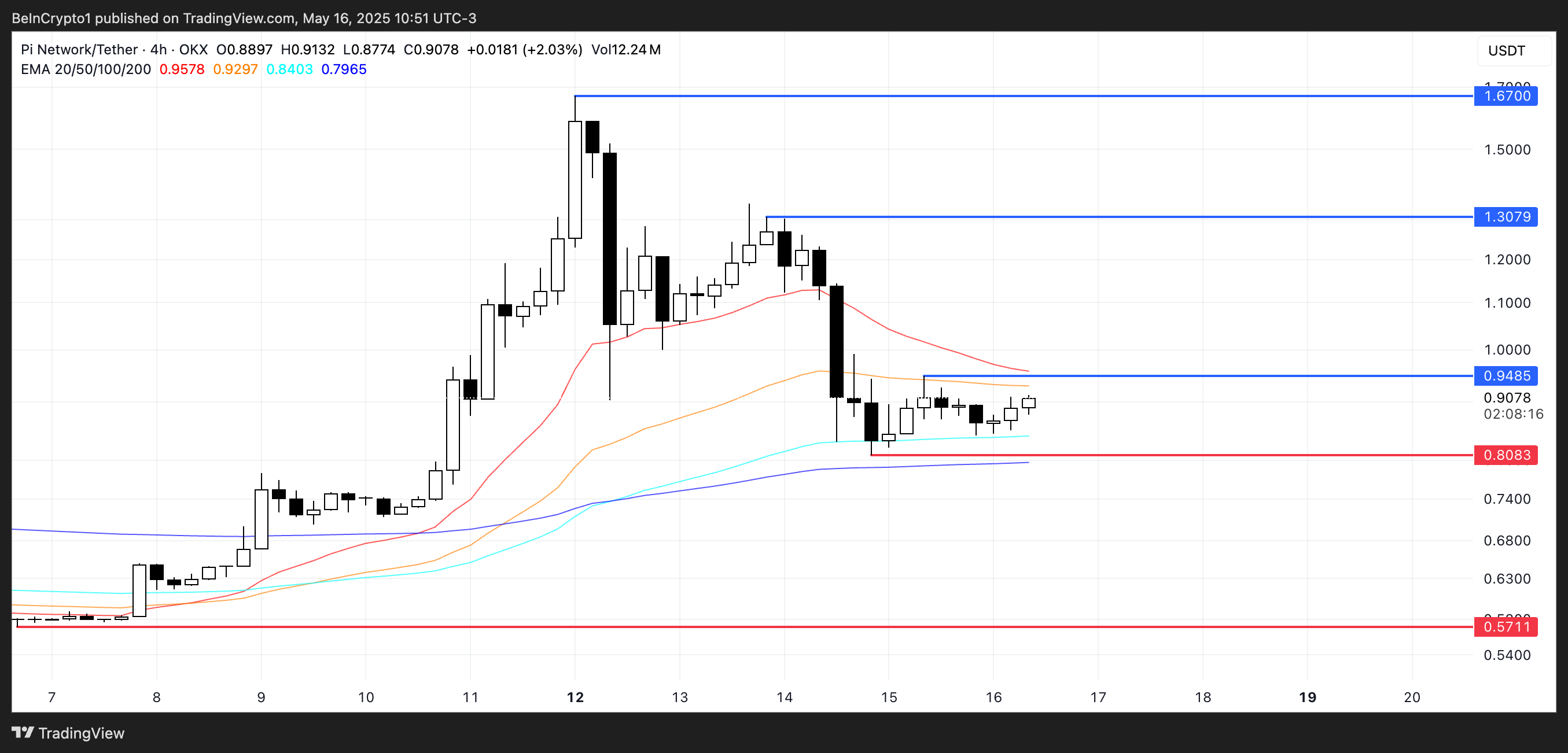

Technically, PI’s indicators support the bearish outlook. Momentum signals like the DMI and CMF show declining strength and increased distribution, while the EMA lines are tightening and hinting at possible death crosses.

Even though PI has been up 23% over the last seven days, the recent price action suggests a loss of confidence and potential for further downside.

If the token fails to hold the key $0.80 support level, it could decline toward $0.57—but if momentum returns, a breakout above $0.94 could open the path to $1.30 or even $1.67.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.