PI’s price has plummeted by 25% over the past 24 hours, marking a sharp decline just one day after the launch of its $100 million startup fund, Pi Network Ventures.

Despite this major initiative, the market response has been lackluster, raising concerns about the PI token’s short-term price trajectory.

PI’s Rally at Risk Amid Growing Bearish Control

The PI/USD one-day chart readings suggest that this decline may not be over. As of this writing, PI’s price is on the verge of dipping below its 20-day Exponential Moving Average (EMA), an indicator of a sustained bearish trend.

The 20-day EMA measures an asset’s average price over the past 20 trading days, weighting recent prices. When an asset’s price is poised to break below this key moving average, it signals weakening short-term momentum and a potential shift to a bearish trend.

For PI, a break below its 20-day EMA could undermine its recent bullish climb between May 8 and May 13, and open the door for deeper price corrections.

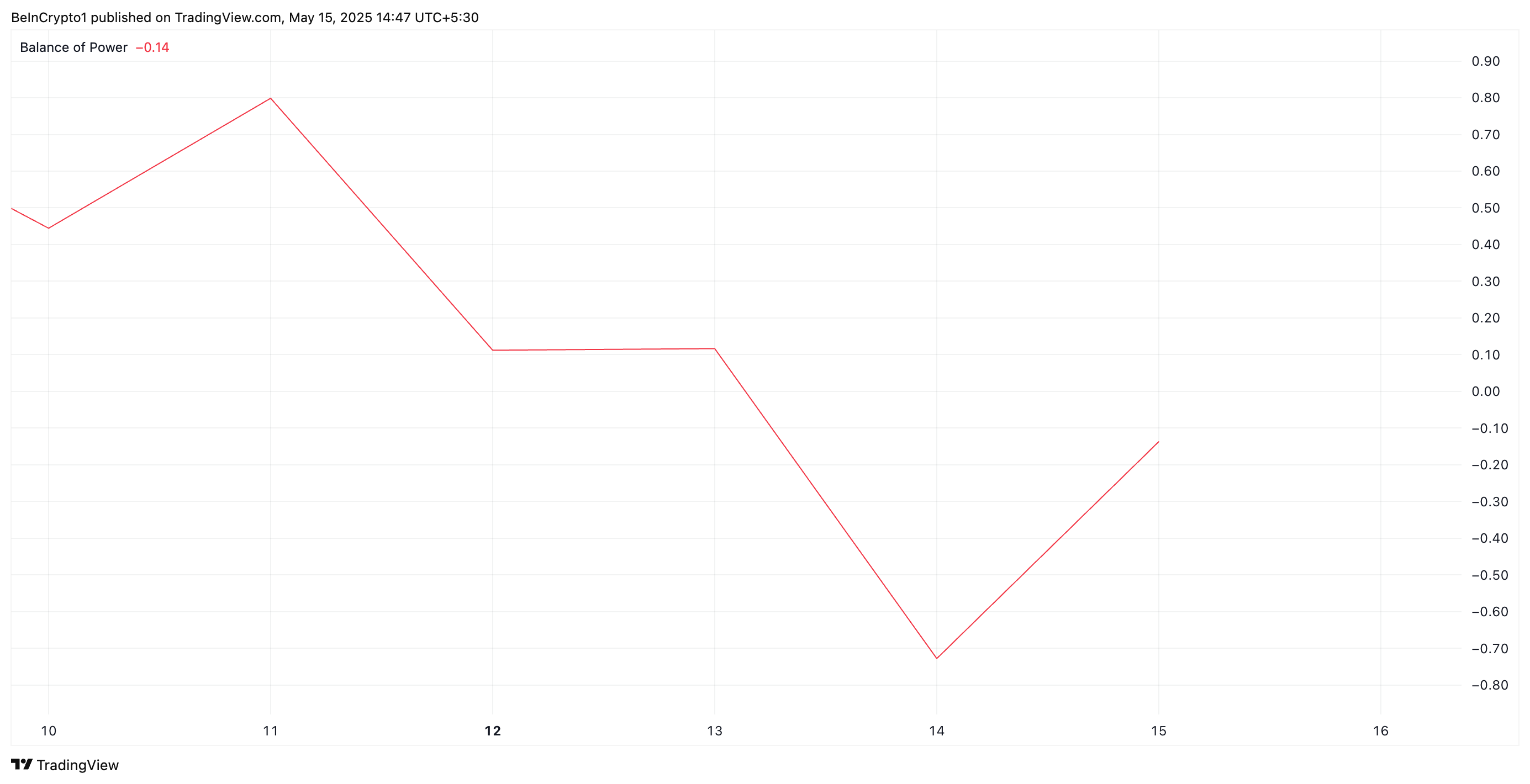

Moreover, PI’s Balance of Power (BoP) is currently negative, highlighting the selloff trend among market participants. As of this writing, it is at -0.14.

The BoP indicator measures the strength of buyers versus sellers by comparing closing prices to the trading range. When it is negative like this, sellers are dominating and pushing prices lower.

PI Risks Breakdown Toward $0.40

PI’s decisive break below its 20-day EMA would confirm the bearish shift in market sentiment. The 20-day EMA, currently acting as dynamic support at $0.80, has cushioned recent price pullbacks and attracted buying interest.

Therefore, a close below this level would invalidate that support and reinforce the prevailing bearish outlook. It would confirm the increased selling pressure among PI token holders and hint at the potential for a deeper correction soon.

In this scenario, PI could revisit its all-time low of $0.40.

However, if the bulls regain market dominance, they could drive PI’s price toward $1.01.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.