A comprehensive report from Global Ledger claims that Garantex’s founders created a new exchange, Grinex, just a week after the previous exchange was shut down by US and EU authorities. The new platform, Grinex, has already processed $36 million in incoming transactions.

Global Ledger shared this report exclusively with BeInCrypto.

Is Garantex Back Under a New Name?

Garantex, a Russian crypto exchange, was shut down last week, but apparently, it isn’t out. Earlier this month, Tether froze some of its wallets containing USDT worth $28 million, and the US Department of Justice seized its domains, as its co-founder was arrested.

However, a new report shows that Garantex’s team has already launched a similar exchange, Grinex.

“Swiss blockchain analytics company Global Ledger has completed its investigation and gathered conclusive evidence that Grinex, the exchange that emerged shortly after the dramatic collapse of Garantex, is, in fact, a direct continuation of Garantex itself,” Global Ledger claimed in an exclusive press release shared with BeInCrypto.

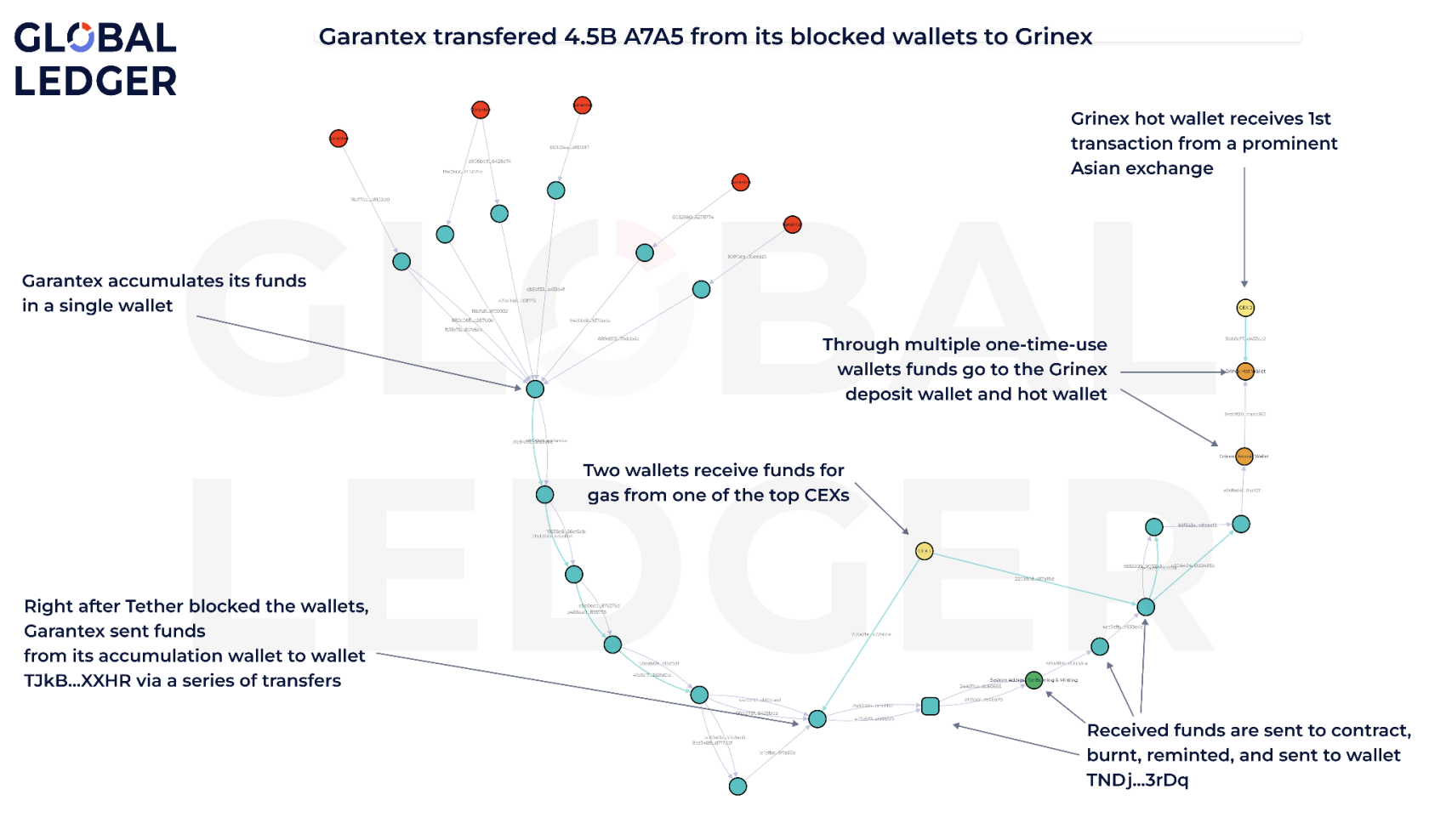

The center of this claim comes from on-chain analysis. A7A5, a ruble-backed stablecoin, was listed on Garantex less than a month before its shutdown.

Soon after, its creators confirmed via Telegram that the asset was listed on Grinex. Global Ledger tracked a massive A7A5 liquidity transfer from Garantex to Grinex, proving a connection.

Garantex Users Are Receiving Lost Funds On Grinex

According to Global Ledger’s research, these exchanges have incredibly similar interfaces. Also, a marketing statement on the Russian crypto tracking site ‘CoinMarketRating’ claims that the owners of Garantex created Grinex.

Most notably, some users who lost funds on Garantex have reported receiving reimbursements on Grinex.

Sources also claim that Grinex customers are visiting the Garantex office in person, and many users are moving assets to the new exchange.

Overall, all facts reflect that Grinex has found a way to remain operational, despite the earlier crackdown. The US Department of Justice sanctioned Garantex in 2023.

The case of Grinex is another example of how Russia has been using crypto to actively evade international sanctions. Even if law enforcement acts quickly against Grinex, it could resurface.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.