The Depository Trust & Clearing Corporation (DTCC) has officially listed the first Solana futures ETFs (exchange-traded funds) from Volatility Shares.

The development signifies that these ETFs are now eligible for clearing and settlement through DTCC’s central infrastructure, ensuring a streamlined and secure trading process.

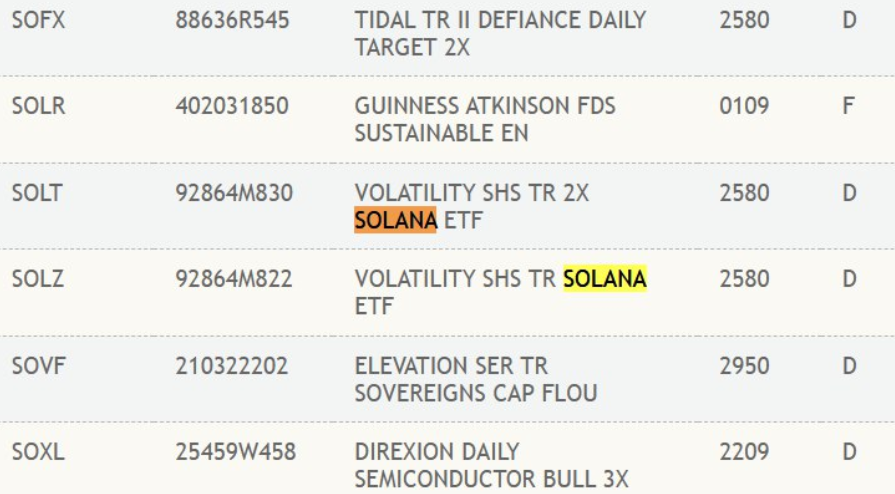

Solana Futures ETFs Cleared by DTCC

The newly listed products include the Volatility Shares 2x Solana ETF (SOLT) and the Volatility Shares Solana ETF (SOLZ).

Volatility Shares had initially filed with the SEC (Securities and Exchange Commission) in December 2024, seeking approval for three Solana-focused ETFs. Among them was the -1x Solana ETF, which aims to provide inverse exposure to Solana futures contracts.

At the time of the initial filing, however, no Solana futures contracts were available on any Commodity Futures Trading Commission (CFTC) regulated exchanges. This raised questions about the feasibility of launching these ETFs without an underlying futures market.

Therefore, listing Solana’s future ETFs on DTCC highlights the growing institutional interest in cryptocurrency investment products. Nevertheless, while DTCC’s listing is a crucial step in making these ETFs accessible to investors, it does not equate to formal approval by the US SEC.

Coinbase’s Role in the Solana Futures Market

In hindsight, the scales shifted earlier this month when Coinbase Derivatives LLC introduced CFTC-regulated Solana futures contracts. This move addressed concerns about the absence of a regulated Solana futures market and bolstered the case for future regulatory approval of Solana ETFs.

Coinbase’s announcement followed speculation that Solana and XRP futures could be launched on the Chicago Mercantile Exchange (CME). This was in light of a leaked staging website hinting at a potential February 10 start date.

“Assuming “beta.cmegroup” is a beta/test version of the actual CMEGroup website — looks like CME is expecting to launch SOL & XRP futures on Feb 10. But this isn’t available on the actual website yet,” ETF analyst James Seyffart observed.

However, the domain was taken down shortly after it was discovered. Thereafter, the CME Group clarified that the leak was an error and that no final decision had been made.

Despite these uncertainties, the availability of regulated Solana futures contracts is a positive step for institutional investors. It provides a structured and secure avenue for trading Solana, bridging the gap between traditional finance (TradFi) and the crypto market.

Meanwhile, the launch of Solana futures ETFs and the emergence of regulated futures contracts could set the stage for the eventual approval of a spot Solana ETF. Several asset management firms, including VanEck and 21Shares, Bitwise, and Canary Capital, have submitted filings for spot Solana ETFs.

The SEC’s handling of these applications will be interesting to watch as the race to create more altcoin ETFs continues.

Despite the positive developments, the SOL price has declined nearly 5% to $137.68 at the time of writing. Market volatility remains a persistent factor in crypto, with regulatory uncertainty and macroeconomic trends influencing price movements.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.