South Korea has pushed Google to restrict access to 17 foreign trading platforms, including KuCoin and MEXC.

The crackdown, which took effect on March 25, is part of the country’s ongoing efforts to regulate the crypto industry and safeguard local investors.

Here’s Why the South Korean Government Took Action

South Korea’s top financial regulator, the Financial Services Commission (FSC), confirmed that Google Play had removed KuCoin and MEXC, among 15 other exchanges, from its platform. The move makes it impossible for new users to install the apps.

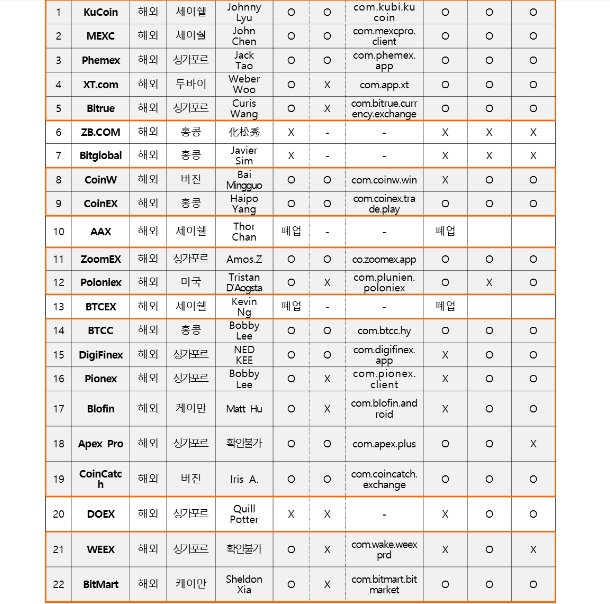

“Since March 25, at the request of the South Korean government, Google has implemented domestic access restrictions on 17 exchanges that are not registered in South Korea. Users cannot install new related applications or update them, including KuCoin, MEXC, Phemex, XT, Biture, CoinW, CoinEX, ZoomEX, Poloniex, BTCC, DigiFinex, Pionex, Blofin, Apex Pro, CoinCatch, WEEX, and BitMart,” Wu Blockchain reported.

Existing users are also unable to update them, further limiting their accessibility. According to the FSC, these platforms failed to register under South Korean law while actively targeting local traders. With this, they effectively violated the country’s regulatory requirements.

South Korea has some of the world’s strictest crypto regulations, and authorities have been increasingly aggressive in enforcing them. Under the Specific Financial Transaction Information Reporting and Use Act, any foreign virtual asset service provider (VASP) operating in South Korea must register with the country’s Financial Intelligence Unit (FIU).

Failure to comply can result in severe penalties, including hefty fines or even imprisonment for those involved.

The FSC emphasized that this latest measure aims to prevent financial crimes such as money laundering and protect investors from potential fraud. The regulator outlined the criteria to determine whether an exchange was operating illegally in the country.

These included offering a Korean-language website, actively marketing to local users, and supporting transactions in Korean won.

While this enforcement action is significant, it is not the first time South Korean authorities have taken a hard stance against foreign exchanges. In 2022, the FIU identified and restricted 16 unregistered platforms, followed by another six in 2023.

The latest crackdown signals regulators are doubling their efforts to bring the crypto market under stricter oversight.

Upbit Exchange To Grow Market Edge

With major international exchanges facing restrictions, the dominance of local platforms like Upbit has only strengthened. The exchange controls a significant share of South Korea’s crypto trading market.

BeInCrypto recently reported that over 30% of South Korea’s population trades cryptocurrency. Upbit processes the bulk of these transactions. This latest move against foreign exchanges could further consolidate Upbit’s position in the market, making it the go-to platform for retail and institutional investors.

“South Korea isn’t playing when it comes to crypto regulations. This move [blacklisting 17 exchanges] puts a real hurdle in front of traders using these exchanges,” one user remarked.

While South Korea’s regulatory framework may seem restrictive, it could pave the way for greater institutional involvement in crypto.

By enforcing compliance measures and weeding out unregistered players, the government is creating a more structured environment that may attract traditional financial (TradFi) institutions looking for regulatory clarity before investing in digital assets.

The country has also been taking steps to delay taxation on crypto investments, which signals a more balanced approach that seeks to encourage growth in the sector while ensuring investor protection.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.