Story Protocol recently announced the acquisition and tokenization of partial copyrights for two hit songs, “Nobody’s Love” by Maroon 5 and “Daisies” by Katy Perry.

Bringing Maroon 5 and Katy Perry’s copyrights onto the blockchain could open up a new wave of investment, making it easier for investors to access the music copyright sector. But does the trend of tokenizing Real World Assets (RWA) in the music industry truly have potential?

Story Protocol Tokenizes Songs By Maroon 5 & Katy Perry

According to an official announcement from Story Protocol (IP), the Aria protocol—part of the Story ecosystem—has acquired and tokenized a portion of the copyrights for the hit songs Nobody’s Love by Maroon 5 and Daisies by Katy Perry.

The choice of Maroon 5 and Katy Perry likely stems from their status as top-tier artists with massive fan bases. Maroon 5 has won three Grammy Awards and sold over 135 million records worldwide, while Katy Perry has sold over 100 million records, with multiple diamond-certified singles.

“Katy Perry and Maroon 5 aren’t just topping charts anymore—they’re topping investment portfolios,” commented an X user.

Both Nobody’s Love and Daisies have high streaming numbers, generating sustainable passive revenue. Tokenizing the copyright for these songs allows for the rights to be divided into digital tokens that investors can trade or hold.

This move is part of a broader plan to acquire portions of over 50 copyrights from major artists, including BLACKPINK, Miley Cyrus, Justin Bieber, and others, as previously announced by Story Protocol.

Does Music Copyright Tokenization Have Real Potential?

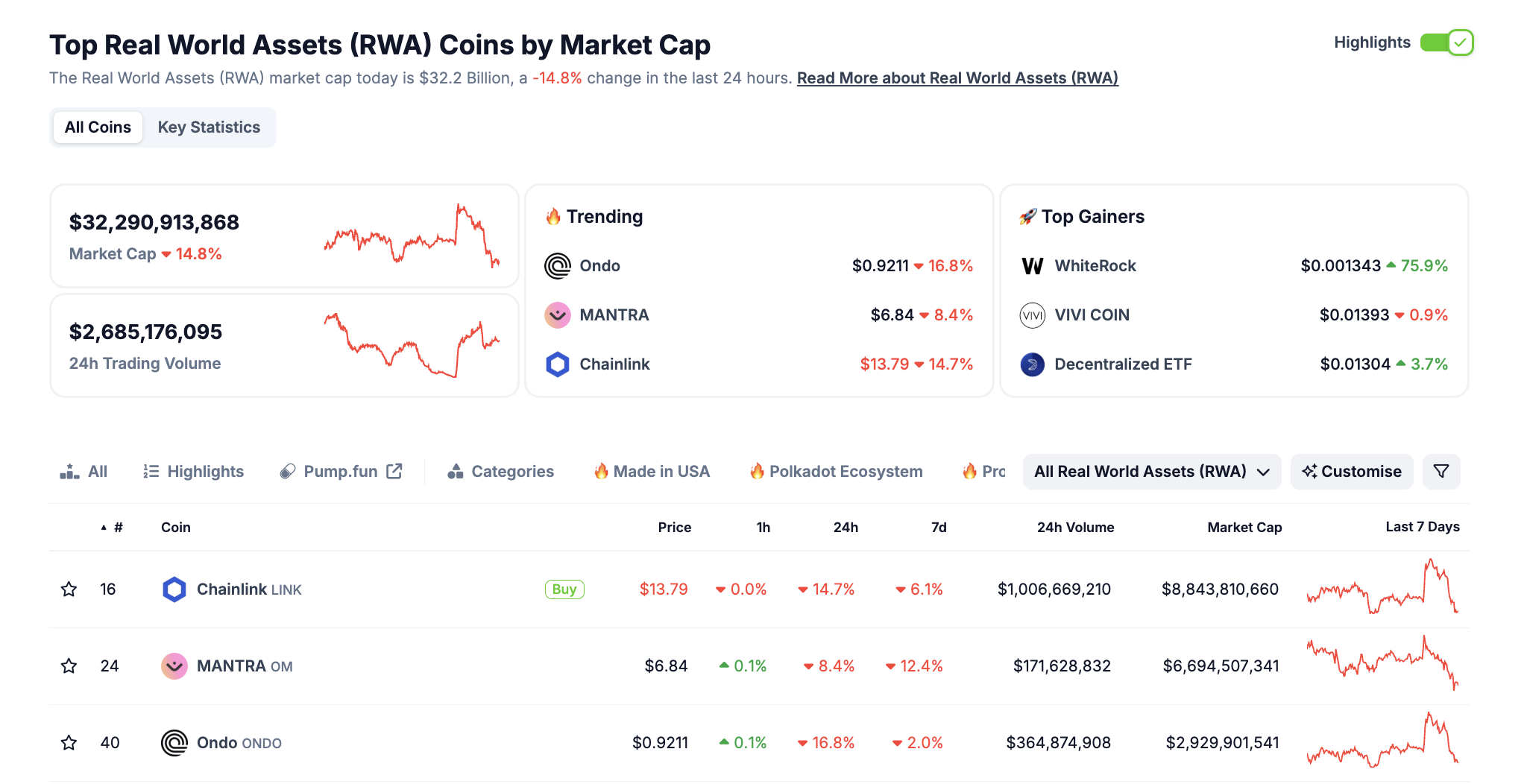

As BeInCrypto has highlighted, Real-World Asset Tokenization refers to the process of converting physical or intangible assets into digital tokens on the blockchain. According to CoinGecko data, as of press time, the market capitalization of RWA-related projects stands at over $32 billion.

“It’s clear that the world’s largest financial market infrastructures see a huge opportunity emerging from the DLT/Blockchain industry’s ability to connect counterparties around various forms of RWA tokenization,” said Sergey Nazarov, Co-founder of Chainlink.

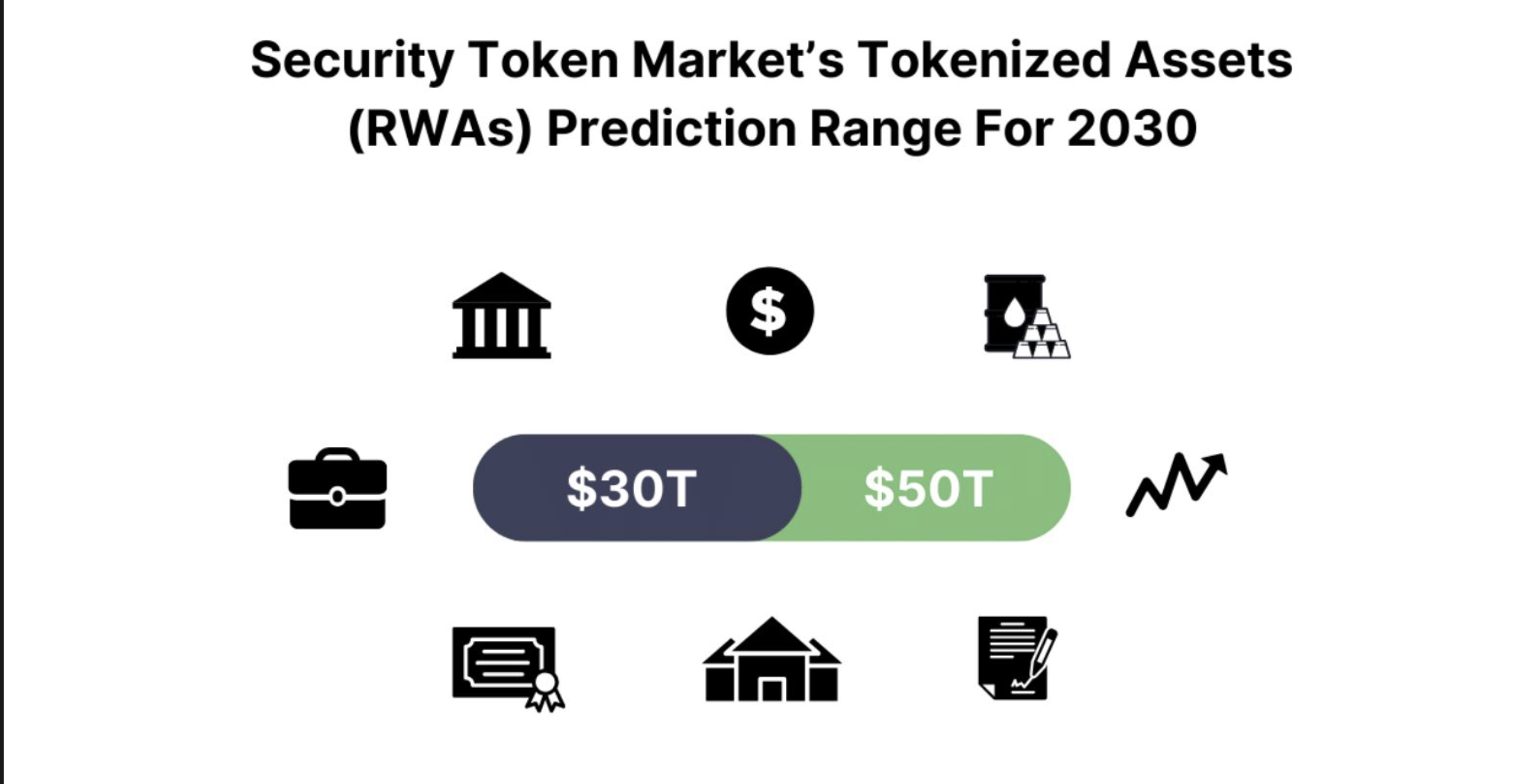

Moreover, Security Token Market recently predicted that the tokenized RWA market could reach $30 trillion by 2030, with leading sectors including securities, real estate, bonds, and gold.

According to the World Intellectual Property Organization (WIPO), the economic value of Intellectual Property (IP)—including copyrights, patents, and trademarks—contributes around 38% of global GDP, equivalent to more than $30 trillion annually (based on a global GDP of $80-$100 trillion). The copyright industry alone (music, film, books) accounts for approximately $5.8 trillion.

Despite its massive value, the IP sector remains one of the least liquid asset classes. Buying, licensing, or valuing IP is often complex, time-consuming, and dependent on legal intermediaries. Tokenizing IP could enable more transparent, efficient transactions and management through digital tokens, making this a potential sector that Story Protocol aims to solve.

Opportunities And Challenges Ahead for Story Protocol

While the potential of RWA in the IP sector is undeniable, Story Protocol still faces significant challenges in capturing this market. First, Story is not the only RWA-focused project.

Competitors like Ondo Finance (Ondo Chain), Centrifuge, and MakerDAO have already established a presence. Story Protocol is still relatively small and just recently launched its mainnet, meaning it must demonstrate unique advantages in the IP niche.

Second, tokenizing IP requires legal recognition from organizations like WIPO and compliance with the Berne Convention. Without overcoming these legal hurdles, Story Protocol may struggle to attract major IP holders.

Story Protocol’s move to tokenize the copyrights of hit songs aligns with its broader strategy to enter the IP sector. However, success in this space will require proving its utility and overcoming legal and market adoption challenges.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.