Tornado Cash (TORN) has recently experienced a sharp rally, rising by 40% over the last 24 hours. This surge was primarily driven by Tornado Cash’s removal from the U.S. Treasury’s Office of Foreign Assets Control (OFAC) sanctions list.

While the price spike has been significant, the market may be preparing for a decline as it adjusts to the news.

Tornado Cash Skyrockets

Tornado Cash’s recent rally has pushed its Relative Strength Index (RSI) past the 70.0 threshold, indicating that the crypto is currently overbought.

This level is often seen as a sign of market saturation, where the altcoin’s bullish momentum has peaked. Historically, once the RSI crosses the 70.0 mark, a price reversal has typically followed, suggesting that a correction may be imminent.

The overbought condition of TORN suggests that the bullish sentiment driving the rally is losing steam. As the price continues to consolidate or pull back, the likelihood of a price drop increases, making the current price unsustainable in the short term.

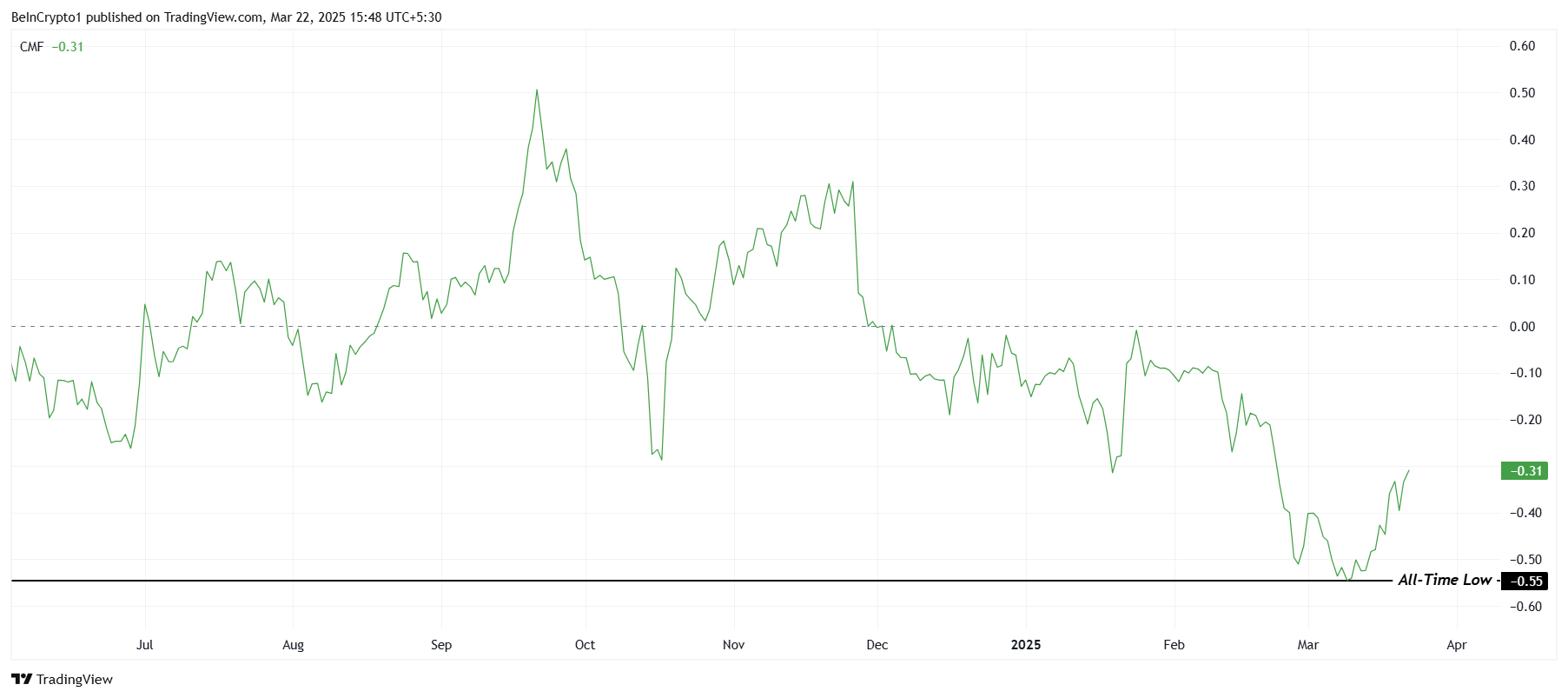

The macro momentum of Tornado Cash points to further challenges. The Chaikin Money Flow (CMF) indicator, which measures the volume-weighted average of accumulation and distribution, is currently stuck in the bearish zone.

It has remained far from the zero line for an extended period, signaling that selling pressure continues to outweigh buying pressure.

Additionally, Tornado Cash has seen its highest outflows since its inception, further dampening the outlook. These outflows suggest that investors are increasingly cashing out, which weakens the token’s long-term recovery potential.

Without significant inflows to counteract the outflows, TORN will have difficulty maintaining or extending its recent gains.

TORN Price Stirred Up A Tornado

Tornado Cash’s price is currently trading at $11.77, up 41% in the last 24 hours. The altcoin also noted an impressive intra-day high increase of 88%. Over the past 12 days, TORN has gained 135%, marking a strong short-term performance.

However, with the token sitting at these elevated levels, it faces substantial downside risk.

Given the overbought condition and bearish macro momentum, TORN is vulnerable to a fall through key support levels at $11.63 and $9.75. A breach of these levels could send the price down to $7.36, extending the correction and potentially erasing recent gains.

On the other hand, if Tornado Cash can sustain its bullish momentum and hold above $11.63, it may rebound. This could pave the way for the price to aim for $15.81.

A successful rally to this level would invalidate the bearish thesis. It would also solidify the recent price gains, signaling the potential for further upside.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.