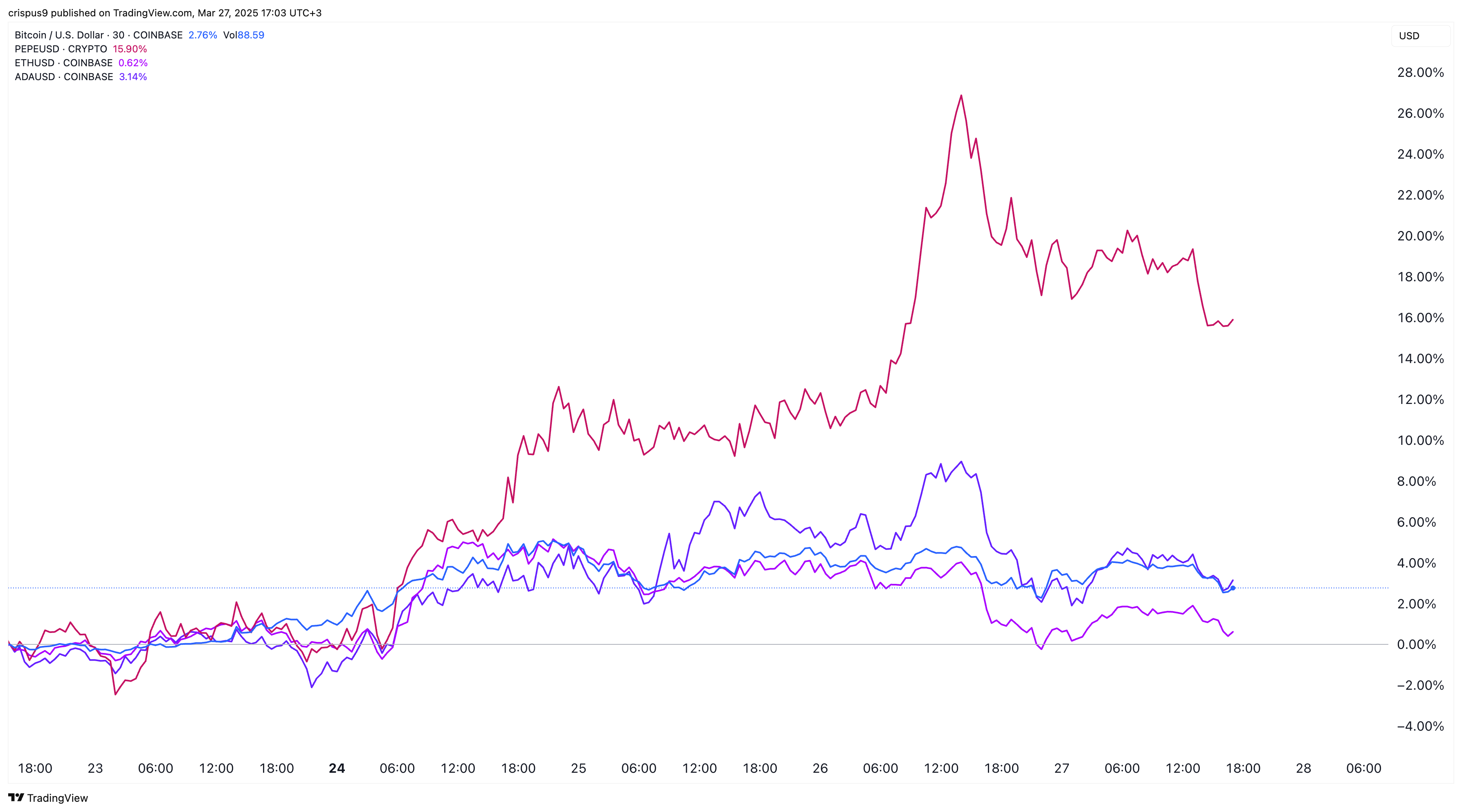

Cryptocurrency prices retreated slightly on March 27 after Donald Trump’s Liberation Day came early for global automakers.

Bitcoin (BTC) fell below $86,000, while the total crypto market capitalization tracked by CoinMarketCap declined by 1.67% to $2.83 trillion. Meanwhile, the crypto fear and greed index remained in the fear zone at 38.

The pullback in digital assets mirrored losses in traditional markets, with futures tracking the Dow Jones, Nasdaq 100, and S&P 500 all down by over 0.70%.

The main catalyst for the downturn was Trump’s decision to impose broad tariffs on all vehicles and parts imported into the United States. These new tariffs are expected to hit all automakers, including domestic manufacturers, due to additional duties on steel, aluminum, and auto components.

The auto industry is a critical sector of the U.S. economy. Companies like General Motors, Ford, and Stellantis directly employ more than 150,000 people, not counting supplier and dealership networks. New tariffs could strain these businesses and potentially trigger layoffs in the coming months.

At the same time, the tariffs are expected to raise vehicle prices, prompting many consumers to delay purchases. Supporting this trend, recent data shows U.S. consumer confidence has plunged by 17 points over the past three months.

Trump’s broader tariff policy is set to be unveiled on Liberation Day, when he’s expected to announce reciprocal tariffs on additional imports.

Why Liberation Day may benefit Bitcoin and altcoin prices

Trump’s tariff strategy may be viewed as a Black Swan event due to its scope and potential economic disruption. For instance, his proposed 25% tariffs on imports from Mexico and Canada disrupt trade between three countries that have enjoyed decades of tariff-free commerce.

The risk is that these tariffs will lead to a recession this year. In a recent article, crypto.news cited Mark Zandi, Moody’s Chief Economist, who predicted that recession odds were rising in the US.

Contrary to popular belief, a recession could actually benefit Bitcoin and other altcoins, largely due to the likely fiscal and monetary response. In past downturns, the Federal Reserve stepped in with aggressive policy tools. It provided a $700 billion bailout during the 2008–09 financial crisis, and trillions more in stimulus during the COVID-19 pandemic.

Similar measures could follow if the economy slows in 2025. Trump may seek targeted relief for farmers and automakers impacted by his own tariffs, while the Fed may respond with rate cuts and quantitative easing.

With current benchmark interest rates at 4.50%, the Fed has room to ease policy. Lower borrowing costs and a renewed risk-on environment could drive another crypto bull run, just as they did in 2020–2021.