The total crypto market cap (TOTAL) and Bitcoin (BTC) have grown over the past day, even as general market sentiment remains fearful. Ethereum-based SPX has led the altcoin market with double-digit gains over the past 24 hours.

In the news today:-

- Ethereum’s quarterly transaction fee revenue has dropped about 95% from its peak in Q4 2021, mainly due to lower Layer 2 contributions and a decline in NFT market activity.

- Coinbase avoided a supply chain attack that could have compromised its open-source infrastructure. The incident was flagged on March 23 by Yu Jian, founder of SlowMist, citing a report from Palo Alto Networks’ Unit 42.

Fearful Sentiment Fuels Buying Pressure

The Crypto Fear & Greed Index shows that market sentiment has remained significantly fearful as traders continue to deal with losses. Today, the Index stands at 28, indicating fear in the market. This suggests that investors are cautious due to recent price declines.

However, historically, fear can sometimes present buying opportunities, as it may indicate undervaluation. Traders appear to be taking advantage of this buying signal, as reflected by the spike in TOTAL over the past day.

It has added $98 billion in the past 24 hours, standing at $2.8 trillion at press time. On the daily chart, the positive Balance of Power (BoP) confirms this surge in buying pressure among market participants. It is currently at 0.58.

The BOP indicator measures the strength of buyers versus sellers by analyzing price movements within a given period. A positive BOP value like this indicates buyers are in control, pushing prices higher and signaling potential bullish momentum.

If buyers consolidate their control and push the sellers out, TOTAL could maintain its upward trend and climb toward $2.87 trillion.

However, if profit-taking spikes or sentiment grows more bearish, TOTAL could slip and fall to $2.70 trillion.

BTC Holds Above Key Moving Average, Eyes $89,000 Target

Leading coin Bitcoin trades at $87,182, noting a 3% price growth over the past 24 hours. BTC’s steady uptick over the past week has pushed its price above the 20-day exponential moving average (EMA), which now forms a dynamic support level at $85,047.

The 20-day EMA measures an asset’s average price over the past 20 trading days. It gives more weight to recent prices, making it responsive to market changes.

When an asset breaks above this moving average, it suggests growing bullish momentum and a potential shift toward an uptrend. BTC could extend its weekly gains and climb to $89,434 if this trend is maintained.

However, if buying pressure weakens again, BTC could shed its recent gains and fall to test the support at $85,036.

If the bulls fail to defend this level, the decline could reach $77,114.

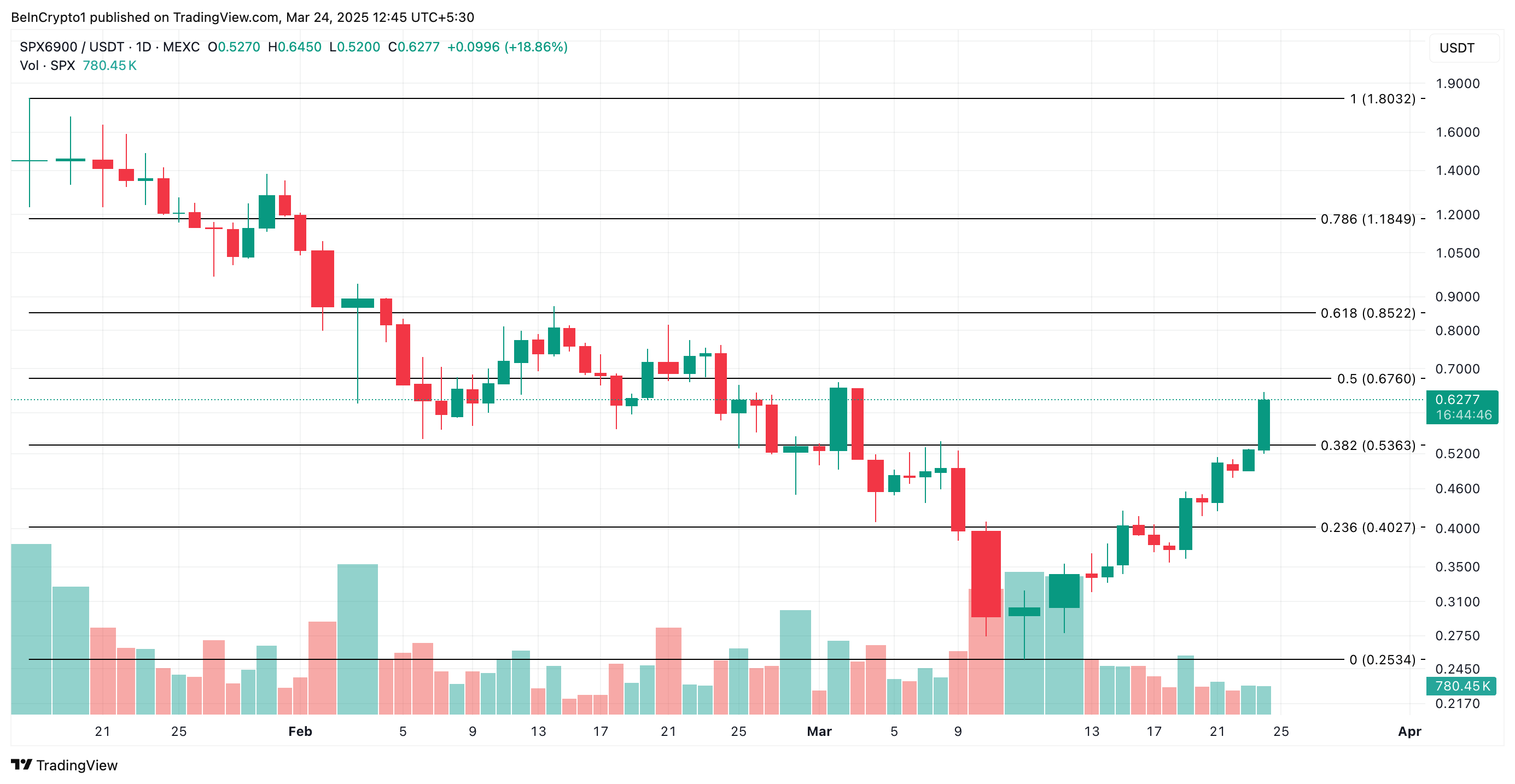

SPX Leads Market Gains with Strong Buying Interest

SPX is the market’s top gainer during the review period. It currently trades at $0.62, up 20% over the past day.

Its double-digit hike is accompanied by a surge in daily trading volume, highlighting the demand for the altcoin. The volume has climbed by 112% over the past 24 hours and is $34 million at press time.

The surge in SPX’s price, accompanied by a rise in its daily trading volume, indicates strong buying interest and confirms the validity of the upward move. If the trend persists, the altcoin’s price could rally to $0.67.

On the other hand, a reversal could trigger a decline toward $0.53.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.