Bitcoin has surged 8% in the last 24 hours, recovering from last month’s losses. Now trading at $93,202, it is attempting to establish $93,625 as support. This sharp rebound has reignited bullish sentiment, but caution is advised.

While Bitcoin gains strength, traders and market trends remain at odds, increasing volatility risks.

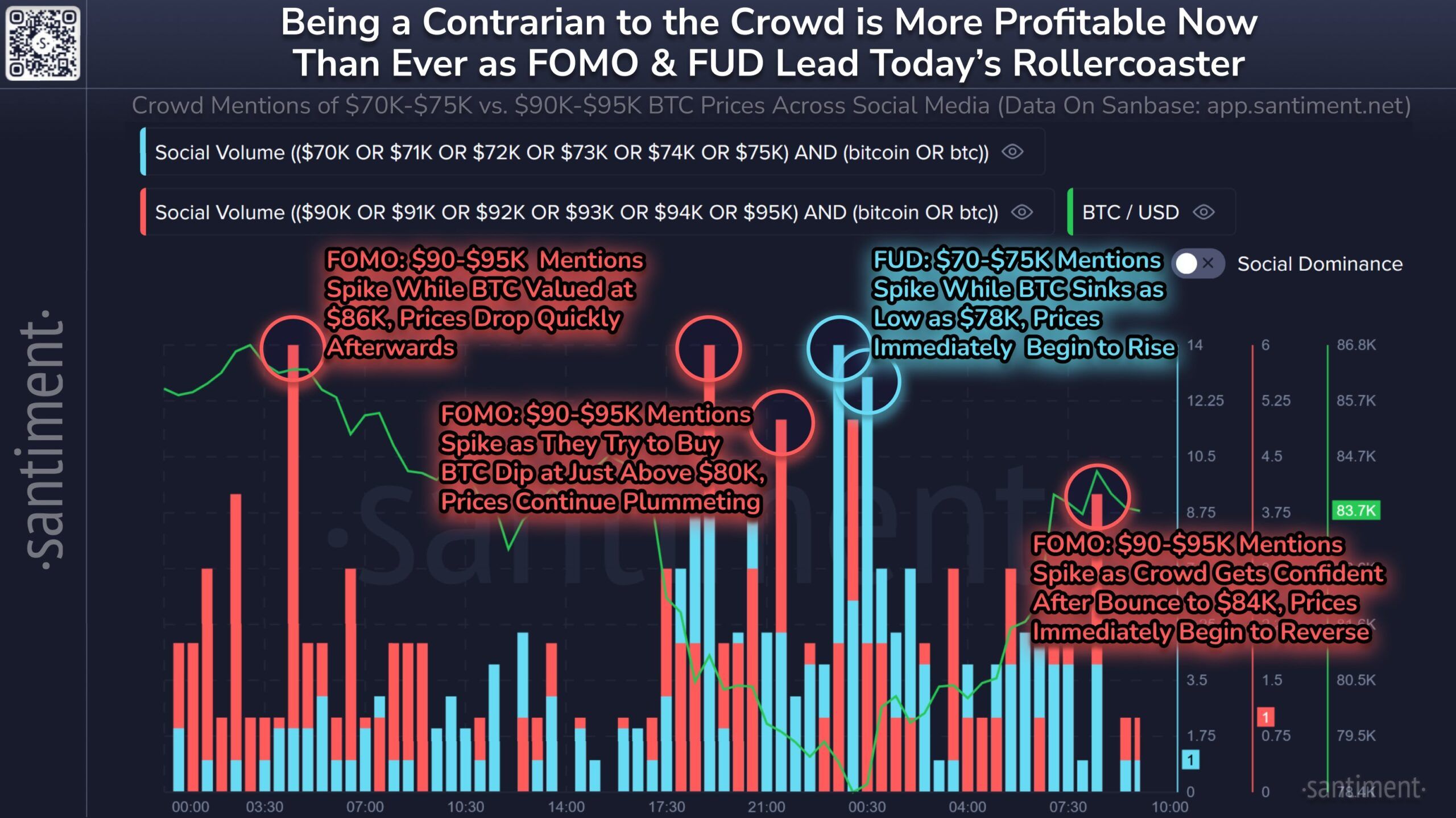

Bitcoin Sentiment-Driven Trades Are Risky

Santiment data highlights a recurring trend—traders often misjudge Bitcoin’s price movements. When traders expect a rally, the market tends to decline. Conversely, when they anticipate a drop, Bitcoin often surprises with an uptrend. This pattern suggests the market’s unpredictability remains high, making sentiment-driven trades risky.

Investors should closely monitor volatility as Bitcoin aims to break $100,000. Historically, contrarian strategies have worked better than following trader sentiment. With uncertainty prevailing, market participants may consider doing the opposite of prevailing opinions to navigate the current conditions effectively.

Bitcoin’s dominance at 60.74% is forming a fractal similar to 2020-2021, when it surged sharply before declining. A similar trend is emerging, suggesting historical patterns could repeat. Bitcoin’s price has, on a few occasions, shown signs of recovery during periods of declining dominance, though the strength and sustainability of such moves depend on broader market conditions.

As dominance declines, altcoins gain traction, but Bitcoin often benefits in the long run. The current market structure reflects a transition phase, where BTC could see further upside. If this fractal holds, Bitcoin’s recent price surge may continue, reinforcing positive momentum.

BTC Price Needs To Secure Support

Bitcoin’s 8% rise has pushed its price to $93,202. If BTC holds $93,625 as support, a further upside of $97,696 becomes likely. Securing this level would enhance bullish momentum, reinforcing Bitcoin’s recovery.

Flipping the 50-day EMA into support is critical for sustaining gains. This move would erase February’s losses and establish a foundation for further appreciation. Maintaining this trajectory could position Bitcoin for a retest of higher resistance zones.

However, failure to hold above $95,761 could invalidate bullish momentum, leading to a drop toward $92,005. Losing this key level may trigger additional declines, weakening Bitcoin’s upward trajectory.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.