XRP surged 30% yesterday after being included in the US crypto reserve. This pushed its price above $2.90 for the first time in a month. This massive rally ignited strong bullish momentum, but the altcoin slumped 10% a day later.

XRP is seeing notable correction today, suggesting that profit-taking is underway. Whether the price can regain bullish momentum or continue its retracement will depend on key resistance and support levels, with traders closely watching $2.75 on the upside and $2.52 on the downside.

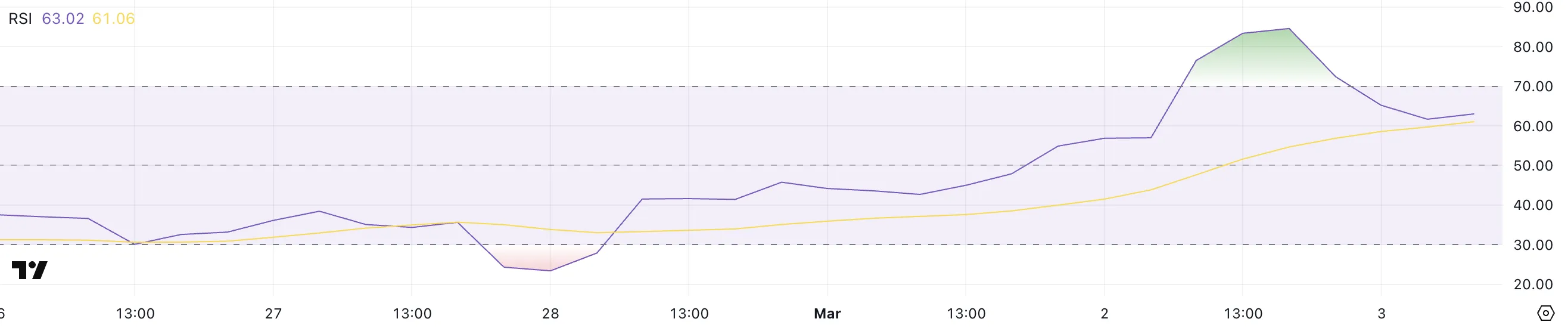

XRP RSI Is Neutral After Reaching Overbought Levels

XRP saw a significant surge in momentum after being included in the US crypto reserve. Its price rallied 30%, pushing its Relative Strength Index (RSI) to a peak of 84.5.

The RSI, a widely used momentum oscillator, measures the speed and change of price movements on a scale of 0 to 100. Readings above 70 indicate that an asset is overbought and could be due for a pullback. Readings below 30 suggest oversold conditions and a potential buying opportunity.

XRP’s RSI reached 84.5 – its highest level since December 2, 2024 – signaling extreme bullish sentiment, often preceding a short-term correction.

Now sitting at 63, XRP’s RSI has cooled off from its overbought zone, reflecting the recent retracement in price. While a reading above 60 still suggests bullish momentum, the decline from extreme levels could indicate that buying pressure is waning.

If RSI continues to decline toward the neutral 50 zone, XRP could see further consolidation or even a deeper pullback.

However, if buyers step in again and push RSI back above 70, it could signal renewed strength and another potential attempt at higher price levels.

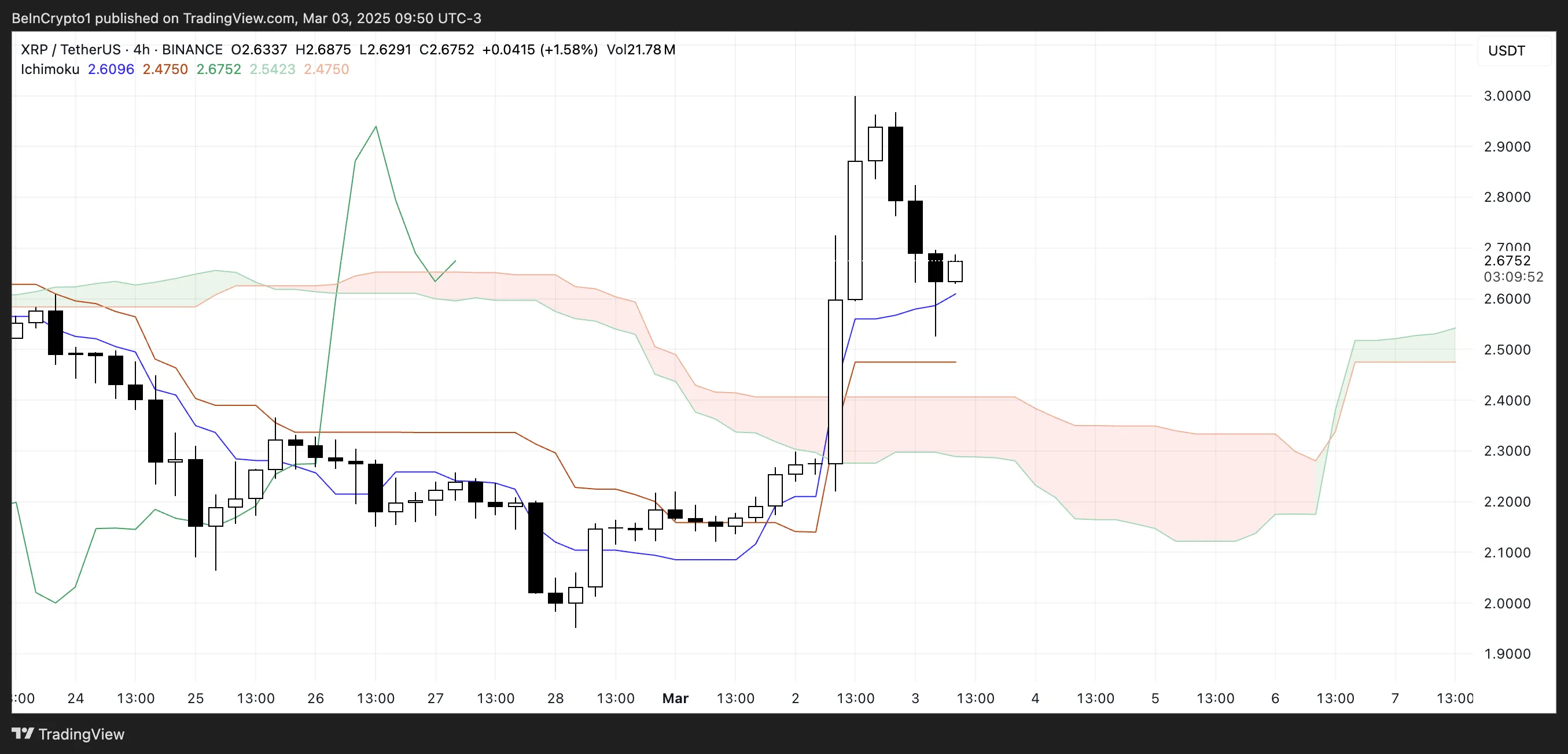

Ichimoku Cloud Shows the Bullish Setup Is Still Here, But This Could Change

XRP Ichimoku Cloud chart analysis shows that the price saw a sharp breakout above the cloud (Kumo) following its 30% surge after being included in the US crypto reserve.

This breakout confirmed a strong bullish move, with XRP moving well above both the Tenkan-sen (blue line) and Kijun-sen (red line), signaling short-term and medium-term trend strength.

The sharp spike pushed XRP into overextended territory. However, as seen in the last few candles, a pullback has started, bringing the price closer to the Kijun-sen.

This suggests that while the uptrend remains intact, the market is reassessing its recent gains, and XRP is testing key short-term support.

If the price holds above the Kijun-sen, XRP price could consolidate before making another attempt at higher resistance levels.

However, if the correction deepens and XRP falls back toward the cloud, it could indicate a loss of momentum. The future cloud (Senkou Span A and B) remains bullish but with some flattening. That indicates that the market is at a pivotal point.

XRP Price Can Have a Hard Time to Reach $3

XRP surged to nearly $2.95 following its inclusion in the US crypto reserve, marking a sharp bullish move.

However, after this rapid climb, the price has started to correct in the last few hours, suggesting that some traders are taking profits.

The technical outlook now depends on whether the uptrend can regain strength. If buying pressure returns, XRP could test the $2.75 resistance again. A breakout above this level could see it retesting $2.96, which acted as a barrier during yesterday’s rally.

A successful move past this resistance would open the door to a push toward $3.15, marking the first time XRP has traded above $3 since February 1. The SEC dropping the case against XRP could be a potential drive for that.

On the downside, if the correction continues and selling pressure increases, XRP price could find support at $2.52. A breakdown below this level would put the next key support at $2.36 in focus. Further declines could potentially drive the price toward $2.15 and $2.06.

This could be driven if more questions about the asset being included in the US crypto reserve start to emerge. Harrison Seletsky, director of business development at digital identity platform SPACE ID, told BeInCrypto that these assets are odd choices to the reserve:

“I’m certainly surprised that US President Donald Trump has chosen to announce a full-blown crypto strategic reserve, rather than just a Bitcoin strategic reserve, as everyone had been expecting. Beyond that, the choice of assets is also unusual. ETH and SOL make sense, given their strong and growing developer activity. But it’s not clear to me why XRP and ADA were included at all, considering they are virtually ghost chains compared to Ethereum and Solana. Indeed, the total value locked (TVL) and stablecoin capabilities on XRPL and Cardano are tiny compared to other ecosystem players – $80 million and $460 million, respectively. In my eyes, it somewhat delegitimizes the whole idea of crypto reserve assets like industry mainstays Bitcoin, Ether and Solana,” Harrison Seletsky told BeInCrypto.

If bearish momentum strengthens significantly, XRP could fall below the psychological $2 mark, with $1.77 emerging as the next major support level.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.