XRP has risen nearly 5% in the last 24 hours, breaking above $2.30 as bullish momentum continues to build. This recovery comes amid broader market anticipation, even as the SEC delayed its decision on several XRP ETF applications.

Technical indicators show that XRP’s RSI has climbed steadily since March 10, approaching levels that signal strong buying pressure. XRP could soon challenge key resistance levels, potentially eyeing a breakout above $3 for the first time since late January.

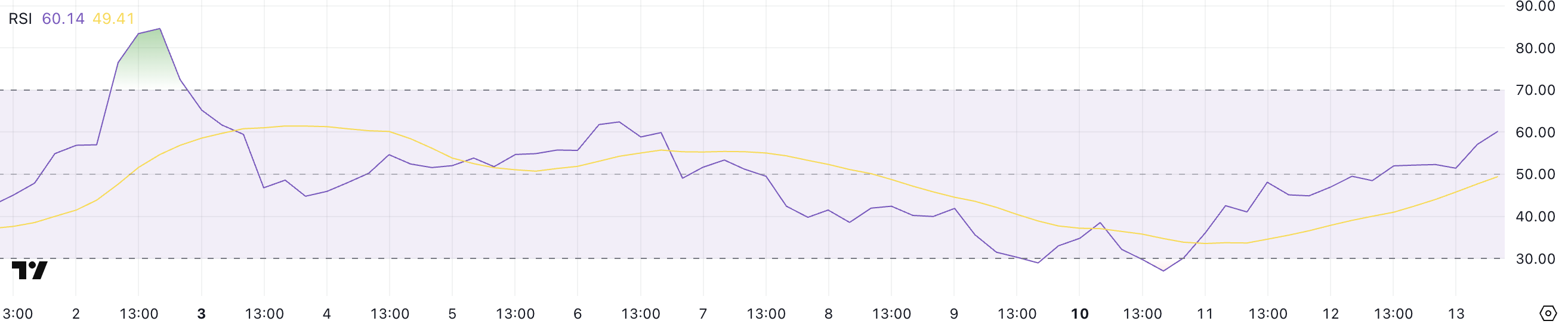

XRP RSI Is Growing Steadily Since March 10

XRP’s Relative Strength Index (RSI) has climbed significantly to 60.14, rising from 27 just three days ago. RSI is a momentum oscillator that measures the speed and magnitude of recent price changes on a scale from 0 to 100.

Typically, an RSI above 70 indicates overbought conditions, suggesting a potential pullback, while an RSI below 30 signals oversold conditions, often preceding a price recovery.

The rapid increase from oversold levels suggests a strong shift in momentum, with buyers stepping in to drive the price higher.

With the altcoin’s RSI now at 60.14, it is approaching bullish territory but remains below the critical 70 threshold. Notably, XRP has not surpassed 70 since March 2, indicating that this level has historically acted as a resistance for momentum.

If RSI continues to rise and breaks past 70, it would suggest extreme bullish strength, potentially leading to further price gains.

However, if it stabilizes or begins to decline from this level, XRP could enter a consolidation phase or face a temporary slowdown before making another move.

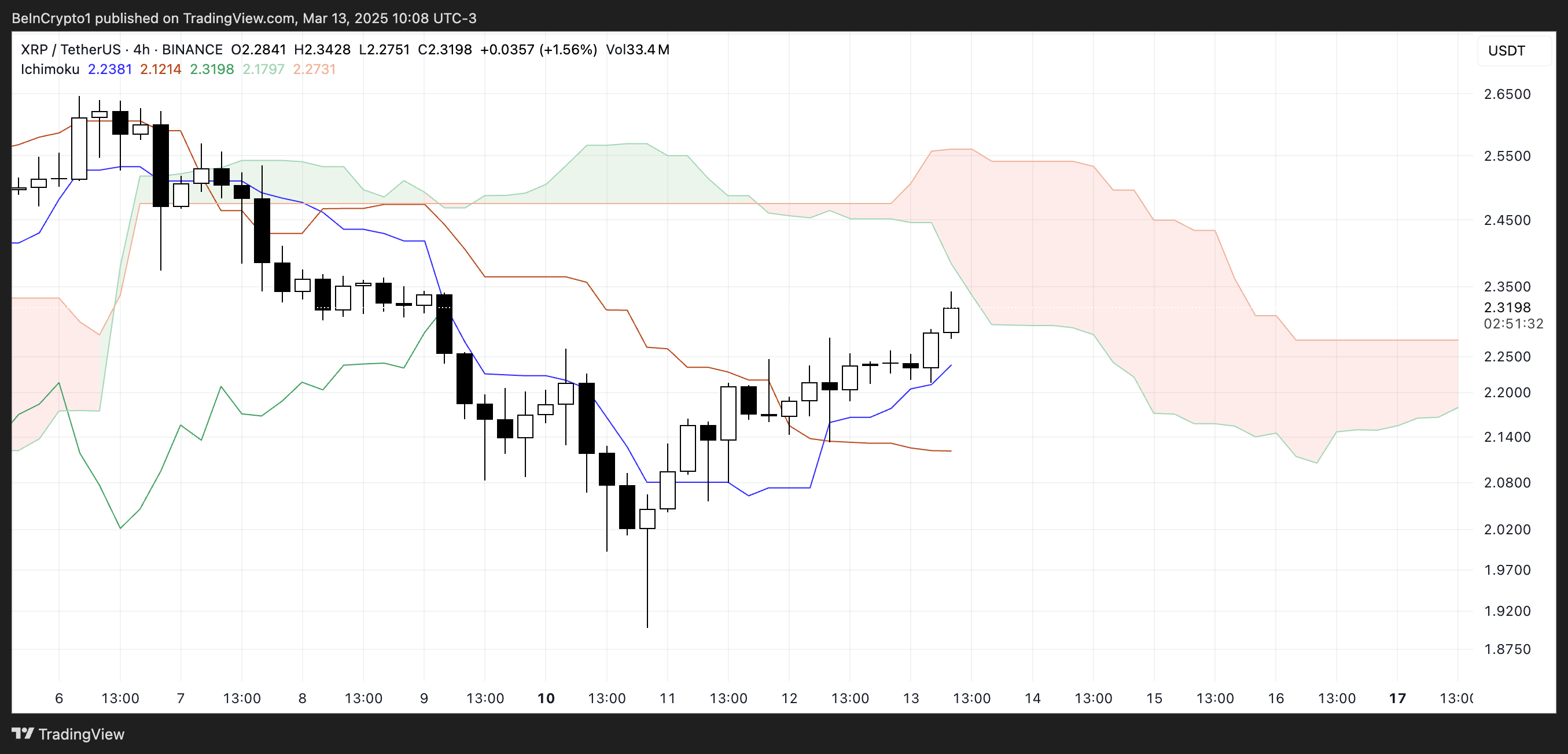

Ichimoku Cloud Shows Momentum Is Shifting

The Ichimoku Cloud chart for XRP shows that price action has recently broken above the blue Tenkan-Sen (conversion line), suggesting short-term bullish momentum.

Additionally, the price is now trading above the red Kijun-Sen (baseline), which further reinforces the bullish shift. However, the cloud (Kumo) ahead remains red, indicating that the longer-term trend is still bearish.

For XRP to sustain its upward movement, it would need to push through the lower boundary of the red cloud and establish support above it.

If it faces resistance at the cloud, it could struggle to maintain its current uptrend and risk a pullback toward the Kijun-Sen for support.

A rejection from the cloud could indicate a continuation of the prior bearish trend, especially if XRP falls back below the Tenkan-Sen.

However, if buyers manage to push it above the red cloud, it would confirm a more significant trend reversal, potentially leading to stronger bullish momentum.

The upcoming candlestick closes will be crucial in determining whether XRP can maintain its recovery or face renewed selling pressure.

Can XRP Break Above $3 In March?

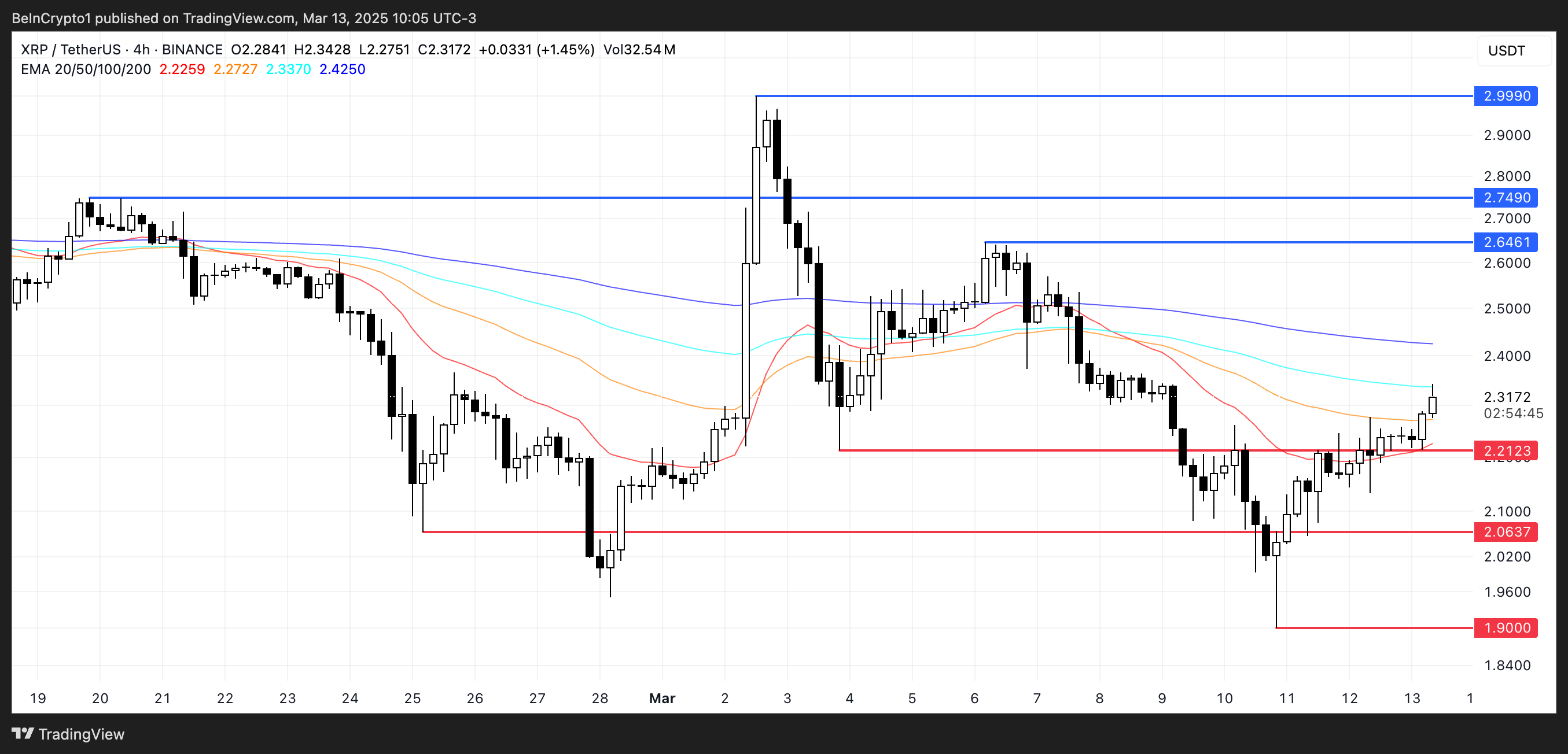

XRP’s EMA lines are still in a bearish formation, with short-term EMAs positioned below the longer-term ones.

However, the recent upward movement in short-term EMAs suggests growing bullish momentum. If they cross above the long-term EMAs, they will form a golden cross—a signal often associated with trend reversals to the upside.

If this bullish crossover occurs, XRP could gain enough strength to test key resistance levels at $2.64 and $2.74. More news around SEC and the XRP ETF could drive that bullish trend.

Breaking above these levels would reinforce the bullish outlook, potentially driving XRP price toward $2.99 and even above $3 for the first time since late January.

On the downside, if the short-term recovery loses strength and the bearish structure remains intact, it could struggle to sustain its current price levels.

A renewed downtrend would bring the $2.21 support level into play, which has been a critical zone in previous price action. If this level fails to hold, XRP could extend its decline toward $2.06, with the possibility of testing $1.90 in a deeper correction.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.